Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The plant expansion cost was 4.5 million and it qualifies for capital cost allowance (therefore allowing 10% CCA rate). The building was put in use

The plant expansion cost was 4.5 million and it qualifies for capital cost allowance (therefore allowing 10% CCA rate). The building was put in use Jul 01,2017. It had a useful life of 30 years and recorded depreciation for 75000. No deferred taxes have been recorded. Research shows that a typical facility of this nature has a 20-year useful life. Provide alternatives regarding this and recommend the best solution

if it needs to depreciated on 30 year or 20 year life?

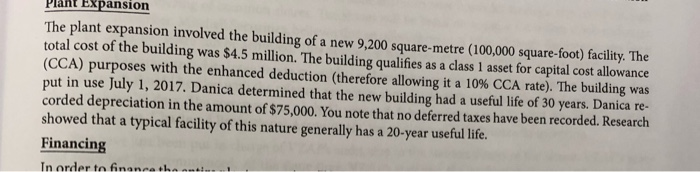

Plant Expansion The plant expansion involved the building of a new 9.200 square metre (100,000 square foot) facility. The total cost of the building was $4.5 million. The building qualifies as a class 1 asset for capital cost allowance (CCA) purposes with the enhanced deduction (therefore allowing it a 10% CCA rate). The building was put in use July 1, 2017. Danica determined that the new building had a useful life of 30 years. Danica re- corded depreciation in the amount of $75,000. You note that no deferred taxes have been recorded. Research showed that a typical facility of this nature generally has a 20-year useful life. Financing Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started