The president of MacDonald Inc., has asked the Controller, Laura Spence, to review the way the company is costing its products. The company uses

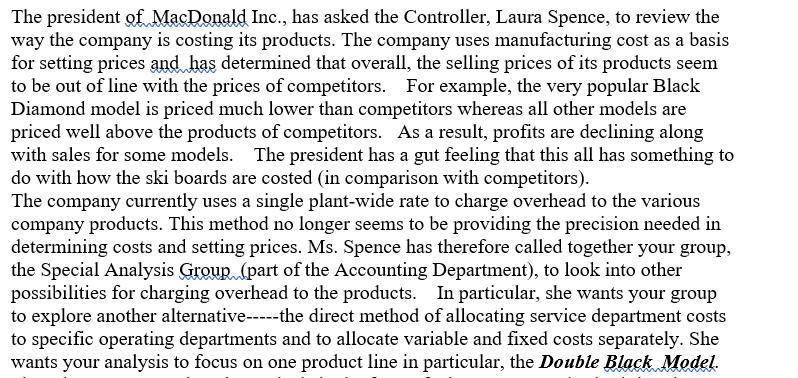

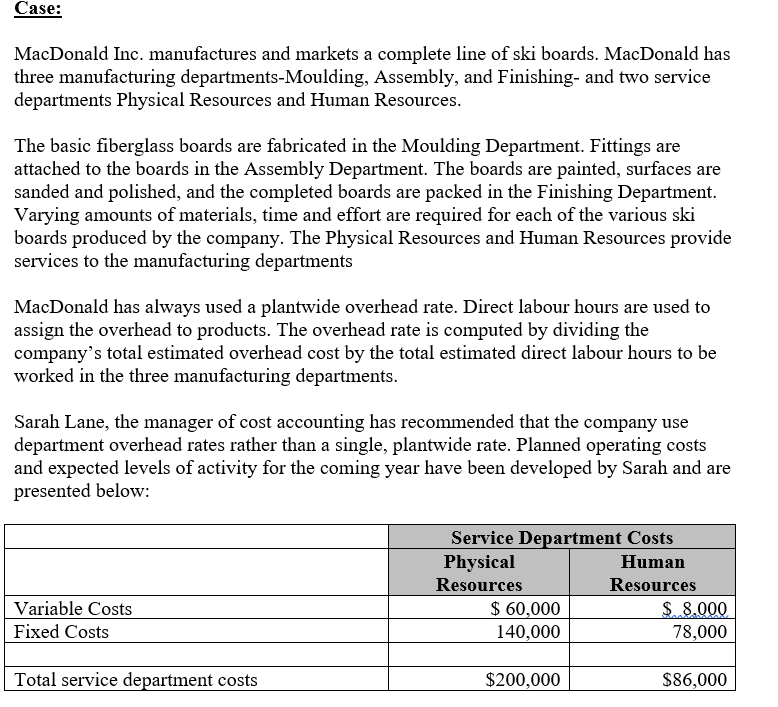

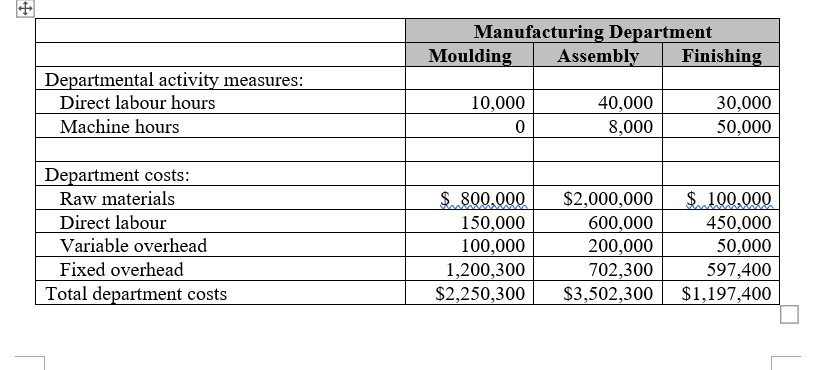

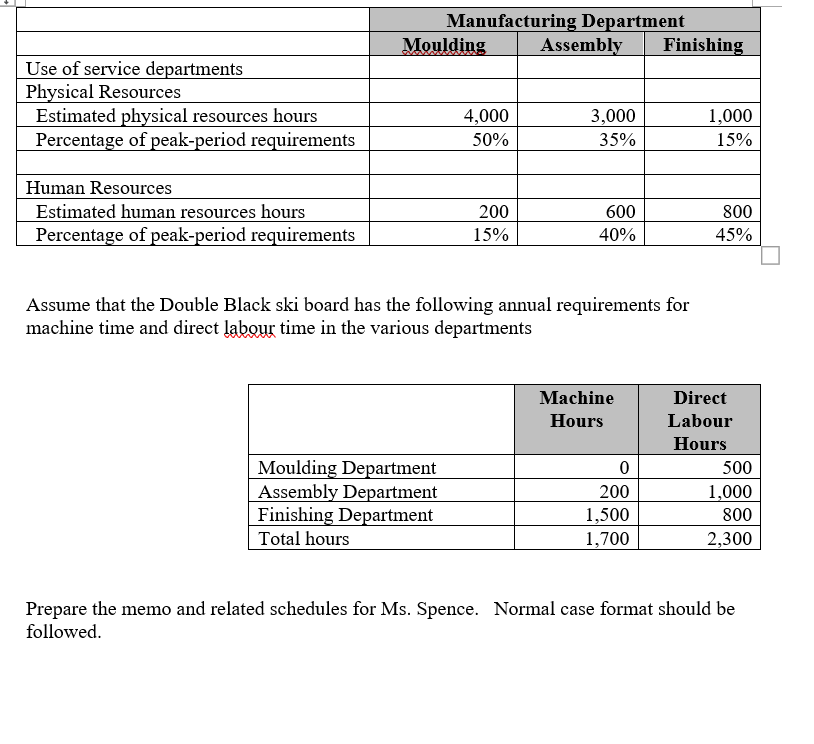

The president of MacDonald Inc., has asked the Controller, Laura Spence, to review the way the company is costing its products. The company uses manufacturing cost as a basis for setting prices and has determined that overall, the selling prices of its products seem to be out of line with the prices of competitors. For example, the very popular Black Diamond model is priced much lower than competitors whereas all other models are priced well above the products of competitors. As a result, profits are declining along with sales for some models. The president has a gut feeling that this all has something to do with how the ski boards are costed (in comparison with competitors). The company currently uses a single plant-wide rate to charge overhead to the various company products. This method no longer seems to be providing the precision needed in determining costs and setting prices. Ms. Spence has therefore called together your group, the Special Analysis Group (part of the Accounting Department), to look into other possibilities for charging overhead to the products. In particular, she wants your group to explore another alternative-----the direct method of allocating service department costs to specific operating departments and to allocate variable and fixed costs separately. She wants your analysis to focus on one product line in particular, the Double Black Model. Case: MacDonald Inc. manufactures and markets a complete line of ski boards. MacDonald has three manufacturing departments-Moulding, Assembly, and Finishing- and two service departments Physical Resources and Human Resources. The basic fiberglass boards are fabricated in the Moulding Department. Fittings are attached to the boards in the Assembly Department. The boards are painted, surfaces are sanded and polished, and the completed boards are packed in the Finishing Department. Varying amounts of materials, time and effort are required for each of the various ski