Answered step by step

Verified Expert Solution

Question

1 Approved Answer

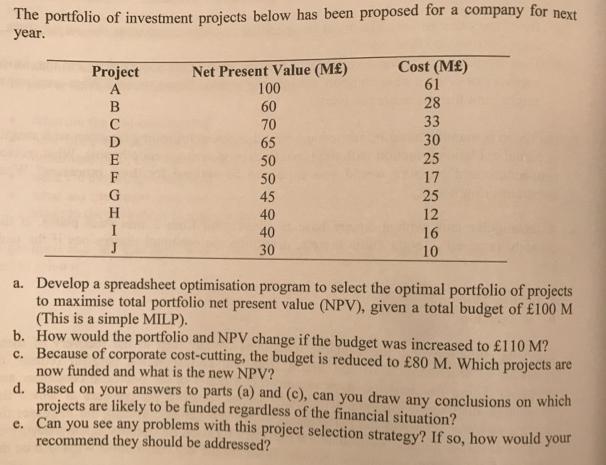

The portfolio of investment projects below has been proposed for a company for next year. Project ABCDEFGHIL J Net Present Value (M) 100 60

The portfolio of investment projects below has been proposed for a company for next year. Project ABCDEFGHIL J Net Present Value (M) 100 60 70 65 50 50 45 40 40 30 Cost (M) 61 28 33 30 25 17 25 12 16 10 a. Develop a spreadsheet optimisation program to select the optimal portfolio of projects to maximise total portfolio net present value (NPV), given a total budget of 100 M (This is a simple MILP). b. How would the portfolio and NPV change if the budget was increased to 110 M? c. Because of corporate cost-cutting, the budget is reduced to 80 M. Which projects are now funded and what is the new NPV? d. Based on your answers to parts (a) and (c), can you draw any conclusions on which projects are likely to be funded regardless of the financial situation? e. Can you see any problems with this project selection strategy? If so, how would your recommend they should be addressed?

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Develop a spreadsheet optimisation program to select the optimal portfolio of projects to maximise total portfolio net present value NPV given a total budget of 100 M This is a simple MILP Formulate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started