Answered step by step

Verified Expert Solution

Question

1 Approved Answer

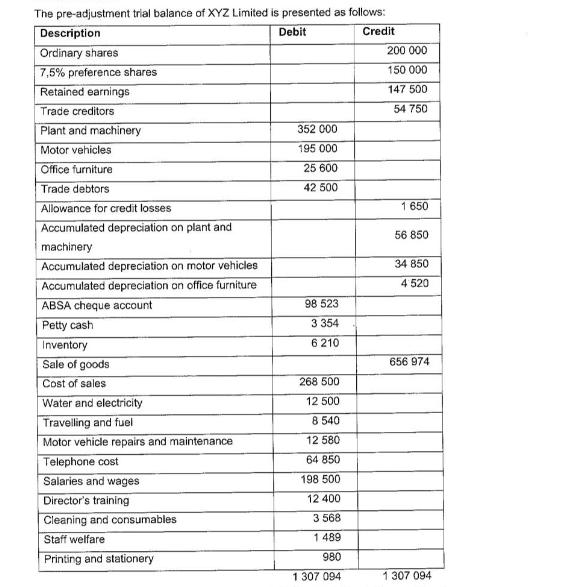

The pre-adjustment trial balance of XYZ Limited is presented as follows: Debit Credit Description Ordinary shares 7,5% preference shares Retained earnings Trade creditors Plant

