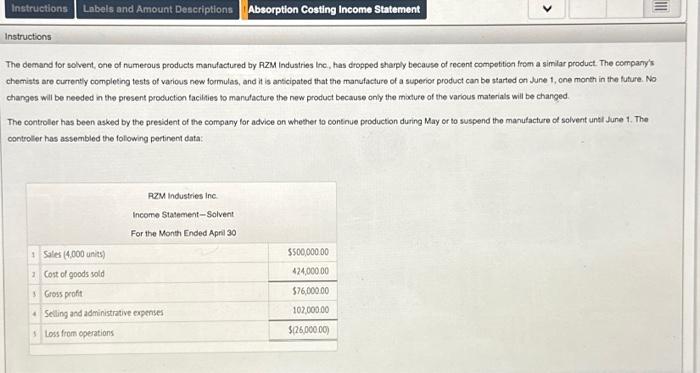

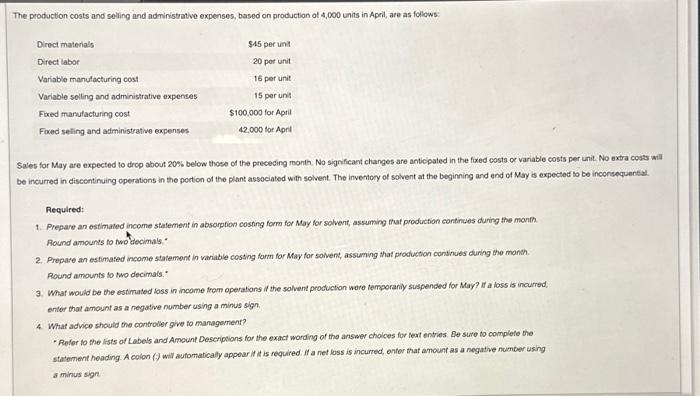

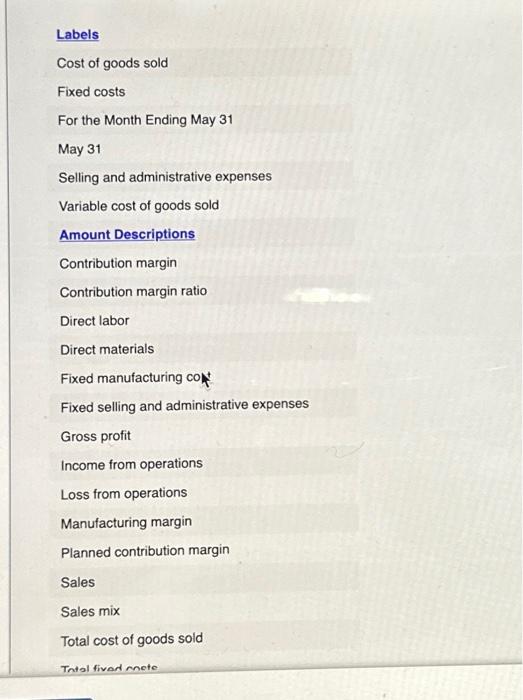

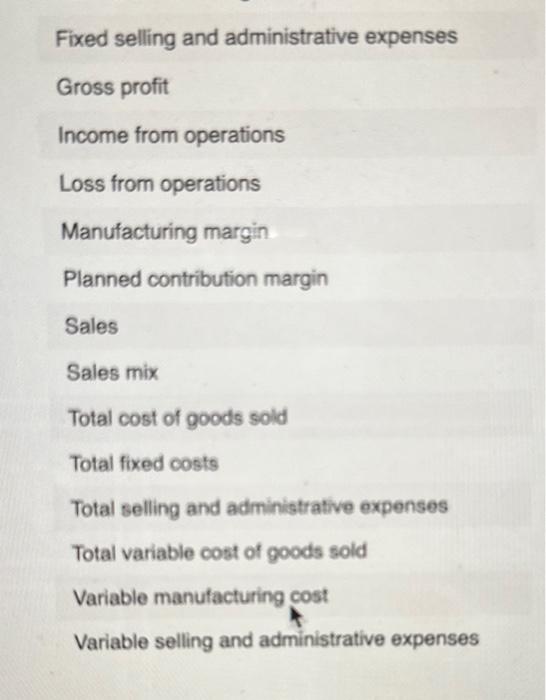

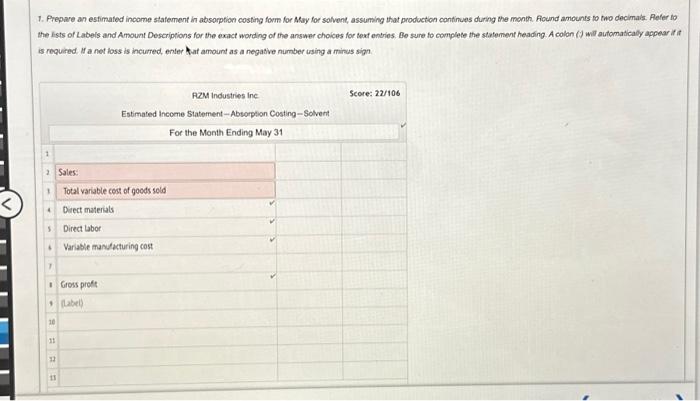

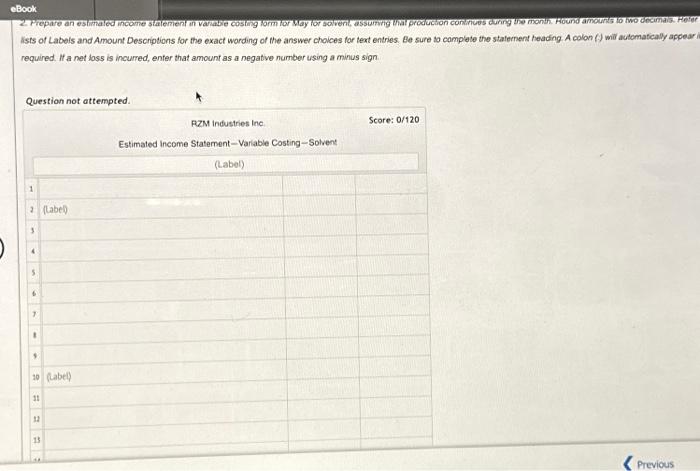

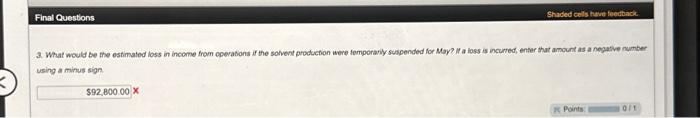

The production costs and seling and administrative expenses, based on production of 4,000 units in April, are as follows: Sales for May are expected to drop about 20% below those of the preceding month. No signficant changes are anticipated in the fixed costs or variable costs per unit. No extra costs be incurred in discontinuing operations in the portion of the plant associated with solvent. The inventory of solvent at the beginning and end of Mar is expected to be inconsequental Required: 1. Prepare an estimated income statement in absorption costing form for May for solvent, assuming ffut production cantinues during the month. Round amoun's to ho'decimals. 2. Prepare an estimated income statement in variable costing form for May for solvent, assuming that proctuction continues during the manth. Round amounts to two decimals. 3. What would be the estimated loss in income from operations d the solvent production weve temporaniy suspended for May? if a loss is incurred, enter that amount as a negative number using a minus sign. 4. What advice should the controller give to management? - Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for lext entries. Be sure to complete the statement heading. A colon () will automatically appour if it is required if a net loss is incurred, enter that amount as a negative number using a minus sign 3. What would be the estimated loss in income from eperabons if the sohvent production weve femporany suspended for Moy? /1 a lass is incumed, enter that amount as a negative number using a minus sign. The demand for solvent, one of numerous products manufactured by RZM Industries inc., has dropped sharply becauso of recent compotition from a similar product. The company's chemists are currently comploting tests of various new