Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The pound spot rate is $1.40/ and the pound interest rate is 2%. The dollar and U.K. inflation rates are both 0% per annum.

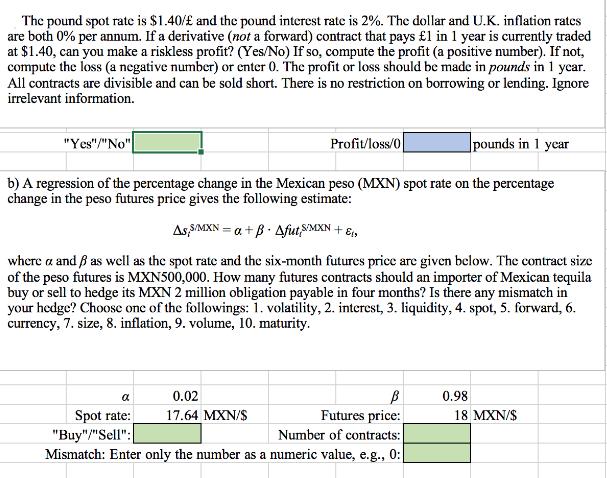

The pound spot rate is $1.40/ and the pound interest rate is 2%. The dollar and U.K. inflation rates are both 0% per annum. If a derivative (not a forward) contract that pays 1 in 1 year is currently traded at $1.40, can you make a riskless profit? (Yes/No) If so, compute the profit (a positive number). If not, compute the loss (a negative number) or enter 0. The profit or loss should be made in pounds in 1 year. All contracts are divisible and can be sold short. There is no restriction on borrowing or lending. Ignore irrelevant information. "Yes"/"No" pounds in 1 year b) A regression of the percentage change in the Mexican peso (MXN) spot rate on the percentage change in the peso futures price gives the following estimate: As, S/MXN = a + B Afut S/MXN + & where a and as well as the spot rate and the six-month futures price are given below. The contract size of the peso futures is MXN500,000. How many futures contracts should an importer of Mexican tequila buy or sell to hedge its MXN 2 million obligation payable in four months? Is there any mismatch in your hedge? Choose one of the followings: 1. volatility, 2. interest, 3. liquidity, 4. spot, 5. forward, 6. currency, 7. size, 8. inflation, 9. volume, 10. maturity. a Spot rate: "Buy"/"Sell": B Futures price: Number of contracts: Mismatch: Enter only the number as a numeric value, e.g., 0:| Profit/loss/0 0.02 17.64 MXN/$ 0.98 18 MXN/$

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a No you cannot make a riskless profit in this scenario The current spot rate for the pound is 140 a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started