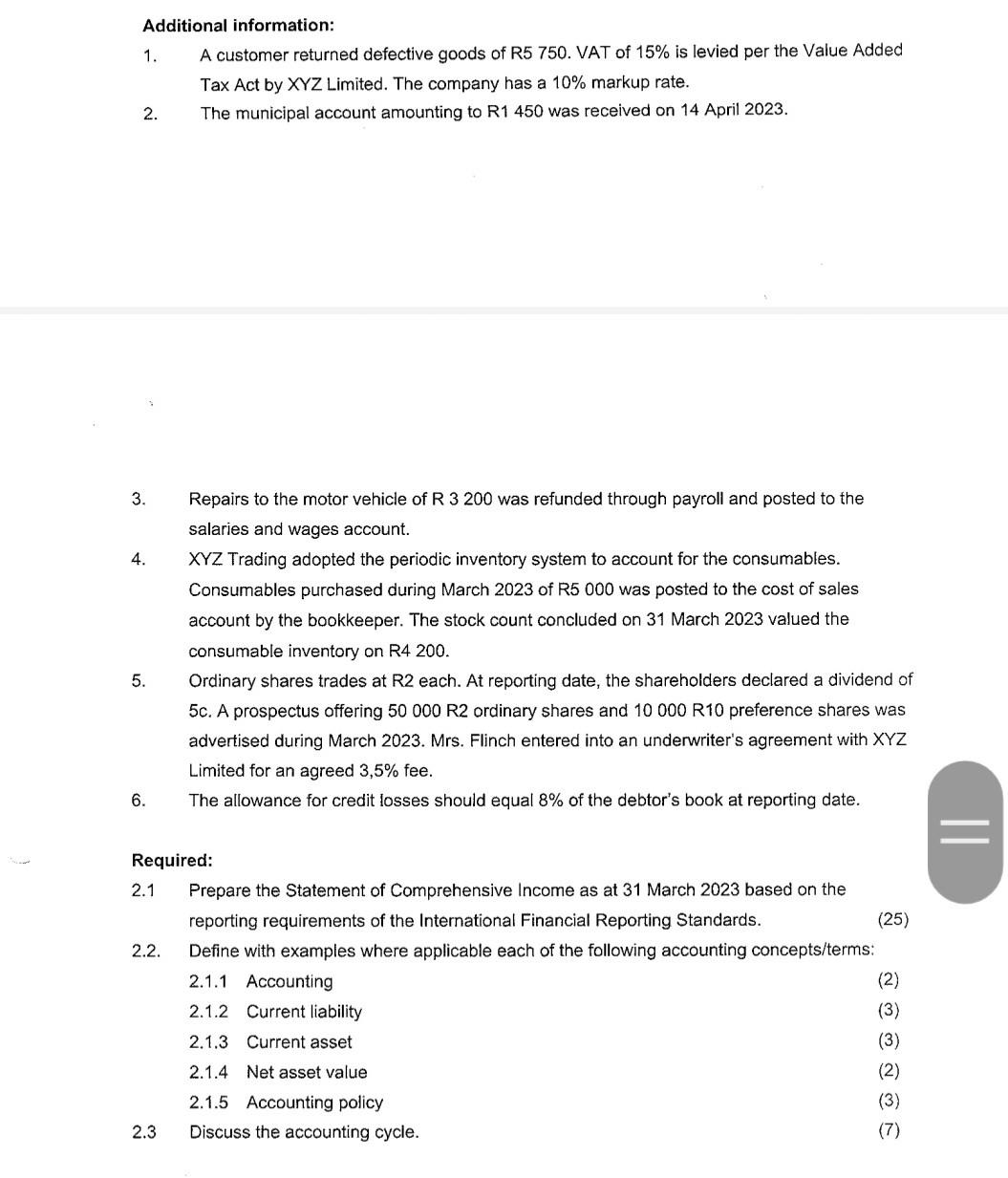

The pre-adjustment trial balance of XYZ Limited is presented as follows: Debit Credit Description Ordinary shares 7,5% preference shares Retained earnings Trade creditors Plant and machinery Motor vehicles Office furniture Trade debtors Allowance for credit losses Accumulated depreciation on plant and machinery Accumulated depreciation on motor vehicles Accumulated depreciation on office furniture ABSA cheque account Petty cash Inventory Sale of goods Cost of sales Water and electricity Travelling and fuel Motor vehicle repairs and maintenance Telephone cost Salaries and wages Director's training Cleaning and consumables Staff welfare Printing and stationery 352 000 195 000 25 600 42 500 98 523 3 354 6210 268 500 12 500 8 540 12 580 64 850 198 500 12 400 3 568 1 489 980 1 307 094 200 000 150 000 147 500 54 750 1650 56 850 34 850 4:520 656 974 1 307 094 Additional information: A customer returned defective goods of R5 750. VAT of 15% is levied per the Value Added Tax Act by XYZ Limited. The company has a 10% markup rate. The municipal account amounting to R1 450 was received on 14 April 2023. 1. 2. 3. 4. 5. 6. Required: 2.1 2.2. Repairs to the motor vehicle of R 3 200 was refunded through payroll and posted to the salaries and wages account. XYZ Trading adopted the periodic inventory system to account for the consumables. Consumables purchased during March 2023 of R5 000 was posted to the cost of sales account by the bookkeeper. The stock count concluded on 31 March 2023 valued the consumable inventory on R4 200. Ordinary shares trades at R2 each. At reporting date, the shareholders declared a dividend of 5c. A prospectus offering 50 000 R2 ordinary shares and 10 000 R10 preference shares was advertised during March 2023. Mrs. Flinch entered into an underwriter's agreement with XYZ Limited for an agreed 3,5% fee. The allowance for credit losses should equal 8% of the debtor's book at reporting date. 2.3 Prepare the Statement of Comprehensive Income as at 31 March 2023 based on the reporting requirements of the International Financial Reporting Standards. Define with examples where applicable each of the following accounting concepts/terms: 2.1.1 Accounting 2.1.2 Current liability 2.1.3 Current asset 2.1.4 Net asset value 2.1.5 Accounting policy Discuss the accounting cycle. (25) (2) (3) (3) (2) (3) (7) ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

21 Prepare the Statement of Comprehensive Income as at 31 March 2023 based on the reporting requirements of the International Financial Reporting Standards Revenue Sale of Goods 656974 Miscellaneous I...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started