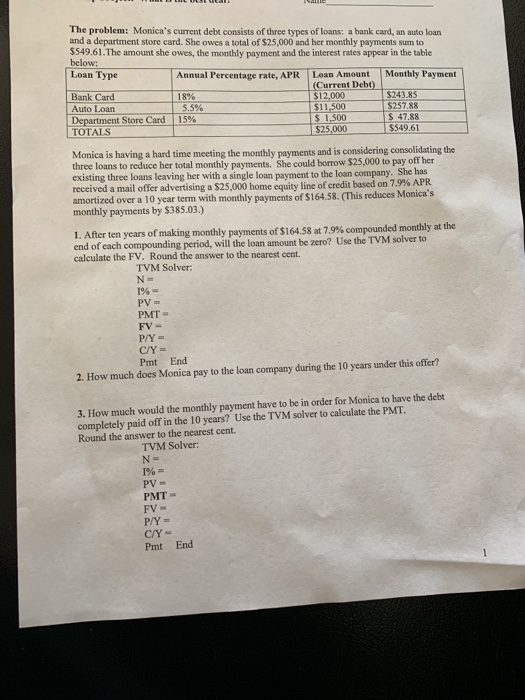

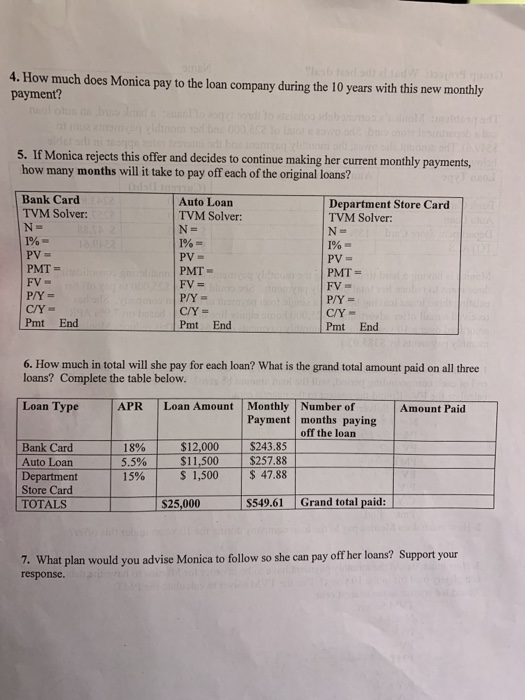

The problem: Monica's current debt consists of three types of loans: a bank card, an auto loan and a department store card. She owes a total of $25,000 and her monthly payments sum to S549.61.The amount she owes, the monthly payment and the interest rates appear in the table below: Loan Type Annual Percentage rate, APR Loan Amount Monthly Payment Bank Card Auto Loan Department Store Card | 15% 243.85 S257.88 $ 47.88 $549.61 18% 5.5% TOTALS S25,000 Monica is having a hard time meeting the monthly payments and is considering consolidating the three loans to reduce her total monthly payments. She could borrow $25,000 to pay off her existing three loans leaving her with a single loan payment to the loan company. She has received a mail offer advertising a $25,000 home equity line of credit based on 79% APR amortized over a 10 year term with monthly monthly payments by $385.03.) payments orsi 64.58. (This reduces Monica's compounded monthly at the i. After ten years of making monthly payments of $164.58 at 7.9% end of each compounding period, will the loan amount be zero? Use the TVM solver to calculate the FV. Round the answer to the nearest cent TVM Solver 1% = PMT P/Y Pmt End 2. How much does Monica pay to the loan company during the 10 years under this offer? 3. How much would the monthly payment have to be in order for Monica to have the debt completely paid off in the 10 years? Use the TVM solver to calculate the PMT. Round the answer to the nearest cent. TVM Solver PMT P/Y- C/Y Pmt End The problem: Monica's current debt consists of three types of loans: a bank card, an auto loan and a department store card. She owes a total of $25,000 and her monthly payments sum to S549.61.The amount she owes, the monthly payment and the interest rates appear in the table below: Loan Type Annual Percentage rate, APR Loan Amount Monthly Payment Bank Card Auto Loan Department Store Card | 15% 243.85 S257.88 $ 47.88 $549.61 18% 5.5% TOTALS S25,000 Monica is having a hard time meeting the monthly payments and is considering consolidating the three loans to reduce her total monthly payments. She could borrow $25,000 to pay off her existing three loans leaving her with a single loan payment to the loan company. She has received a mail offer advertising a $25,000 home equity line of credit based on 79% APR amortized over a 10 year term with monthly monthly payments by $385.03.) payments orsi 64.58. (This reduces Monica's compounded monthly at the i. After ten years of making monthly payments of $164.58 at 7.9% end of each compounding period, will the loan amount be zero? Use the TVM solver to calculate the FV. Round the answer to the nearest cent TVM Solver 1% = PMT P/Y Pmt End 2. How much does Monica pay to the loan company during the 10 years under this offer? 3. How much would the monthly payment have to be in order for Monica to have the debt completely paid off in the 10 years? Use the TVM solver to calculate the PMT. Round the answer to the nearest cent. TVM Solver PMT P/Y- C/Y Pmt End