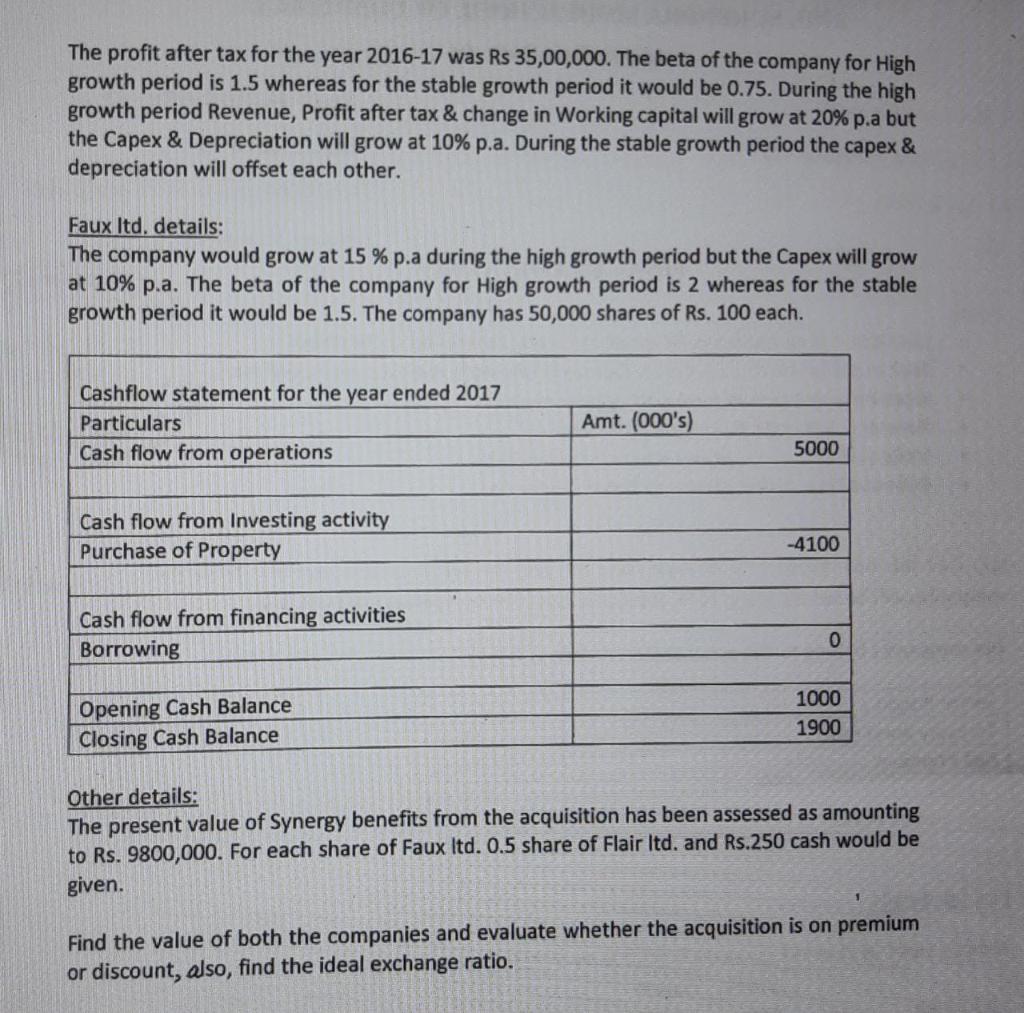

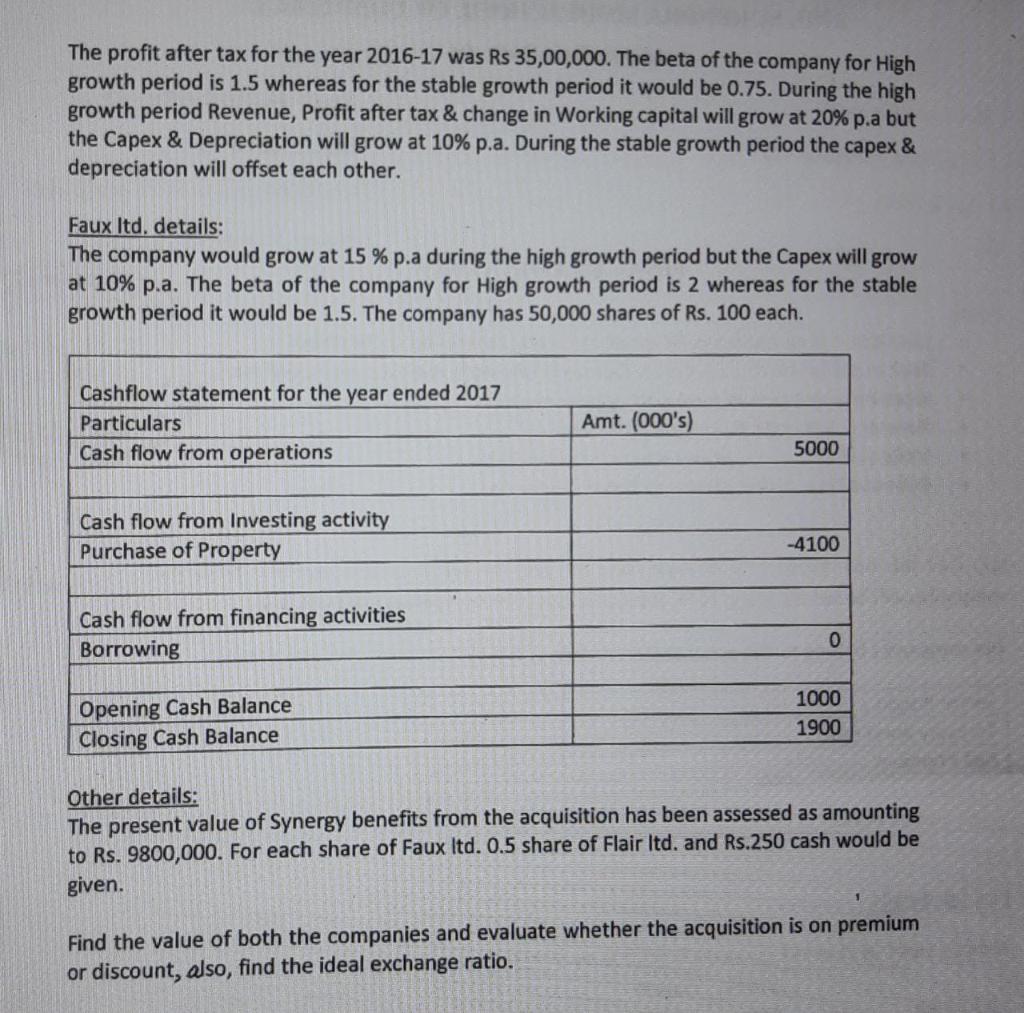

The profit after tax for the year 2016-17 was Rs 35,00,000. The beta of the company for High growth period is 1.5 whereas for the stable growth period it would be 0.75 . During the high growth period Revenue, Profit after tax \& change in Working capital will grow at 20% p.a but the Capex \& Depreciation will grow at 10% p.a. During the stable growth period the capex \& depreciation will offset each other. Faux Itd, details: The company would grow at 15% p.a during the high growth period but the Capex will grow at 10% p.a. The beta of the company for High growth period is 2 whereas for the stable growth period it would be 1.5. The company has 50,000 shares of Rs. 100 each. Other details: The present value of Synergy benefits from the acquisition has been assessed as amounting to Rs. 9800,000 . For each share of Faux Itd. 0.5 share of Flair Itd. and Rs. 250 cash would be given. Find the value of both the companies and evaluate whether the acquisition is on premium or discount, also, find the ideal exchange ratio. The profit after tax for the year 2016-17 was Rs 35,00,000. The beta of the company for High growth period is 1.5 whereas for the stable growth period it would be 0.75 . During the high growth period Revenue, Profit after tax \& change in Working capital will grow at 20% p.a but the Capex \& Depreciation will grow at 10% p.a. During the stable growth period the capex \& depreciation will offset each other. Faux Itd, details: The company would grow at 15% p.a during the high growth period but the Capex will grow at 10% p.a. The beta of the company for High growth period is 2 whereas for the stable growth period it would be 1.5. The company has 50,000 shares of Rs. 100 each. Other details: The present value of Synergy benefits from the acquisition has been assessed as amounting to Rs. 9800,000 . For each share of Faux Itd. 0.5 share of Flair Itd. and Rs. 250 cash would be given. Find the value of both the companies and evaluate whether the acquisition is on premium or discount, also, find the ideal exchange ratio