Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The price of stock you consider investing and the probabilities of occurrence are provided below: State Price Probability Growth 50 Stability 40 Recession 20

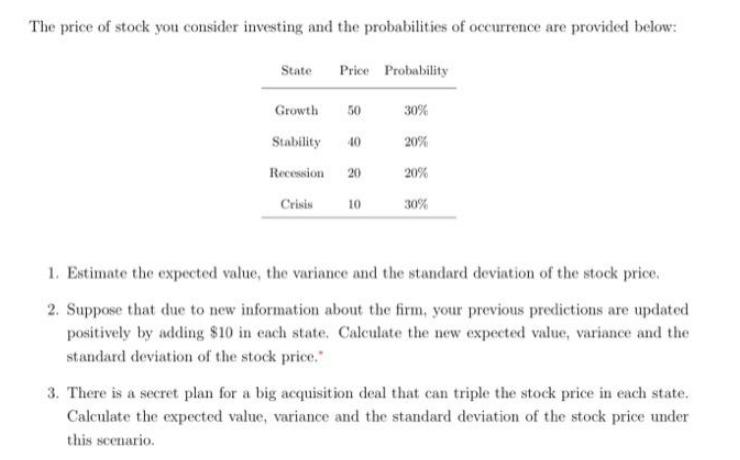

The price of stock you consider investing and the probabilities of occurrence are provided below: State Price Probability Growth 50 Stability 40 Recession 20 Crisis 10 30% 20% 20% 30% 1. Estimate the expected value, the variance and the standard deviation of the stock price. 2. Suppose that due to new information about the firm, your previous predictions are updated positively by adding $10 in each state. Calculate the new expected value, variance and the standard deviation of the stock price." 3. There is a secret plan for a big acquisition deal that can triple the stock price in each state. Calculate the expected value, variance and the standard deviation of the stock price under this scenario.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the expected value variance and standard deviation of the stock price well use the prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started