Answered step by step

Verified Expert Solution

Question

1 Approved Answer

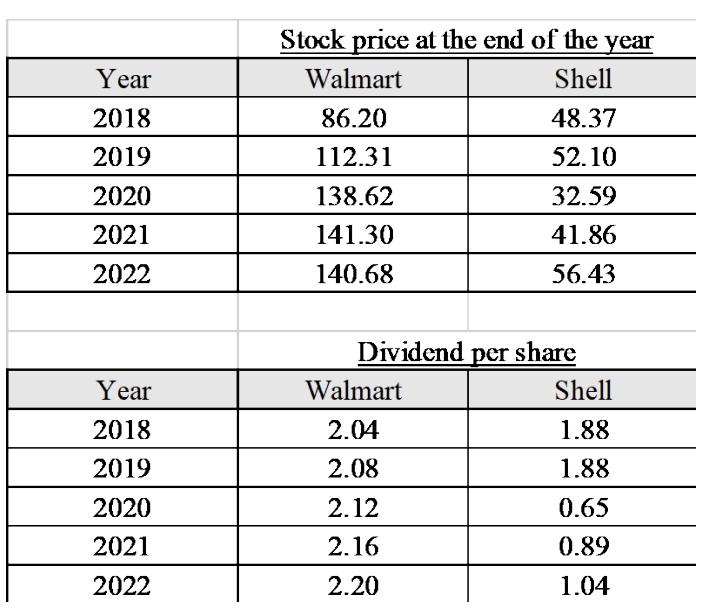

The price and dividend information over the last five years relating to Walmart (operating in the discount stores industry) and Shell (operating in the oil

The price and dividend information over the last five years relating to Walmart (operating in the discount stores industry) and Shell (operating in the oil and gas industry) are shown below:

Year 2018 2019 2020 2021 2022 Year 2018 2019 2020 2021 2022 Stock price at the end of the year Shell 48.37 52.10 32.59 41.86 56.43 Walmart 86.20 112.31 138.62 141.30 140.68 Dividend per share Walmart 2.04 2.08 2.12 2.16 2.20 Shell 1.88 1.88 0.65 0.89 1.04 Year 2018 2019 2020 2021 2022 Year 2018 2019 2020 2021 2022 Stock price at the end of the year Shell 48.37 52.10 32.59 41.86 56.43 Walmart 86.20 112.31 138.62 141.30 140.68 Dividend per share Walmart 2.04 2.08 2.12 2.16 2.20 Shell 1.88 1.88 0.65 0.89 1.04 Year 2018 2019 2020 2021 2022 Year 2018 2019 2020 2021 2022 Stock price at the end of the year Shell 48.37 52.10 32.59 41.86 56.43 Walmart 86.20 112.31 138.62 141.30 140.68 Dividend per share Walmart 2.04 2.08 2.12 2.16 2.20 Shell 1.88 1.88 0.65 0.89 1.04

Step by Step Solution

★★★★★

3.56 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To appraise which stock is less risky if held on its own we can analyze the historical price and div...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started