Answered step by step

Verified Expert Solution

Question

1 Approved Answer

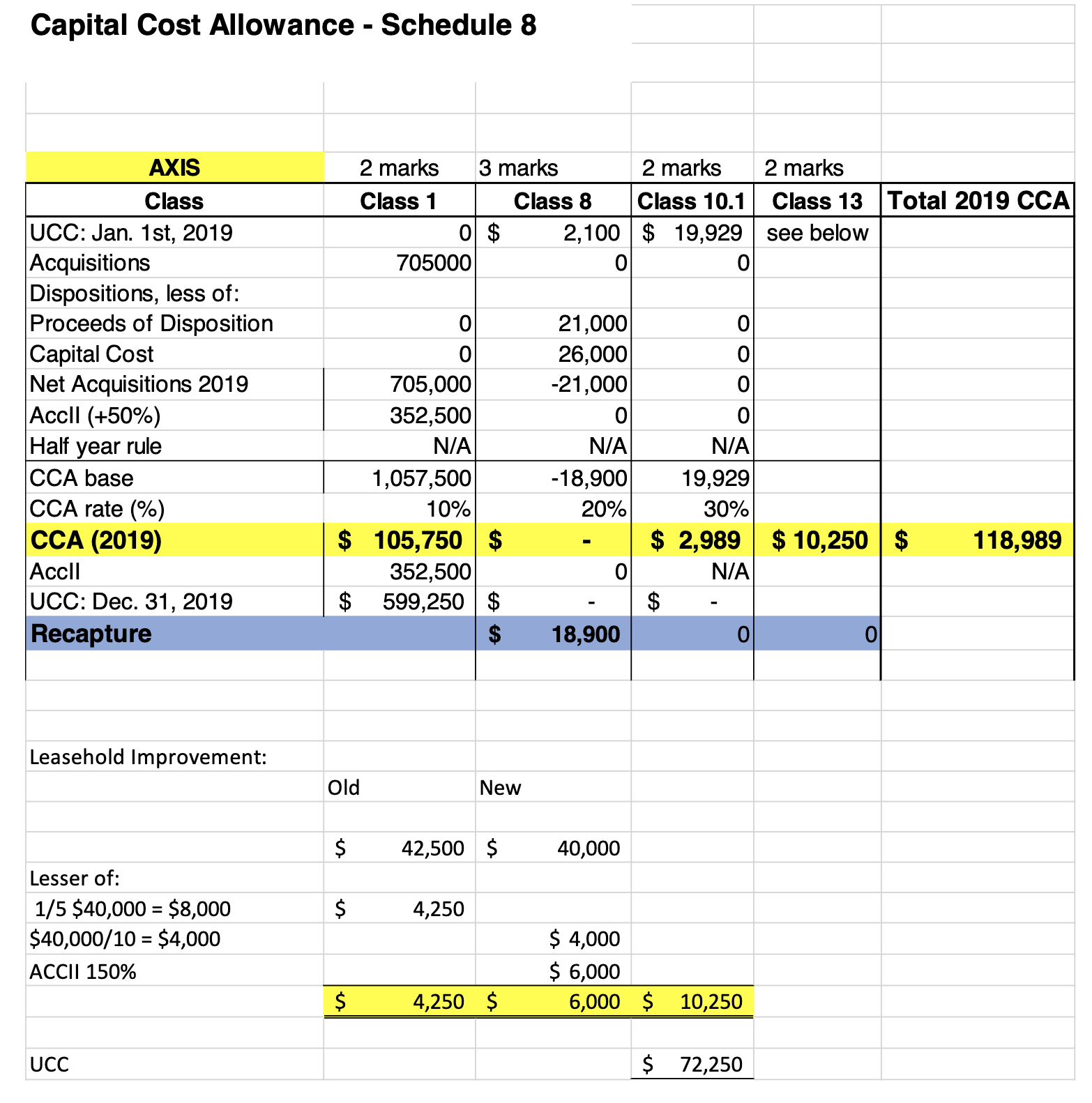

The prof gave us this answer but I feel like it's wrong. For the leasehold improvement, why is it 42500/10years? Would it not be 42500/12

The prof gave us this answer but I feel like it's wrong. For the leasehold improvement, why is it 42500/10years? Would it not be 42500/12 years instead because of the renewal? explain

Capital Cost Allowance - Schedule 8 AXIS Class |UCC: Jan. 1st, 2019 Acquisitions Dispositions, less of: Proceeds of Disposition 2 marks 3 marks 2 marks Class 1 Class 8 Class 10.1 0 $ 2,100 $ 19,929 2 marks Class 13 Total 2019 CCA see below 705000 0 0 0 21,000 0 Capital Cost 0 26,000 0 Net Acquisitions 2019 705,000 -21,000 0 Accll (+50%) 352,500 0 0 Half year rule N/A N/A N/A CCA base 1,057,500 -18,900 19,929 CCA rate (%) 10% 20% CCA (2019) $ 105,750 $ Accll 352,500 0 30% $ 2,989 $10,250 $ 118,989 N/A UCC: Dec. 31, 2019 $ 599,250 $ $ Recapture 18,900 0 Leasehold Improvement: Lesser of: 1/5 $40,000 = $8,000 $40,000/10 = $4,000 ACCII 150% UCC Old New 42,500 $ 40,000 4,250 $ 4,000 $ 6,000 es $ 4,250 $ 6,000 $ 10,250 $ 72,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started