Question

1. The price of the three-times leveraged Bull SP&500 ETF (tic:SPXL) is $44. The initial margin is 69%. The maintenance margin is 47%. The amount

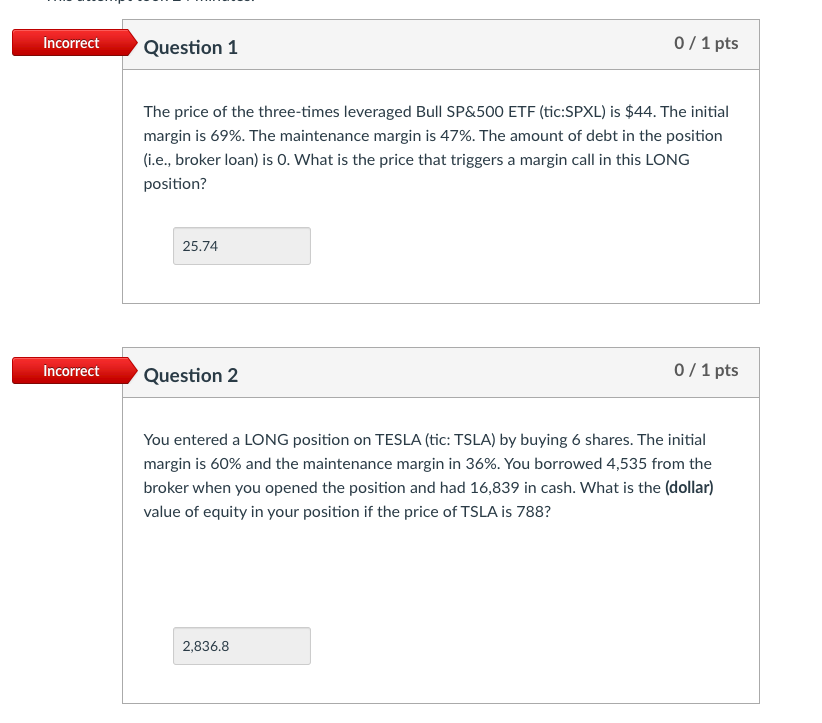

1. The price of the three-times leveraged Bull SP&500 ETF (tic:SPXL) is $44. The initial margin is 69%. The maintenance margin is 47%. The amount of debt in the position (i.e., broker loan) is 0. What is the price that triggers a margin call in this LONG position?

2. You entered a LONG position on TESLA (tic: TSLA) by buying 6 shares. The initial margin is 60% and the maintenance margin in 36%. You borrowed 4,535 from the broker when you opened the position and had 16,839 in cash. What is the?(dollar)?value of equity in your position if the price of TSLA is 788?

Incorrect Question 1 0/1 pts The price of the three-times leveraged Bull SP&500 ETF (tic:SPXL) is $44. The initial margin is 69%. The maintenance margin is 47%. The amount of debt in the position (i.e., broker loan) is 0. What is the price that triggers a margin call in this LONG position? 25.74 Incorrect Question 2 0/1 pts You entered a LONG position on TESLA (tic: TSLA) by buying 6 shares. The initial margin is 60% and the maintenance margin in 36%. You borrowed 4,535 from the broker when you opened the position and had 16,839 in cash. What is the (dollar) value of equity in your position if the price of TSLA is 788? 2,836.8

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here 2 Diiferent Questions are given So according to Cheggs policy I ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started