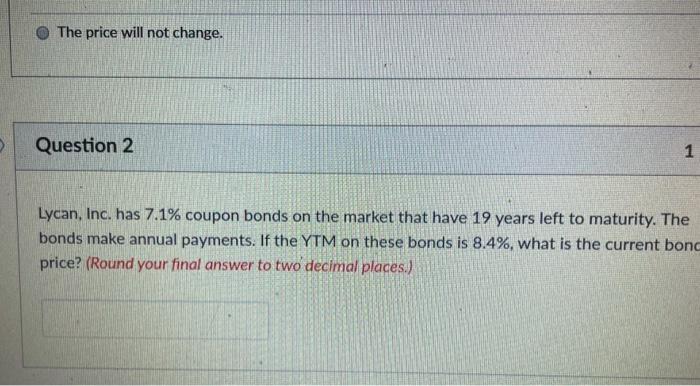

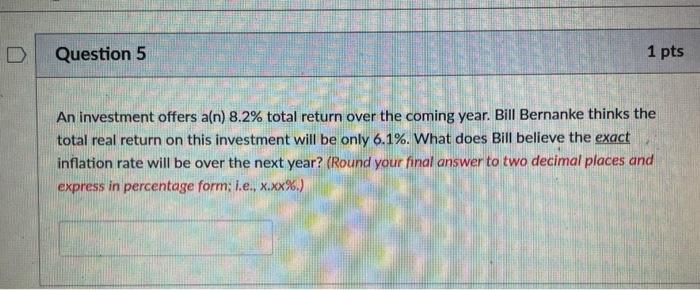

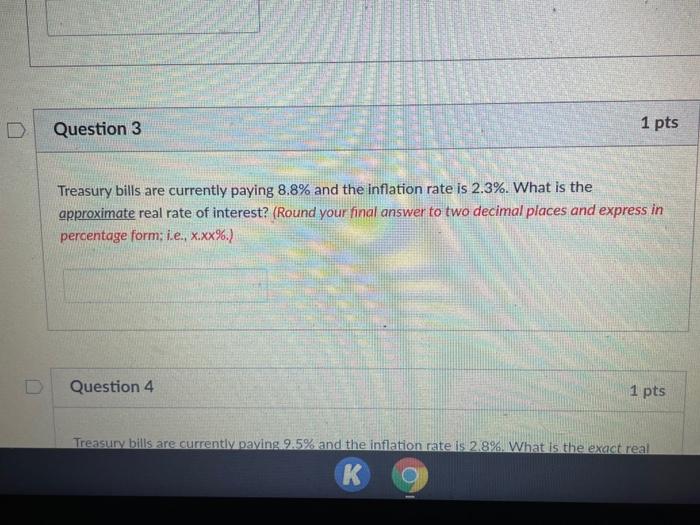

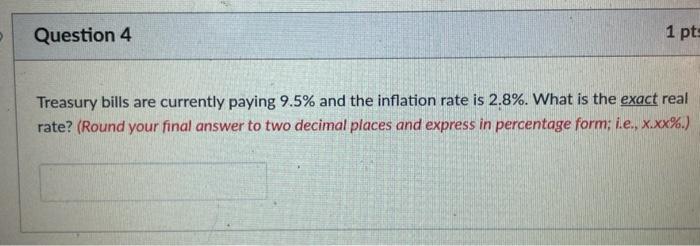

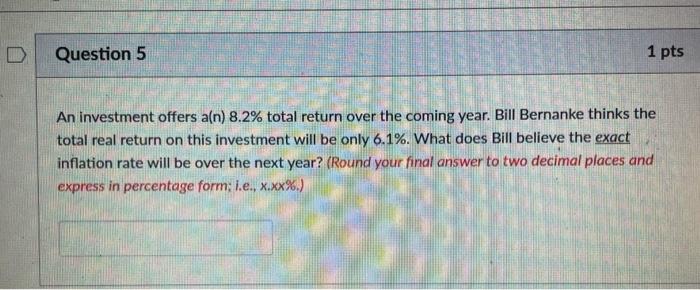

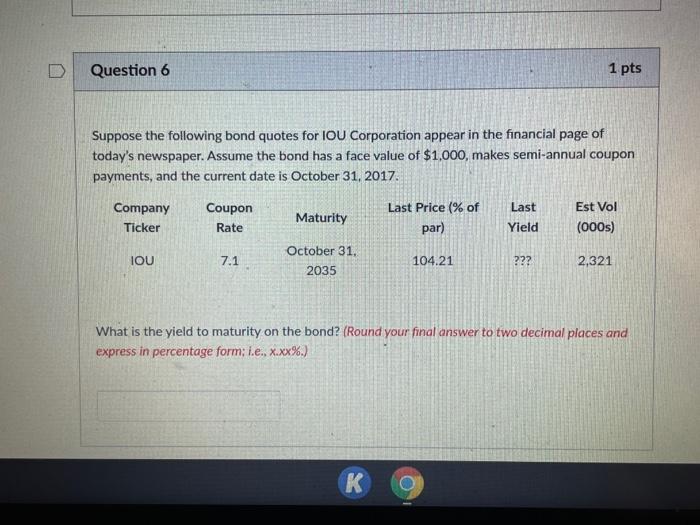

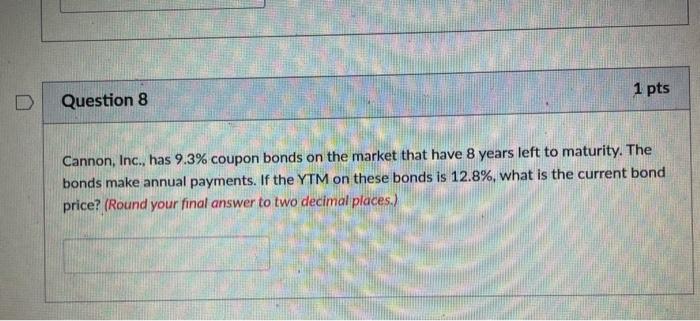

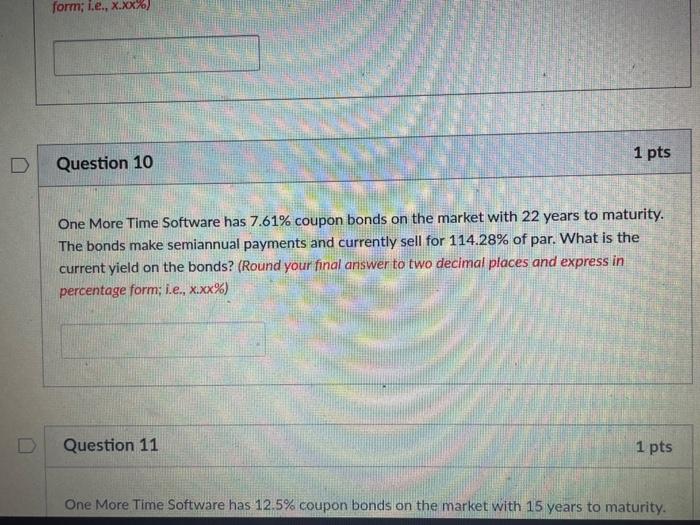

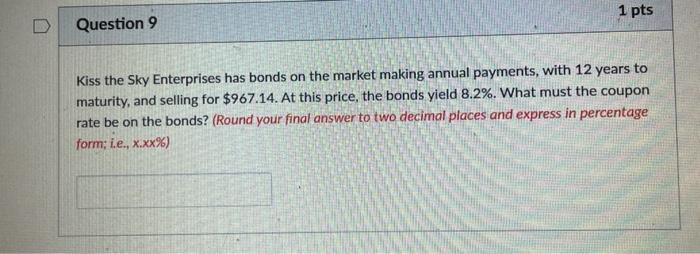

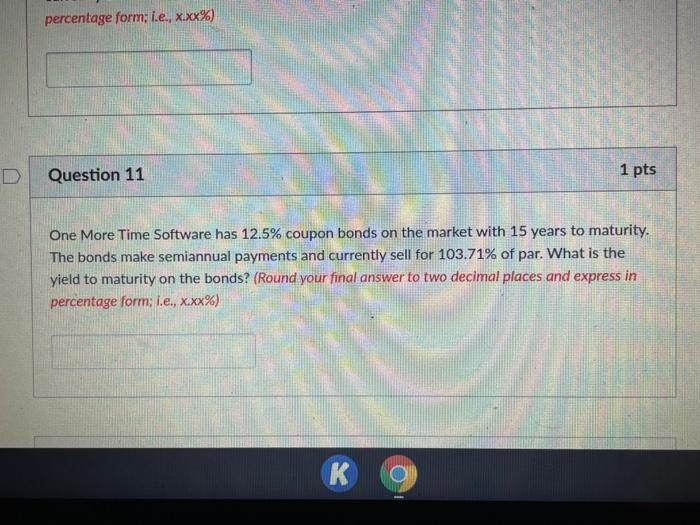

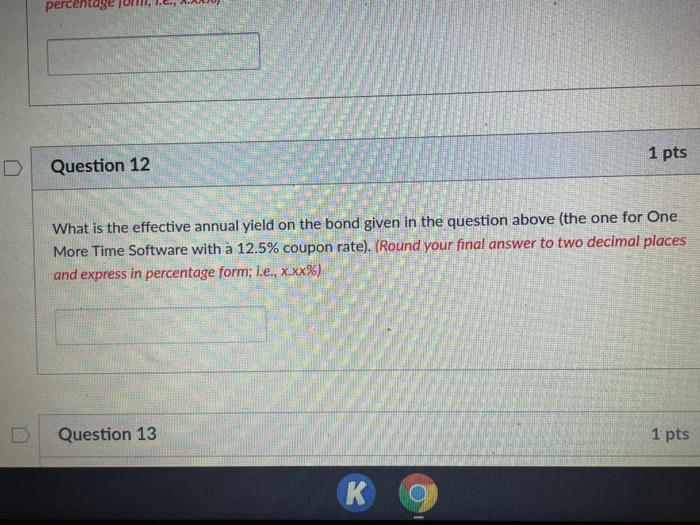

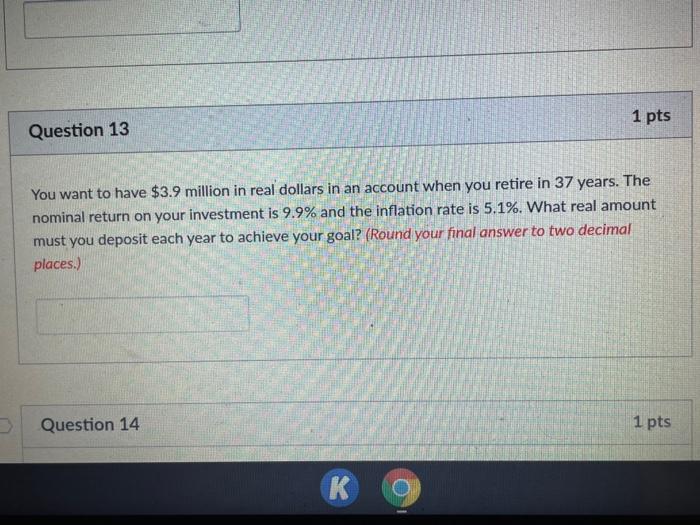

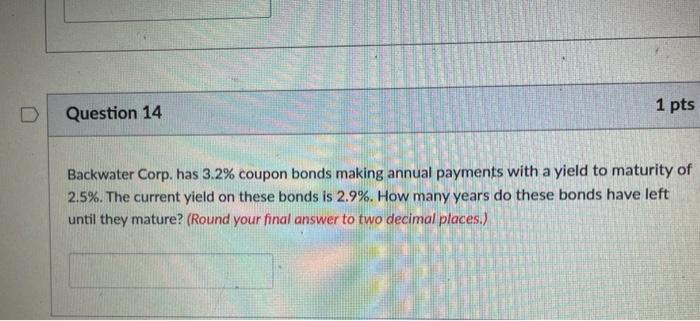

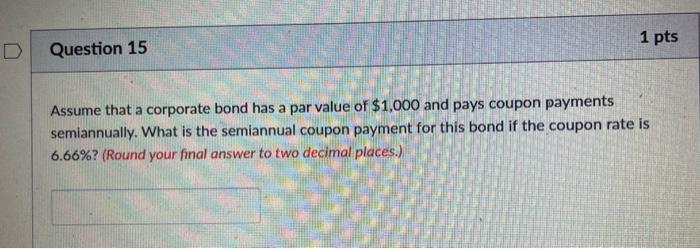

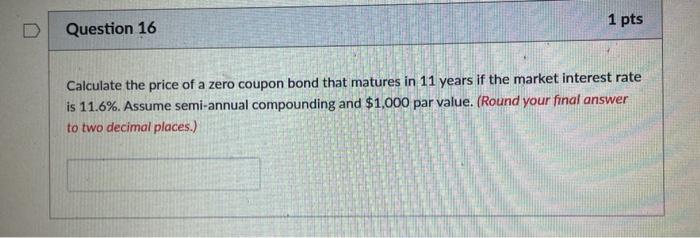

The price will not change. Question 2 1 Lycan, Inc. has 7.1% coupon bonds on the market that have 19 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 8.4%, what is the current bond price? (Round your final answer to two decimal places.) Question 5 1 pts An investment offers a(n) 8.2% total return over the coming year. Bill Bernanke thinks the total real return on this investment will be only 6.1%. What does Bill believe the exact inflation rate will be over the next year? (Round your final answer to two decimal places and express in percentage form: 1.e., x.xx%.) Question 3 1 pts Treasury bills are currently paying 8.8% and the inflation rate is 2.3%. What is the approximate