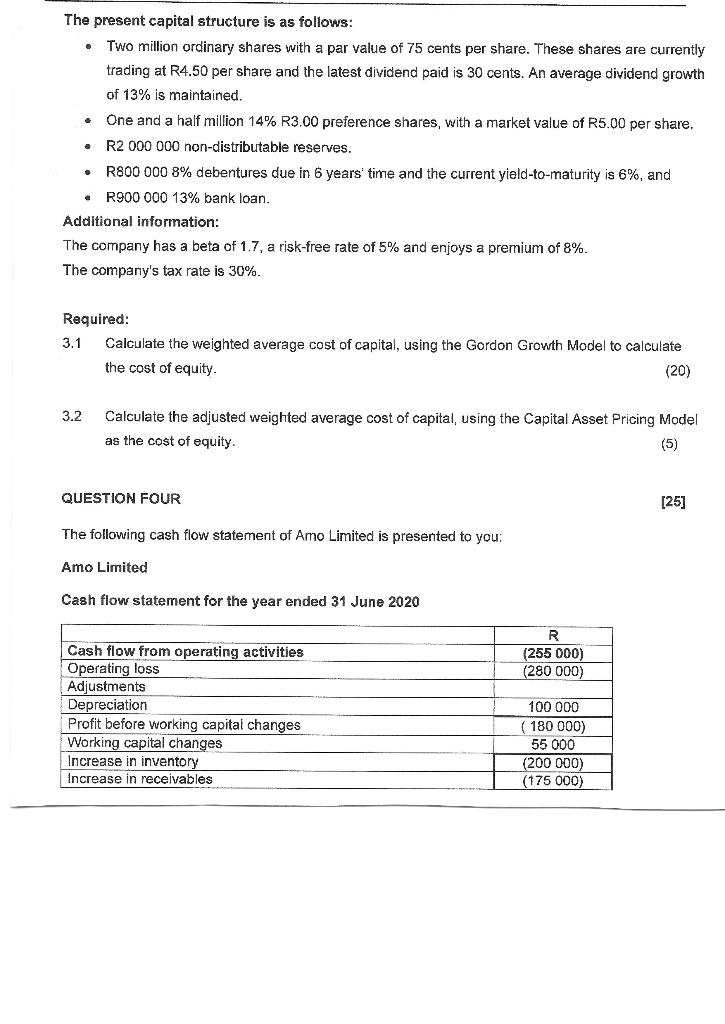

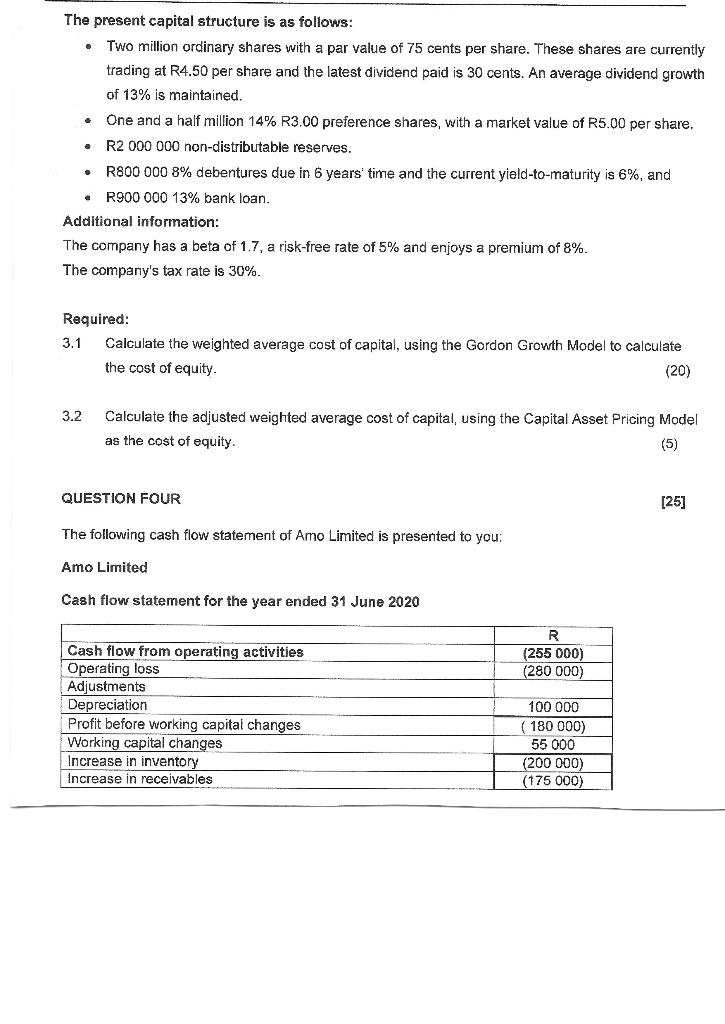

. The present capital structure is as follows: Two million ordinary shares with a par value of 75 cents per share. These shares are currently trading at R4.50 per share and the latest dividend paid is 30 cents. An average dividend growth of 13% is maintained. One and a half million 14% R3.00 preference shares, with a market value of R5.00 per share. R2 000 000 non-distributable reserves. R800 000 8% debentures due in 6 years' time and the current yield-to-maturity is 6%, and R900 000 13% bank loan. Additional information: The company has a beta of 1.7, a risk-free rate of 5% and enjoys a premium of 8%. The company's tax rate is 30%. . Required: 3.1 Calculate the weighted average cost of capital, using the Gordon Growth Model to calculate the cost of equity. (20) 3.2 Calculate the adjusted weighted average cost of capital, using the Capital Asset Pricing Model as the cost of equity. (5) QUESTION FOUR [25] The following cash flow statement of Amo Limited is presented to you: Amo Limited Cash flow statement for the year ended 31 June 2020 R (255 000) (280 000) Cash flow from operating activities Operating loss Adjustments Depreciation Profit before working capital changes Working capital changes Increase in inventory Increase in receivables 100 000 180 000) 55 000 (200 000) (175 000) . The present capital structure is as follows: Two million ordinary shares with a par value of 75 cents per share. These shares are currently trading at R4.50 per share and the latest dividend paid is 30 cents. An average dividend growth of 13% is maintained. One and a half million 14% R3.00 preference shares, with a market value of R5.00 per share. R2 000 000 non-distributable reserves. R800 000 8% debentures due in 6 years' time and the current yield-to-maturity is 6%, and R900 000 13% bank loan. Additional information: The company has a beta of 1.7, a risk-free rate of 5% and enjoys a premium of 8%. The company's tax rate is 30%. . Required: 3.1 Calculate the weighted average cost of capital, using the Gordon Growth Model to calculate the cost of equity. (20) 3.2 Calculate the adjusted weighted average cost of capital, using the Capital Asset Pricing Model as the cost of equity. (5) QUESTION FOUR [25] The following cash flow statement of Amo Limited is presented to you: Amo Limited Cash flow statement for the year ended 31 June 2020 R (255 000) (280 000) Cash flow from operating activities Operating loss Adjustments Depreciation Profit before working capital changes Working capital changes Increase in inventory Increase in receivables 100 000 180 000) 55 000 (200 000) (175 000)