Answered step by step

Verified Expert Solution

Question

1 Approved Answer

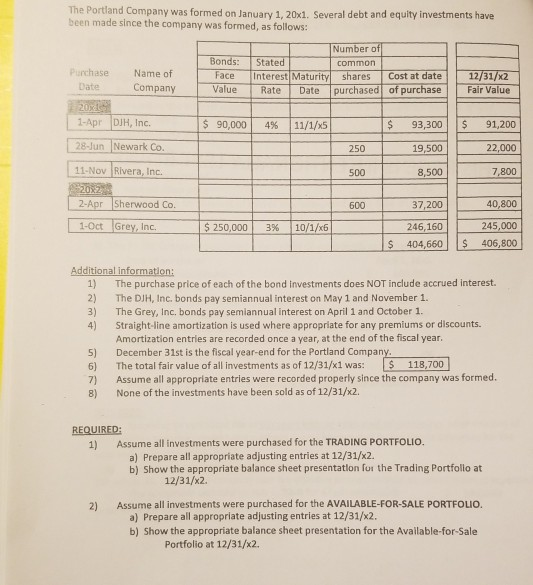

The Portland Company was formed on January 1, 20x1. Several debt and equity investments have been made since the company was formed, as follows: Number

The Portland Company was formed on January 1, 20x1. Several debt and equity investments have been made since the company was formed, as follows: Number of Bonds: Stated Face Interest Maturityl shares Cost at date12/31/x2 Purchase Date Name of CompanyValue Rate Date purchased of purchase Fair Value 1-Apr DJH, Inc. 28-Jun Newark Co. 11-Nov Rivera, Inc 2-Apr Sherwood Co 1-Oct Grey, Inc. $ 90,000| | 11/1/x51 $93,300 91,200 22,000 7,800 4% 250 19,500 500 8,500 40,800 245,000 S 404,660 S 406,800 37,200 600 $ 250,000 | | 10/1/6 246,160 3% Additional information: 1) The purchase price of each of the bond investments does NOT include accrued interest. 2) The DJH, Inc. bonds pay semiannual interest on May 1 and November 1. 3) The Grey, Inc. bonds pay semiannual interest on April 1 and October 1 4) Straight-line amortization is used where appropriate for any premiums or discounts Amortization entries are recorded once a year, at the end of the fiscal year. 5) December 31st is the fiscal year-end for the Portland Company 6) The total fair value of all investments as of 12/31/x1 was: 118,700 7) Assume all appropriate entries were recorded properly since the company was formed. 8) None of the investments have been sold as of 12/31/x2. REQUIRED Assume all investments were purchased for the TRADING PORTFOLIO. 1) a) Prepare all appropriate adjusting entries at 12/31/x2. b) Show the appropriate balance sheet presentation fus the Trading Portfollo at 12/31/x2. Assume all investments were purchased for the AVAILABLE-FOR-SALE PORTFOLIo. 2) a) Prepare all appropriate adjusting entries at 12/31/x2. b) Show the appropriate balance sheet presentation for the Available-for-Sale Portfolio at 12/31/x2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started