Answered step by step

Verified Expert Solution

Question

1 Approved Answer

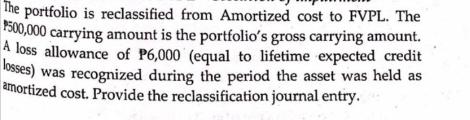

The portfolio is reclassified from Amortized cost to FVPL. The P500,000 carrying amount is the portfolio's gross carrying amount. A loss allowance of P6,000

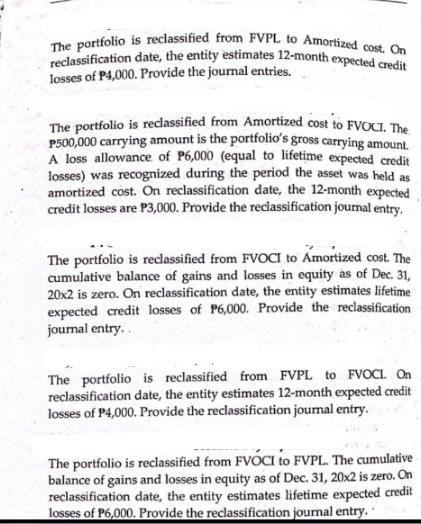

The portfolio is reclassified from Amortized cost to FVPL. The P500,000 carrying amount is the portfolio's gross carrying amount. A loss allowance of P6,000 (equal to lifetime expected credit losses) was recognized during the period the asset was held as amortized cost. Provide the reclassification journal entry. The portfolio is reclassified from FVPL to Amortized cost. On reclassification date, the entity estimates 12-month expected credit losses of P4,000. Provide the journal entries. The portfolio is reclassified from Amortized cost to FVOCI. The P500,000 carrying amount is the portfolio's gross carrying amount. A loss allowance of P6,000 (equal to lifetime expected credit losses) was recognized during the period the asset was held as amortized cost. On reclassification date, the 12-month expected credit losses are P3,000. Provide the reclassification journal entry. The portfolio is reclassified from FVOCI to Amortized cost. The cumulative balance of gains and losses in equity as of Dec. 31, 20x2 is zero. On reclassification date, the entity estimates lifetime expected credit losses of P6,000. Provide the reclassification journal entry.. The portfolio is reclassified from FVPL to FVOCL. On reclassification date, the entity estimates 12-month expected credit losses of P4,000. Provide the reclassification journal entry. The portfolio is reclassified from FVOCI to FVPL. The cumulative balance of gains and losses in equity as of Dec. 31, 20x2 is zero. On reclassification date, the entity estimates lifetime expected credit losses of P6,000. Provide the reclassification journal entry.

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the journal entries for each of the scenarios you described 1 Reclassification from Amortiz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started