Question

The preferred stock has 557,740 shares authorized, with a par value of $100 and an annual $3.75 per share cumulative dividend preference. On Jan 1,

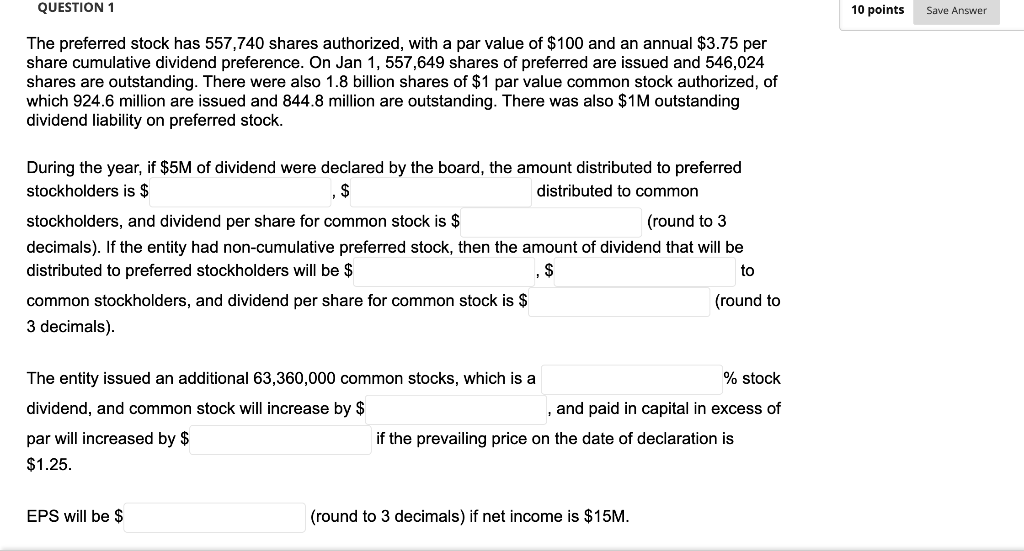

The preferred stock has 557,740 shares authorized, with a par value of $100 and an annual $3.75 per share cumulative dividend preference. On Jan 1, 557,649 shares of preferred are issued and 546,024 shares are outstanding. There were also 1.8 billion shares of $1 par value common stock authorized, of which 924.6 million are issued and 844.8 million are outstanding. There was also $1M outstanding dividend liability on preferred stock.

Instruction: You have one submission attempt. Read the questions carefully and all numeric answers must be whole numbers, so round up where applicable. NO decimals, NO commas. Responses like $2,000.00, $2,000, $2000 are not acceptable. Some solutions require you to round to 3 decimals. Response should be written as 2000 and any negative written as (2000). Make reference to your textbook and zoom recordings if required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started