Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The price of a call option on a stock XYZ with exercise price $40 and maturity 1 year is $3, a corresponding put trades

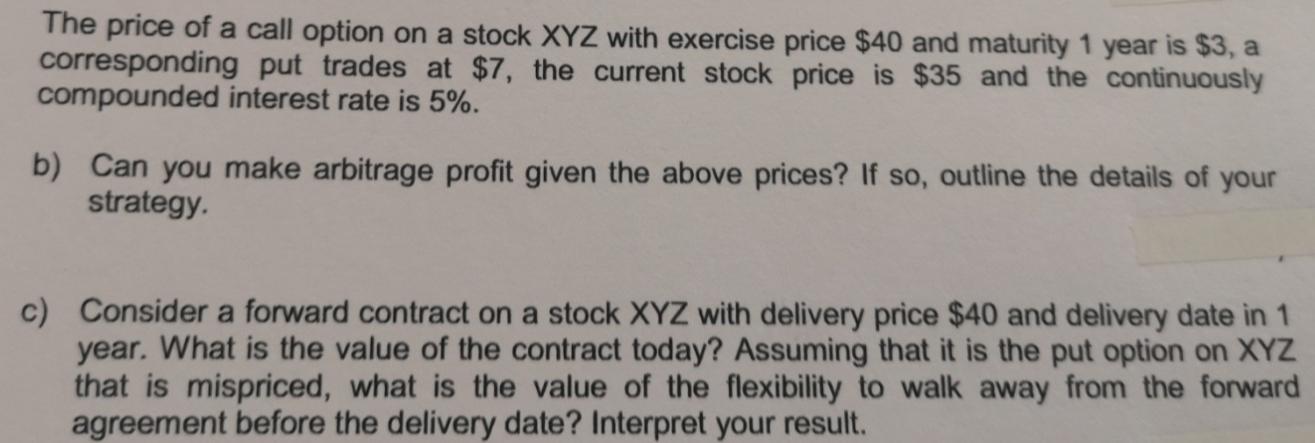

The price of a call option on a stock XYZ with exercise price $40 and maturity 1 year is $3, a corresponding put trades at $7, the current stock price is $35 and the continuously compounded interest rate is 5%. b) Can you make arbitrage profit given the above prices? If so, outline the details of your strategy. c) Consider a forward contract on a stock XYZ with delivery price $40 and delivery date in 1 year. What is the value of the contract today? Assuming that it is the put option on XYZ that is mispriced, what is the value of the flexibility to walk away from the forward agreement before the delivery date? Interpret your result.

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether arbitrage profit can be made we need to compare the cost of constructing a riskfree portfolio to the payoff of the options We can ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started