Answered step by step

Verified Expert Solution

Question

1 Approved Answer

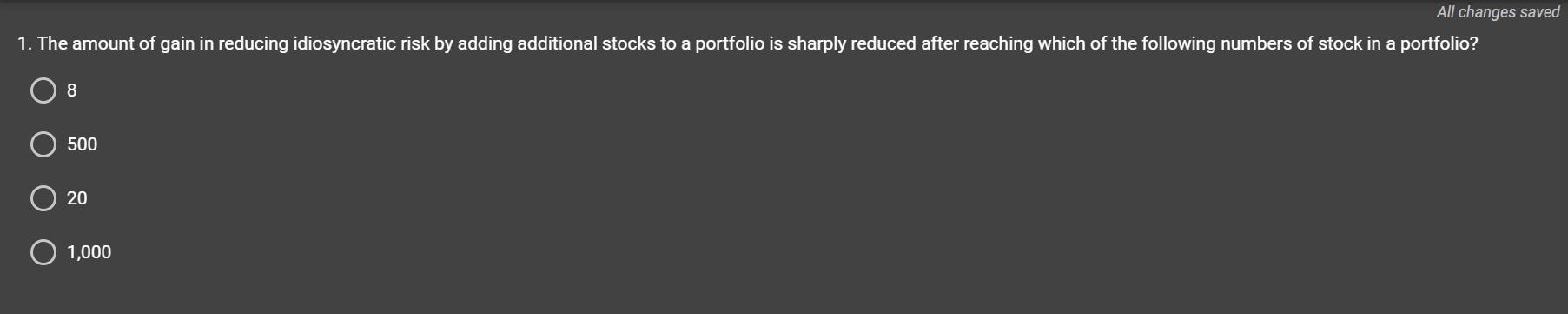

All changes saved 1. The amount of gain in reducing idiosyncratic risk by adding additional stocks to a portfolio is sharply reduced after reaching

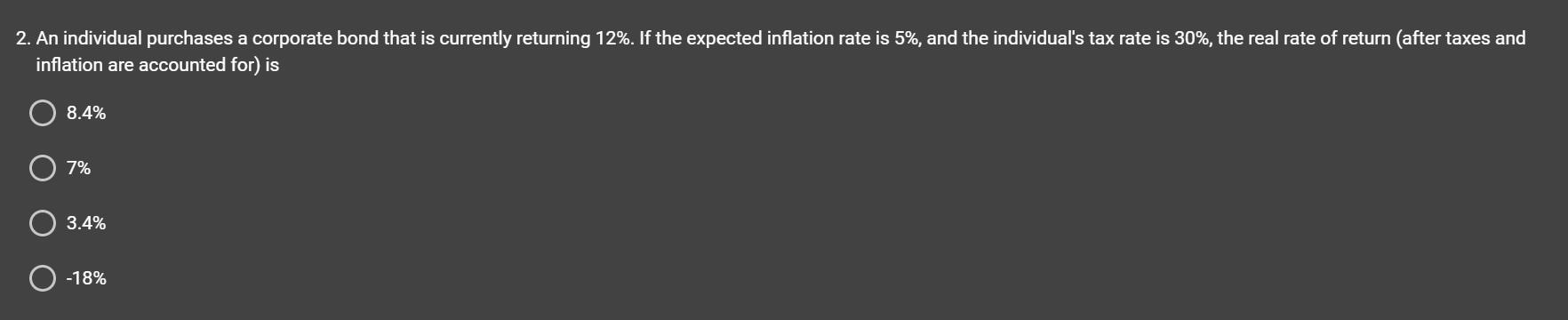

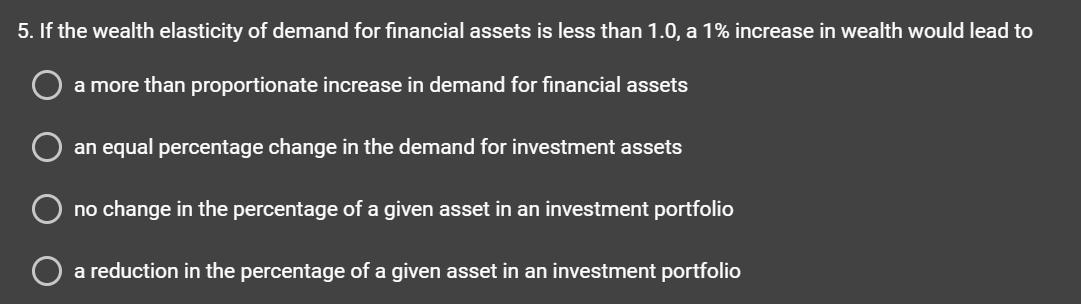

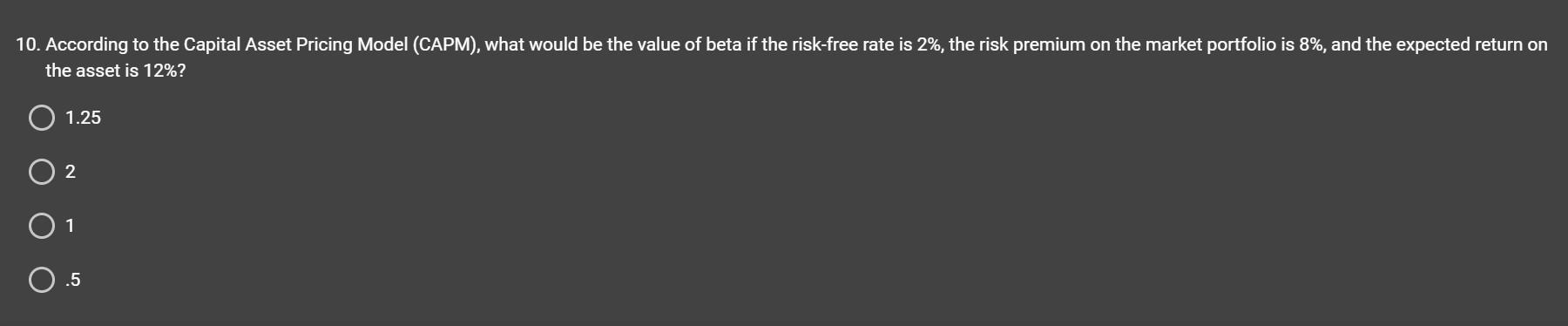

All changes saved 1. The amount of gain in reducing idiosyncratic risk by adding additional stocks to a portfolio is sharply reduced after reaching which of the following numbers of stock in a portfolio? 8 500 20 1,000 2. An individual purchases a corporate bond that is currently returning 12%. If the expected inflation rate is 5%, and the individual's tax rate is 30%, the real rate of return (after taxes and inflation are accounted for) is 8.4% 7% 3.4% -18% 5. If the wealth elasticity of demand for financial assets is less than 1.0, a 1% increase in wealth would lead to a more than proportionate increase in demand for financial assets an equal percentage change in the demand for investment assets no change in the percentage of a given asset in an investment portfolio a reduction in the percentage of a given asset in an investment portfolio 10. According to the Capital Asset Pricing Model (CAPM), what would be the value of beta if the risk-free rate is 2%, the risk premium on the market portfolio is 8%, and the expected return on the asset is 12%? 1.25 0 2 1 .5

Step by Step Solution

★★★★★

3.54 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

1 20 The amount of gain in reducing idiosyncr atic risk by adding additional stocks to a portfolio i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started