Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The problem involves a Swiss Company and a U.S. company. The U.S. company is considering making an initial investment of $2000 and the cash

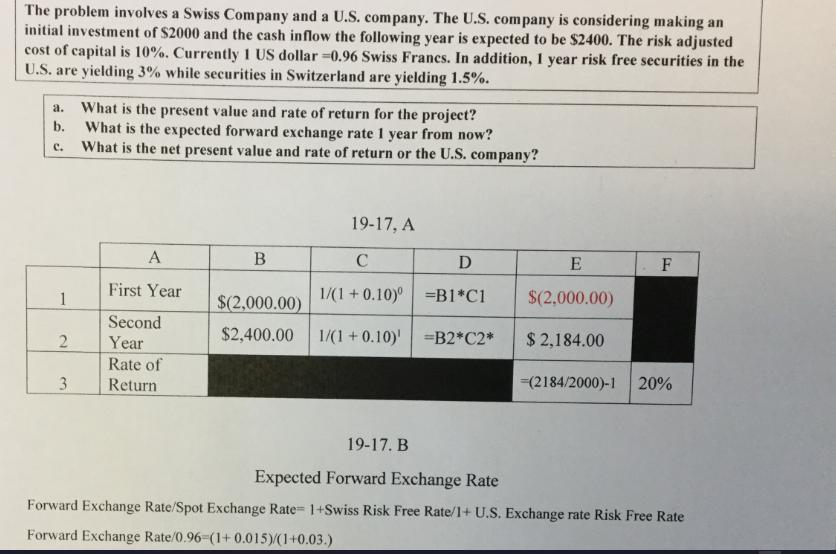

The problem involves a Swiss Company and a U.S. company. The U.S. company is considering making an initial investment of $2000 and the cash inflow the following year is expected to be $2400. The risk adjusted cost of capital is 10%. Currently 1 US dollar =0.96 Swiss Francs. In addition, 1 year risk free securities in the U.S. are yielding 3% while securities in Switzerland are yielding 1.5%. a. b. C. What is the present value and rate of return for the project? What is the expected forward exchange rate 1 year from now? What is the net present value and rate of return or the U.S. company? 19-17, A A B C D E F First Year 1 $(2,000.00) 1/(1+0.10) =B1*C1 $(2,000.00) Second $2,400.00 1/(1+0.10)' =B2*C2* 2 $ 2,184.00 Year Rate of 3 Return =(2184/2000)-1 20% 19-17. B Expected Forward Exchange Rate Forward Exchange Rate/Spot Exchange Rate 1+Swiss Risk Free Rate/1+ U.S. Exchange rate Risk Free Rate Forward Exchange Rate/0.96-(1+ 0.015)/(1+0.03.) Forward Exchange Rate/0.96 (1.015)/(1.03.) Forward Exchange Rate/0.96 0.985 Forward Exchange Rate (0.96) (0.985) Forward Exchange Rate 0.946 Exchange Rate 1 year Forward? TO Some students are saying that I Swiss Franc 1/1.05-1.13 US dollar. If this is true, where is the 1.05 coming from?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started