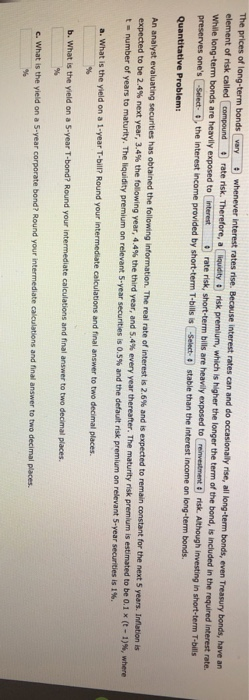

The prices of long-term bonds vary whenever interest rates rise. Because interest rates can and do occasionally rise, all long-term bonds, even Treasury bonds, have an element of risk called compound rate risk. Therefore, a quidity risk premium, which is higher the longer the term of the bond, is included in the required interest rate While long-term bonds are heavily exposed to interest rate risk, short-term bills are heavily exposed to reinvestment risk. Although investing in short-term T-bills preserves one's -Select- :, the interest income provided by short-term T-bills is Select stable than the interest income on long-term bonds. Quantitative Problem: An analyst evaluating securities has obtained the following information. The real rate of interest is 2.6% and is expected to remain constant for the next 5 years. Inflation is expected to be 2.4% next year, 3.4% the following year, 4.4% the third year, and 5.4% every year thereafter. The maturity risk premium is estimated to be 0.1 * (t-1), where t = number of years to maturity. The liquidity premium on relevant 5-year securities is 0.5% and the default risk premium on relevant 5-year securities is 1% a. What is the yield on a 1-year T-bill? Round your intermediate calculations and final answer to two decimal places. b. What is the yield on a 5-year T-bond? Round your intermediate calculations and final answer to two decimal places. c. What is the yield on a 5-year corporate bond? Round your intermediate calculations and final answer to two decimal places. The prices of long-term bonds vary whenever interest rates rise. Because interest rates can and do occasionally rise, all long-term bonds, even Treasury bonds, have an element of risk called compound rate risk. Therefore, a quidity risk premium, which is higher the longer the term of the bond, is included in the required interest rate While long-term bonds are heavily exposed to interest rate risk, short-term bills are heavily exposed to reinvestment risk. Although investing in short-term T-bills preserves one's -Select- :, the interest income provided by short-term T-bills is Select stable than the interest income on long-term bonds. Quantitative Problem: An analyst evaluating securities has obtained the following information. The real rate of interest is 2.6% and is expected to remain constant for the next 5 years. Inflation is expected to be 2.4% next year, 3.4% the following year, 4.4% the third year, and 5.4% every year thereafter. The maturity risk premium is estimated to be 0.1 * (t-1), where t = number of years to maturity. The liquidity premium on relevant 5-year securities is 0.5% and the default risk premium on relevant 5-year securities is 1% a. What is the yield on a 1-year T-bill? Round your intermediate calculations and final answer to two decimal places. b. What is the yield on a 5-year T-bond? Round your intermediate calculations and final answer to two decimal places. c. What is the yield on a 5-year corporate bond? Round your intermediate calculations and final answer to two decimal places