Question

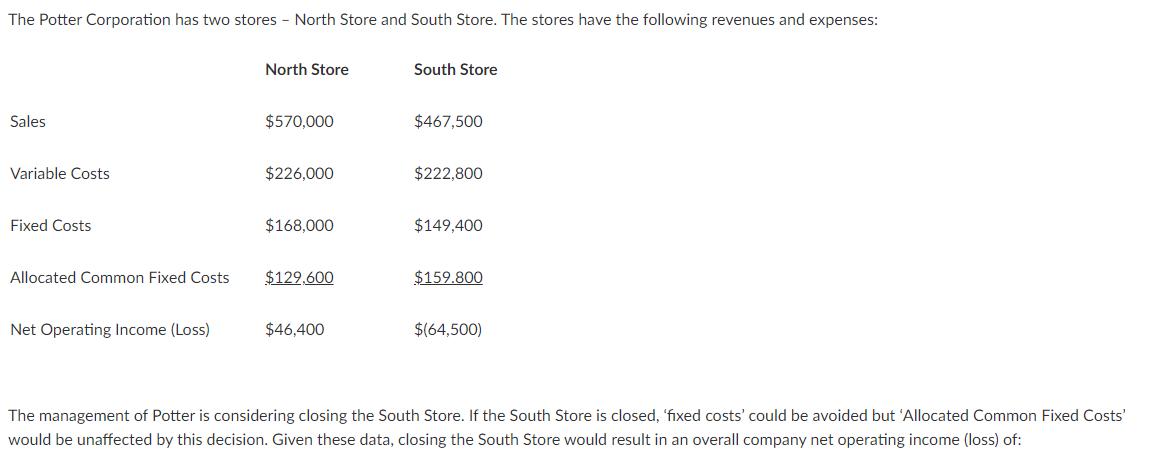

The Potter Corporation has two stores - North Store and South Store. The stores have the following revenues and expenses: Sales Variable Costs Fixed

The Potter Corporation has two stores - North Store and South Store. The stores have the following revenues and expenses: Sales Variable Costs Fixed Costs Allocated Common Fixed Costs Net Operating Income (Loss) North Store $570,000 $226,000 $168,000 $129,600 $46,400 South Store $467,500 $222,800 $149,400 $159.800 $(64,500) The management of Potter is considering closing the South Store. If the South Store is closed, 'fixed costs' could be avoided but 'Allocated Common Fixed Costs' would be unaffected by this decision. Given these data, closing the South Store would result in an overall company net operating income (loss) of:

Step by Step Solution

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

To determine the overall company net operating income loss if the South S...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

13th Edition

978-0073379616, 73379611, 978-0697789938

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App