Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the accumulated depreciation is for 2020 and 2021 (straight line $2,000 each year) but depreciation expense is only debited for the failure to record it

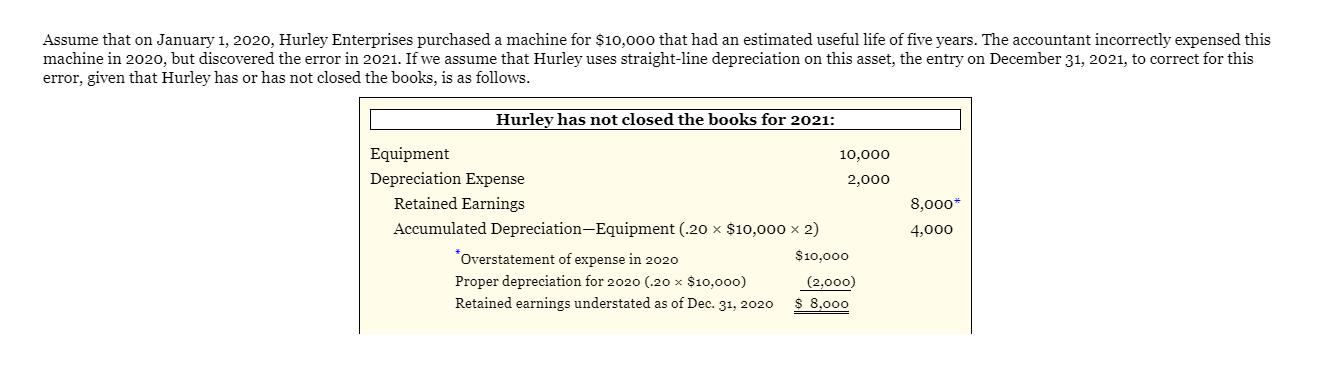

the accumulated depreciation is for 2020 and 2021 (straight line $2,000 each year) but depreciation expense is only debited for the failure to record it in 2020, right? How can you record accumulated depreciation for the current year in this entry without matching it with depreciation expense?

Assume that on January 1, 2020, Hurley Enterprises purchased a machine for $10,000 that had an estimated useful life of five years. The accountant incorrectly expensed this machine in 2020, but discovered the error in 2021. If we assume that Hurley uses straight-line depreciation on this asset, the entry on December 31, 2021, to correct for this error, given that Hurley has or has not closed the books, is as follows. Hurley has not closed the books for 2021: Equipment Depreciation Expense Retained Earnings Accumulated Depreciation-Equipment (.20 $10,000 2) $10,000 *Overstatement of expense in 2020 Proper depreciation for 2020 (.20 x $10,000) Retained earnings understated as of Dec. 31, 2020 10,000 2,000 (2,000) 8,000 8,000* 4,000

Step by Step Solution

★★★★★

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

In the given scenario the depreciation expenses of 2021 are 2000 The depreciation expenses for the y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started