real rate of interest? (Round your final answer to two decimal places and express in percentage form i.e., X.XX%.) Question 4 1 pts Treasury bills are currently paying 9.5% and the inflation rate is 2.8% What is the exact real K Question 4 1 pts Treasury bills are currently paying 9.5% and the inflation rate is 2.8%. What is the exact real rate? (Round your final answer to two decimal places and express in percentage form; i.e., x.xx%. Question 5 1 pts An investment offers a(n) 8.2% total return over the coming year. Bill Bernanke thinks the total real return on this investment will be only 6.1%. What does Bill believe the exact inflation rate will be over the next year? (Round your final answer to two decimal places and express in percentage form: 1.e., x.xx%.) Question 6 1 pts Suppose the following bond quotes for IOU Corporation appear in the financial page of today's newspaper. Assume the bond has a face value of $1,000, makes semi-annual coupon payments, and the current date is October 31, 2017 Last Company Ticker Coupon Rate Maturity Last Price% of par) Est Vol (000s) Yield IOU 7.1 October 31. 2035 104.21 ??? 2,321 What is the yield to maturity on the bond? (Round your final answer to two decimal places and express in percentage form; i.e., X.xx%.) 1 pts Question 8 Cannon, Inc., has 9.3% coupon bonds on the market that have 8 years left to maturity. The bonds make annual payments. If the YTM on these bonds is 12.8%, what is the current bond price? (Round your final answer to two decimal places.) form; i.e., X.xx%) 1 pts D Question 10 One More Time Software has 7.61% coupon bonds on the market with 22 years to maturity. The bonds make semiannual payments and currently sell for 114.28% of par. What is the current yield on the bonds? (Round your final answer to two decimal places and express in percentage form; i.e., x.xx%) Question 11 1 pts One More Time Software has 12.5% coupon bonds on the market with 15 years to maturity. 1 pts Question 9 Kiss the Sky Enterprises has bonds on the market making annual payments, with 12 years to maturity, and selling for $967.14. At this price, the bonds yield 8.2%. What must the coupon rate be on the bonds? (Round your final answer to two decimal places and express in percentage form; i.e., X.XX%) percentage form; i.e., x.xx%) Question 11 1 pts One More Time Software has 12.5% coupon bonds on the market with 15 years to maturity. The bonds make semiannual payments and currently sell for 103.71% of par. What is the yield to maturity on the bonds? (Round your final answer to two decimal places and express in percentage form; i.e., X.XX%) O K percentage 1 pts Question 12 What is the effective annual yield on the bond given in the question above (the one for One More Time Software with a 12.5% coupon rate). (Round your final answer to two decimal places and express in percentage form; l.e., X.XX%) Question 13 1 pts 1 pts Question 13 You want to have $3.9 million in real dollars in an account when you retire in 37 years. The nominal return on your investment is 9.9% and the inflation rate is 5.1%. What real amount must you deposit each year to achieve your goal? (Round your final answer to two decimal places.) 3 Question 14 1 pts K Question 14 1 pts Backwater Corp. has 3.2% coupon bonds making annual payments with a yield to maturity of 2.5%. The current yield on these bonds is 2.9%. How many years do these bonds have left until they mature? (Round your final answer to two decimal places.) 1 pts D Question 15 Assume that a corporate bond has a par value of $1,000 and pays coupon payments semiannually. What is the semiannual coupon payment for this bond if the coupon rate is 6.66%? (Round your final answer to two decimal places.) 1 pts Question 16 Calculate the price of a zero coupon bond that matures in 11 years if the market interest rate is 11.6%. Assume semi-annual compounding and $1,000 par value. (Round your final answer to two decimal places.)