Answered step by step

Verified Expert Solution

Question

1 Approved Answer

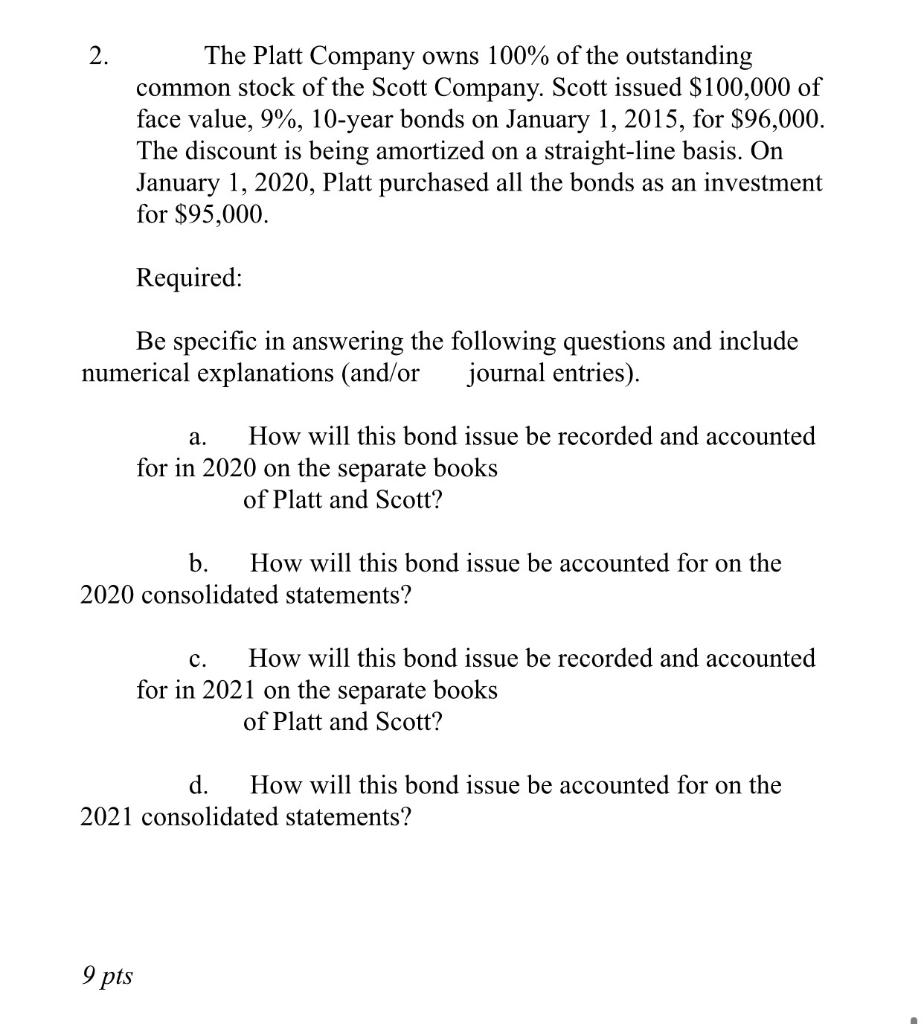

The Platt Company owns 100% of the outstanding common stock of the Scott Company. Scott issued $100,000 of face value, 9%, 10-year bonds on

The Platt Company owns 100% of the outstanding common stock of the Scott Company. Scott issued $100,000 of face value, 9%, 10-year bonds on January 1, 2015, for $96,000. The discount is being amortized on a straight-line basis. On January 1, 2020, Platt purchased all the bonds as an investment for $95,000. 2. Required: Be specific in answering the following questions and include numerical explanations (and/or journal entries). . How will this bond issue be recorded and accounted for in 2020 on the separate books of Platt and Scott? b. How will this bond issue be accounted for on the 2020 consolidated statements? . How will this bond issue be recorded and accounted for in 2021 on the separate books of Platt and Scott? d. How will this bond issue be accounted for on the 2021 consolidated statements? 9 pts

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

A Scott Bonds Payable 100000 Discount on BP 2800 4000 1420 Bonds Payable December 31 2020 97200 Dece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started