The Problem We have currently cash reserves in 10 different currencies in the amounts given in the second column of the following table (in

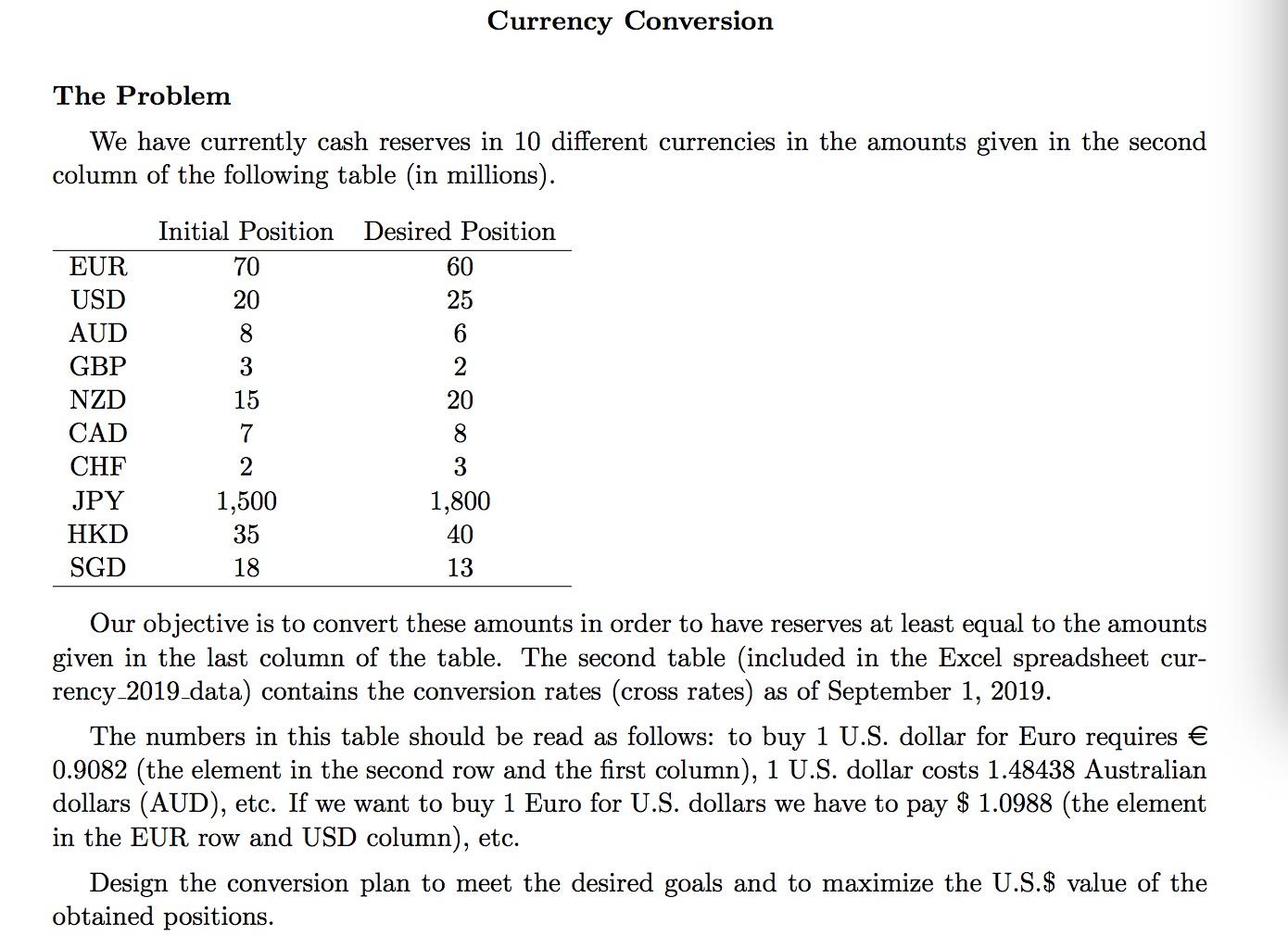

The Problem We have currently cash reserves in 10 different currencies in the amounts given in the second column of the following table (in millions). Initial Position Desired Position 70 20 8 3 15 7 2 1,500 35 18 EUR USD AUD GBP NZD CAD CHF JPY HKD SGD Currency Conversion 60 25 6 2 20 8 3 1,800 40 13 Our objective is to convert these amounts in order to have reserves at least equal to the amounts given in the last column of the table. The second table (included in the Excel spreadsheet cur- rency_2019_data) contains the conversion rates (cross rates) as of September 1, 2019. The numbers in this table should be read as follows: to buy 1 U.S. dollar for Euro requires 0.9082 (the element in the second row and the first column), 1 U.S. dollar costs 1.48438 Australian dollars (AUD), etc. If we want to buy 1 Euro for U.S. dollars we have to pay $ 1.0988 (the element in the EUR row and USD column), etc. Design the conversion plan to meet the desired goals and to maximize the U.S.$ value of the obtained positions.

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Formulate a Linear Programming Model Define decision variables Let xi represent the amount of curr...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started