Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The present sales of ABC Itd are Rs.50 lacs. The company classifies its customers under three credit categories A, B and C. The company

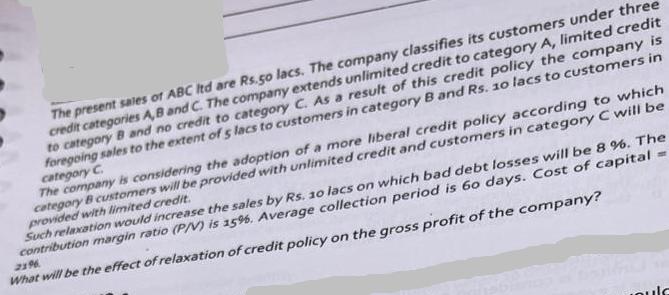

The present sales of ABC Itd are Rs.50 lacs. The company classifies its customers under three credit categories A, B and C. The company extends unlimited credit to category A, limited credit to category B and no credit to category C. As a result of this credit policy the company is foregoing sales to the extent of 5 lacs to customers in category B and Rs. 10 lacs to customers in category C The company is considering the adoption of a more liberal credit policy according to which category B customers will be provided with unlimited credit and customers in category C will be provided with limited credit. Such relaxation would increase the sales by Rs. 10 lacs on which bad debt losses will be 8 %. The contribution margin ratio (P/V) is 1596. Average collection period is 60 days. Cost of capital = 219. What will be the effect of relaxation of credit policy on the gross profit of the company? ould

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Current Situation Sales Rs 50 lacs Foregone sales to Category B customers Rs 5 lacs Foregone sales t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started