Answered step by step

Verified Expert Solution

Question

1 Approved Answer

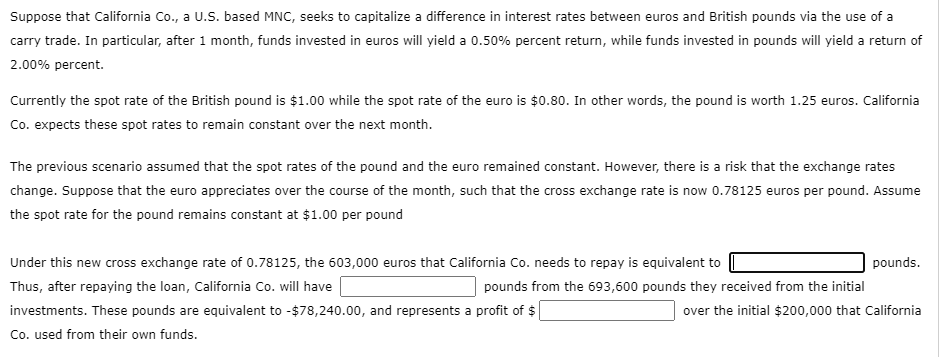

The previous scenario assumed that the spot rates of the pound and the euro remained constant. However, there is a risk that the exchange rates

The previous scenario assumed that the spot rates of the pound and the euro remained constant. However, there is a risk that the exchange rates change. Suppose that the euro appreciates over the course of the month, such that the cross exchange rate is now euros per pound. Assume the spot rate for the pound remains constant at $ per pound

Under this new cross exchange rate of the euros that California Co needs to repay is equivalent to

pounds. Thus, after repaying the loan, California Co will have

pounds from the pounds they received from the initial investments. These pounds are equivalent to $ and represents a profit of $

over the initial $ that California Co used from their own funds.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started