boards produced by the company. The Physical Resources and Human Resources provide services to the manufacturing departments MacDonald has always used a plantwide overhead rate. Direct labour hours are used to assign the overhead to products. The overhead rate is computed by dividing the company's total estimated overhead cost by the total estimated direct labour hours to be worked in the three manufacturing departments. Sarah Lane, the manager of cost accounting has recommended that the company use department overhead rates rather than a single, plantwide rate. Planned operating costs and expected levels of activity for the coming year have been developed by Sarah and are presented below: Variable Costs Fixed Costs Total service department costs Service Department Costs Physical Human Resources Resources $ 60,000 $ 8.000 140,000 78,000 $200,000 $86,000 + Departmental activity measures: Direct labour hours Machine hours Department costs: Raw materials Direct labour Variable overhead Fixed overhead Total department costs Moulding Manufacturing Department Assembly Finishing 10,000 0 40,000 30,000 8,000 50,000 $ 800.000 $2,000,000 $ 100,000 150,000 600,000 100,000 200,000 450,000 50,000 1,200,300 702,300 597,400 $2,250,300 $3,502,300 $1,197,400 Use of service departments Physical Resources Estimated physical resources hours Percentage of peak-period requirements Human Resources Estimated human resources hours Percentage of peak-period requirements Manufacturing Department Moulding Assembly Finishing 4,000 3,000 1,000 50% 35% 15% 200 600 800 15% 40% 45% Assume that the Double Black ski board has the following annual requirements for machine time and direct labour time in the various departments Moulding Department Assembly Department Finishing Department Total hours Machine Hours Direct Labour Hours 0 500 200 1,000 1,500 800 1,700 2,300 Prepare the memo and related schedules for Ms. Spence. Normal case format should be followed.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To break this problem we need to cypher the colorful costs and allocate them to the departments and products as per the new system which uses department grounded outflow rates way for working the Prob...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started