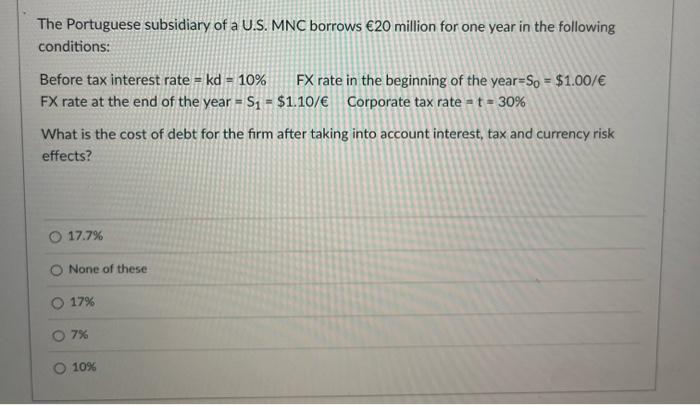

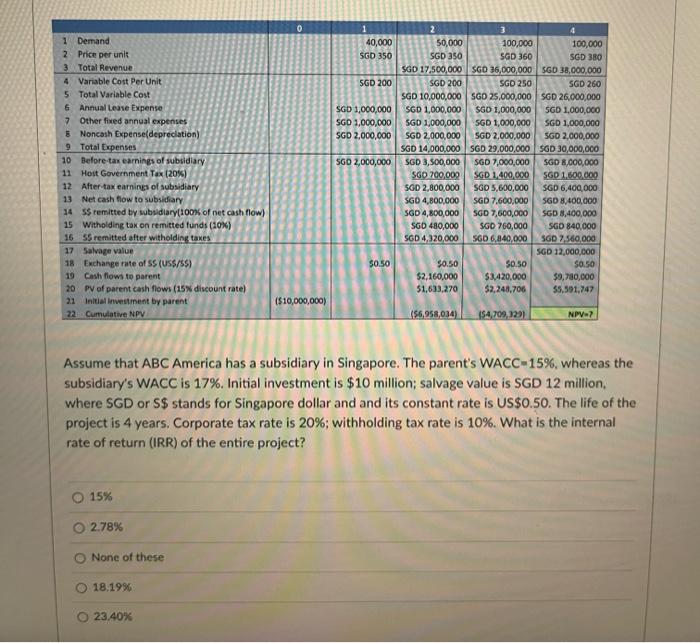

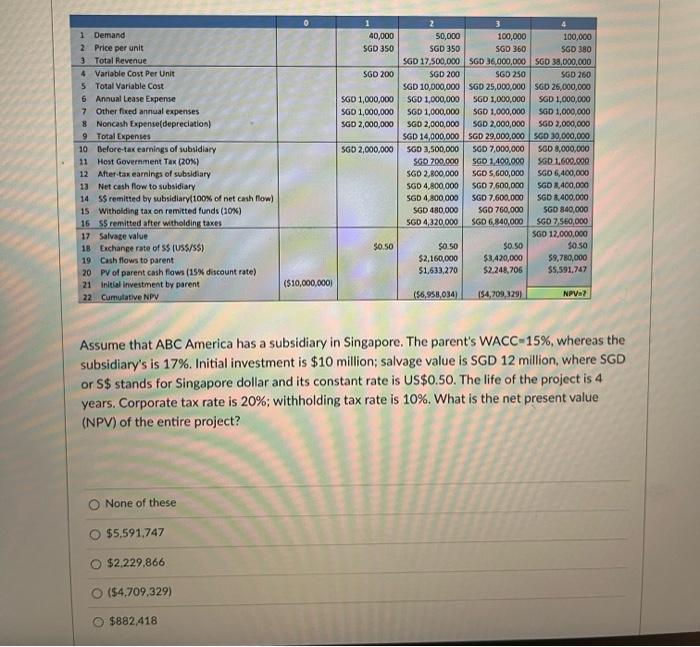

The Portuguese subsidiary of a U.S. MNC borrows 20 million for one year in the following conditions: Before tax interest rate = kd = 10% FX rate in the beginning of the year-So = $1.00/ FX rate at the end of the year = S = $1.10/ Corporate tax rate = t = 30% What is the cost of debt for the firm after taking into account interest, tax and currency risk effects? 17.7% None of these O 17% O 7% 10% 3 1 Demand 50,000 100,000 100,000 2 Price per unit SGD 350 SGD 360 SGD 380 3 Total Revenue SGD 17,500,000 SGD 36,000,000 SGD 38,000,000 4 Variable Cost Per Unit 5 Total Variable Cost 6 Annual Lease Expense 7 Other fixed annual expenses 8 Noncash Expense(depreciation) 9 Total Expenses 10 Before-tax earnings of subsidiary SGD 200 SGD 10,000,000 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 14,000,000 SGD 3,500,000 SGD 700,000 SGD 2,800,000 SGD 4,800,000 SGD 4,800,000 SGD 480,000 SGD 4,320,000 SGD 250 SGD 25,000,000 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 29,000,000 SGD 7,000,000 SGD 1,400,000 SGD 5,600,000 SGD 7,600,000 SGD 7,600,000 SGD 760,000 SGD 6,840,000 SGD 260 SGD 26,000,000 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 30,000,000 SGD 8,000,000 SGD 1,600,000 SGD 6,400,000 SGD 8,400,000 SGD 8,400,000 SGD 840,000 SGD 7,560,000 SGD 12,000,000 11 Host Government Tax (20%) 12 After-tax earnings of subsidiary 13 Net cash flow to subsidiary 14 55 remitted by subsidiary(100% of net cash flow) 15 Witholding tax on remitted funds (10%) 16 55 remitted after witholding taxes 17 Salvage value 18 Exchange rate of SS (US$/SS) $0.50 $2,160,000 $1,633,270 $0.50 $3,420,000 $0.50 $9,780,000 19 Cash flows to parent 20 PV of parent cash flows (15% discount rate) $2,248,706 $5,591,747 21 Initial investment by parent ($10,000,000) 22 Cumulative NPV ($6,958,034) (54,709,329) NPV-7 Assume that ABC America has a subsidiary in Singapore. The parent's WACC-15%, whereas the subsidiary's WACC is 17%. Initial investment is $10 million; salvage value is SGD 12 million, where SGD or S$ stands for Singapore dollar and and its constant rate is US$0.50. The life of the project is 4 years, Corporate tax rate is 20%; withholding tax rate is 10%. What