Answered step by step

Verified Expert Solution

Question

1 Approved Answer

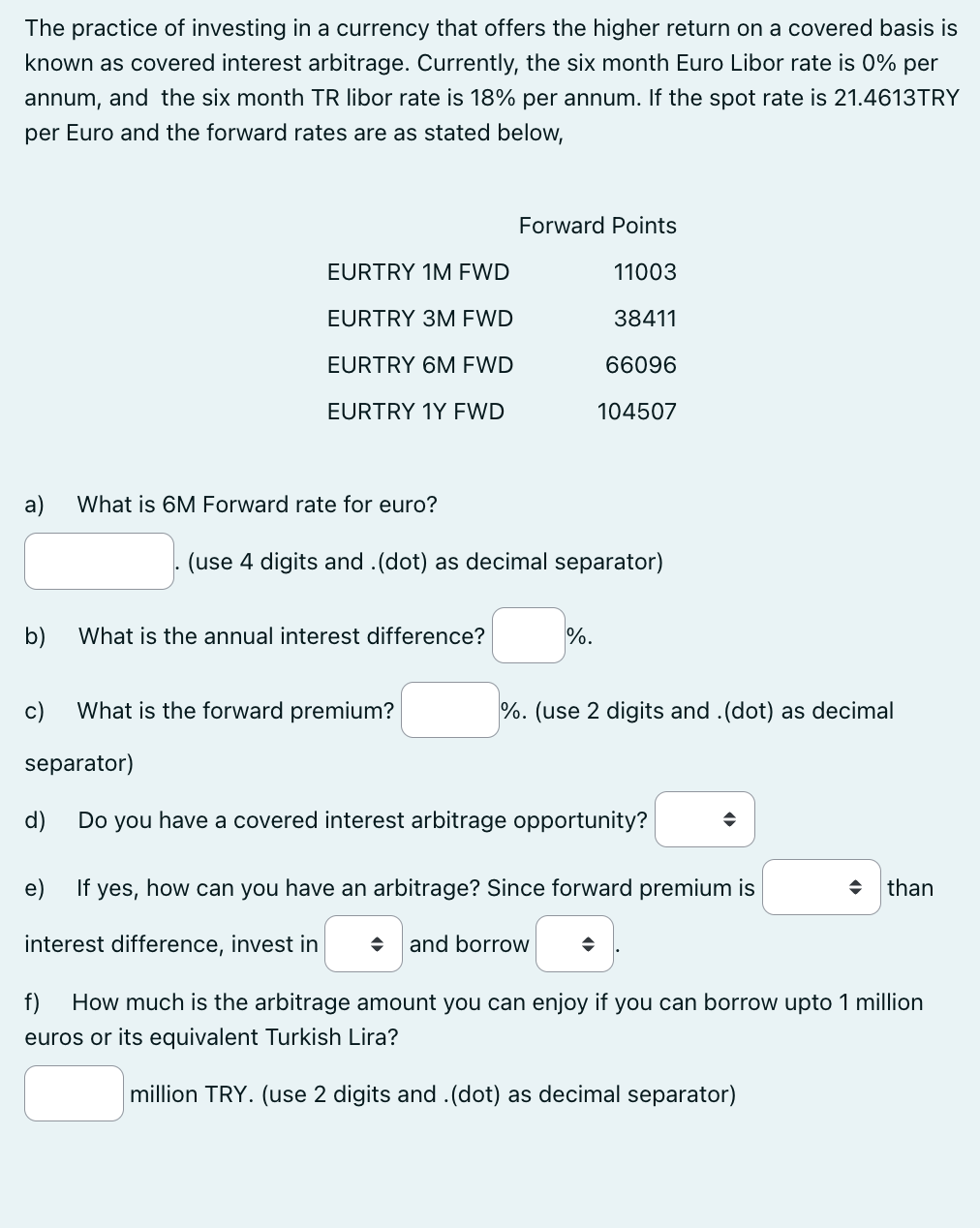

The practice of investing in a currency that offers the higher return on a covered basis is known as covered interest arbitrage. Currently, the six

The practice of investing in a currency that offers the higher return on a covered basis is known as covered interest arbitrage. Currently, the six month Euro Libor rate is 0% per annum, and the six month TR libor rate is 18% per annum. If the spot rate is 21.4613RY per Euro and the forward rates are as stated below, a) What is 6M Forward rate for euro? (use 4 digits and .(dot) as decimal separator) b) What is the annual interest difference? % c) What is the forward premium? %. (use 2 digits and .(dot) as decimal separator) d) Do you have a covered interest arbitrage opportunity? e) If yes, how can you have an arbitrage? Since forward premium is than interest difference, invest in and borrow f) How much is the arbitrage amount you can enjoy if you can borrow upto 1 million euros or its equivalent Turkish Lira? million TRY. (use 2 digits and .(dot) as decimal separator)

The practice of investing in a currency that offers the higher return on a covered basis is known as covered interest arbitrage. Currently, the six month Euro Libor rate is 0% per annum, and the six month TR libor rate is 18% per annum. If the spot rate is 21.4613RY per Euro and the forward rates are as stated below, a) What is 6M Forward rate for euro? (use 4 digits and .(dot) as decimal separator) b) What is the annual interest difference? % c) What is the forward premium? %. (use 2 digits and .(dot) as decimal separator) d) Do you have a covered interest arbitrage opportunity? e) If yes, how can you have an arbitrage? Since forward premium is than interest difference, invest in and borrow f) How much is the arbitrage amount you can enjoy if you can borrow upto 1 million euros or its equivalent Turkish Lira? million TRY. (use 2 digits and .(dot) as decimal separator) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started