Answered step by step

Verified Expert Solution

Question

1 Approved Answer

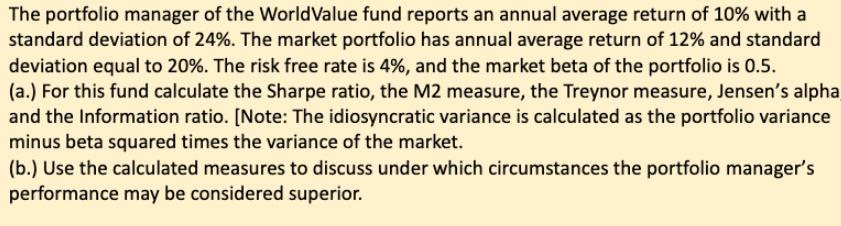

The portfolio manager of the WorldValue fund reports an annual average return of 10% with a standard deviation of 24%. The market portfolio has

The portfolio manager of the WorldValue fund reports an annual average return of 10% with a standard deviation of 24%. The market portfolio has annual average return of 12% and standard deviation equal to 20%. The risk free rate is 4%, and the market beta of the portfolio is 0.5. (a.) For this fund calculate the Sharpe ratio, the M2 measure, the Treynor measure, Jensen's alpha, and the Information ratio. [Note: The idiosyncratic variance is calculated as the portfolio variance minus beta squared times the variance of the market. (b.) Use the calculated measures to discuss under which circumstances the portfolio manager's performance may be considered superior.

Step by Step Solution

★★★★★

3.62 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Sharpe ratio M2 measure Treynor measure Jensens alpha and Information ratio we need the following information Portfolio average retur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started