is the internal rate of return (IRR) of the entire project? O 15% 0 2.78% None of these 18.19% 23.40% 1 40,000 SGD 350 SGD 200 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 2,000,000 2 $0.50 1 40,000 SGD 350 SGD 200 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 2,000,000 1 Demand 50,000 100,000 100,000 2 Price per unit SGD 350 SGD 360 SGD 380 3 Total Revenue SGD 17,500,000 SGD 36,000,000 SGD 38,000,000 4 Variable Cost Per Unit 5 Total Variable Cost SGD 260 SGD 25,000,000 SGD 1,000,000 6 Annual Lease Expense 7 Other fixed annual expenses 8 Noncash Expense(depreciation) 9 Total Expenses SGD 250 SGD 25,000,000 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 29,000,000 SGD 7,000,000 SGD 1,400,000 SGD 5,600,000 SGD 7,600,000 SGD 7,600,000 10 SGD 200 SGD 10,000,000 SGD 1,000,000 SGD 1,000,000 SGD 2,000,000 SGD 14,000,000 SGD 3,500,000 SGD 700,000 SGD 2,800,000 SGD 4,800,000 SGD 4,800,000 SGD 480,000 SGD 4,320,000 Before-tax earnings of subsidiary 11 Host Government Tax (20%) 12 After-tax earnings of subsidiary SGD 1,000,000 SGD 2,000,000 SGD 30,000,000 SGD 8,000,000 SGD 1,600,000 SGD 6,400,000 SGD 8,400,000 SGD 8,400,000 SGD 840,000 SGD 7,560,000 SGD 12,000,000 13 Net cash flow to subsidiary 14 SS remitted by subsidiary(100% of net cash flow) 15 Witholding tax on remitted funds (10%) SGD 760,000 SGD 6,840,000 16 55 remitted after witholding taxes 17 Salvage value 18 Exchange rate of $$ (US$/SS) $0.50 19 Cash flows to parent $0.50 $2,160,000 $1,633,270 $0.50 $3,420,000 $2,248,706 59,780,000 20 PV of parent cash flows (15% discount rate) $5,591,747 21 Initial investment by parent ($10,000,000) 22 Cumulative NPV (56,958,034) ($4,709,329) NPV=7 Assume that ABC America has a subsidiary in Singapore. The parent's WACC-15%, whereas the subsidiary's is 17%. Initial investment is $10 million; salvage value is SGD 12 million, where SGD or S$ stands for Singapore dollar and its constant rate is US$0.50. The life of the project is 4 years. Corporate tax rate is 20%; withholding tax rate is 10%. What is the net present value (NPV) of the entire project? O None of these $5,591,747 $2,229,866 O ($4,709,329) $882,418 50.50 Question 33 What economic agents went global in Globalization 1 phase? O None of these Individuals NGOS O Corporations O Countries. 1 pts