Answered step by step

Verified Expert Solution

Question

1 Approved Answer

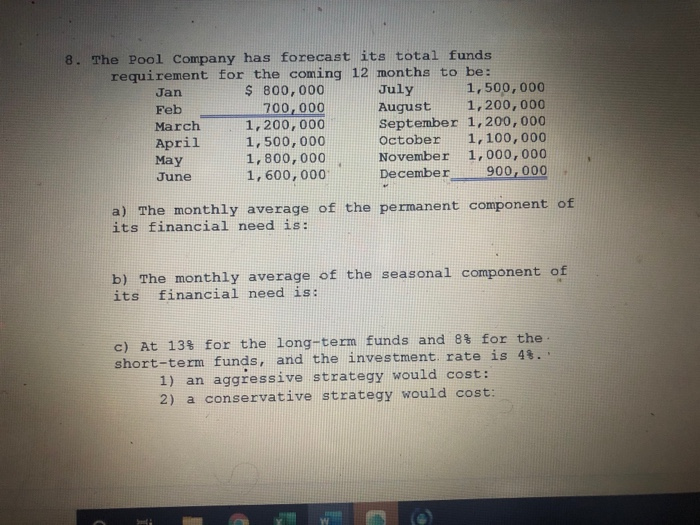

The Pool Comapny 8. The Pool Company has forecast its total funds requirement for the coming 12 months to be: Jan $ 800,000 July 1,500,000

The Pool Comapny

8. The Pool Company has forecast its total funds requirement for the coming 12 months to be: Jan $ 800,000 July 1,500,000 Feb 700,000 August 1,200,000 March 1,200,000 September 1, 200,000 1,500,000 October 1,100,000 May 1,800,000 November 1,000,000 June 1,600,000 December 900,000 April a) The monthly average of the permanent component of its financial need is: b) The monthly average of the seasonal component of its financial need is: c) At 13% for the long-term funds and 8% for the short-term funds, and the investment. rate is 48. 1) an aggressive strategy would cost: 2) a conservative strategy would cost Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started