Answered step by step

Verified Expert Solution

Question

1 Approved Answer

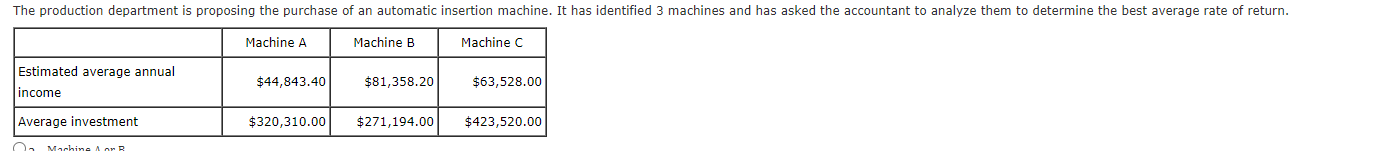

The production department is proposing the purchase of an automatic insertion machine. It has identified 3 machines and has asked the accountant to analyze

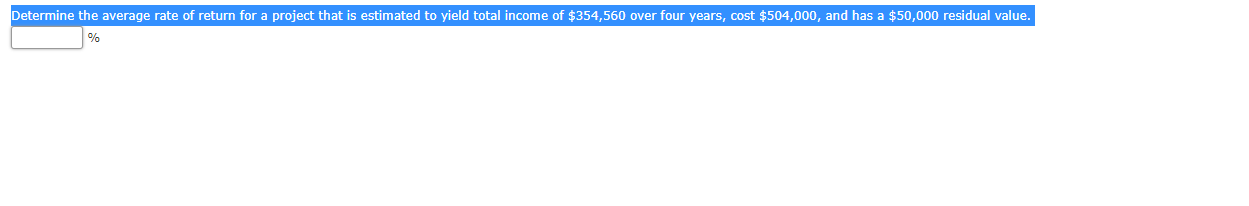

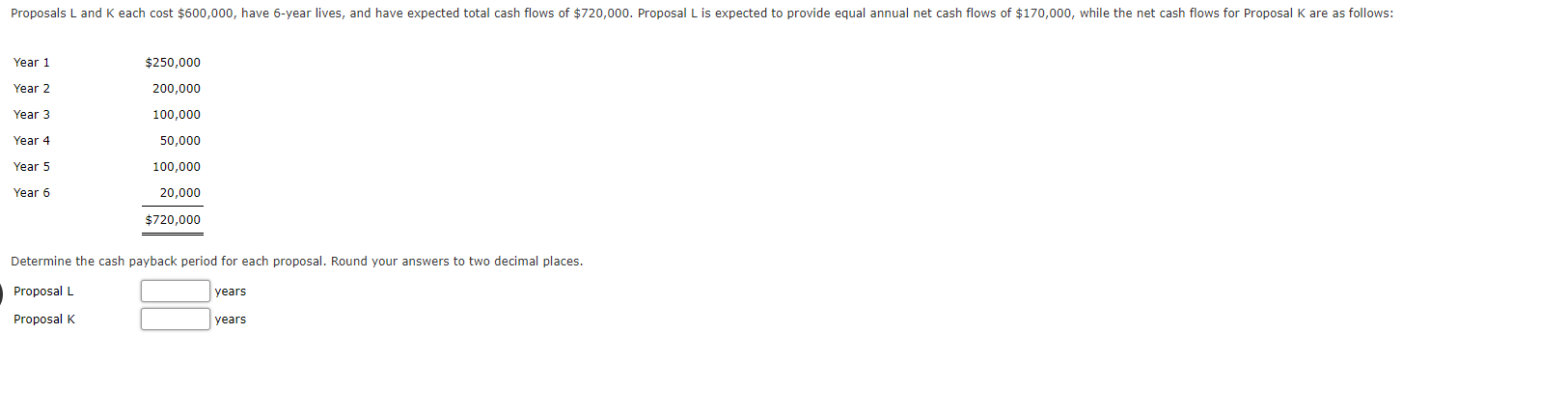

The production department is proposing the purchase of an automatic insertion machine. It has identified 3 machines and has asked the accountant to analyze them to determine the best average rate of return. Machine A Machine C Estimated average annual income Average investment Machine or R $44,843.40 Machine B $81,358.20 $63,528.00 $320,310.00 $271,194.00 $423,520.00 Determine the average rate of return for a project that is estimated to yield total income of $354,560 over four years, cost $504,000, and has a $50,000 residual value. Proposals L and K each cost $600,000, have 6-year lives, and have expected total cash flows of $720,000. Proposal L is expected to provide equal annual net cash flows of $170,000, while the net cash flows for Proposal K are as follows: Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $250,000 200,000 100,000 50,000 100,000 20,000 $720,000 Determine the cash payback period for each proposal. Round your answers to two decimal places. Proposal L Proposal K years years

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Average rate of return Average annual income Average investment Estimated average annua...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started