formulas, and it is ansicipated that the manufacture of a superior product can be started on June 1 , one month in the future. No changes will be needed in the present production facilties to manufacture the new product because only the moture of the various materials will be changed. The controler has been asked by the president of the company for advice on whether to continue peoduction during May or to suspend the manufacture of solvent unti June 1 . The controller has assembled the folowing pertinent data: lists of Labols and Amount Descriptions for the exact warding of the answer choices for text entries. Be sure to complete the staternent heading. A colon () wil automatcally apoear required. If a net loss is incurred, enter that amount as a negative number using a minus sign. 1. Prepare an esfimated income stafement in absorption costing form for Aky for solvent, assuming that production continues during the month. Flound amounts to two decimals. Alefer to the lists of Labels and Amount Descriptions for the exact wonding of the answer choices for text entries. Be sure fo complete the statement heading A colon ( ) will automaticaly appear if it is required. If a net loss is incurred, enter that amount as a negative number using a minus sign Fixed selling and administrative expenses Gross profit Income from operations Loss from operations Manufacturing margin Planned contribution margin Sales Sales mix Total cost of goods sold Total fixed costs Total selling and administrative expenses Total variable cost of goods sold Variable manufacturing cost Variable selling and administrative expenses Labels Cost of goods sold Fixed costs For the Month Ending May 31 May 31 Selling and administrative expenses Variable cost of goods sold Amount Descriptions Contribution margin Contribution margin ratio Direct labor Direct materials Fixed manufacturing co Fixed selling and administrative expenses Gross profit Income from operations Loss from operations Manufacturing margin Planned contribution margin Sales Sales mix Total cost of goods sold Thtal fived mete