Question

The present worth of the after-tax cash flows of an existing machine (defender) with three-year remaining useful life and a replacement alternative (challenger) with

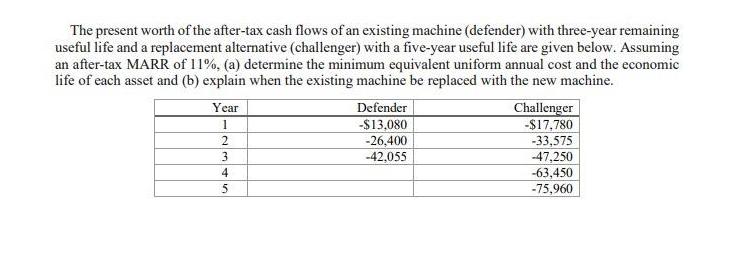

The present worth of the after-tax cash flows of an existing machine (defender) with three-year remaining useful life and a replacement alternative (challenger) with a five-year useful life are given below. Assuming an after-tax MARR of 11%, (a) determine the minimum equivalent uniform annual cost and the economic life of each asset and (b) explain when the existing machine be replaced with the new machine. Year 12345 Defender -$13,080 -26,400 -42,055 Challenger -$17,780 -33,575 -47,250 -63,450 -75,960

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To determine the minimum equivalent uniform annual cost and the economic life of each asset we need to calculate the present worth of the aftertax cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Engineering Economy

Authors: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

15th edition

132554909, 978-0132554909

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App