Answered step by step

Verified Expert Solution

Question

1 Approved Answer

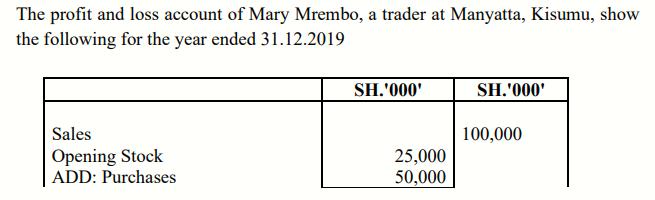

The profit and loss account of Mary Mrembo, a trader at Manyatta, Kisumu, show the following for the year ended 31.12.2019 Sales Opening Stock

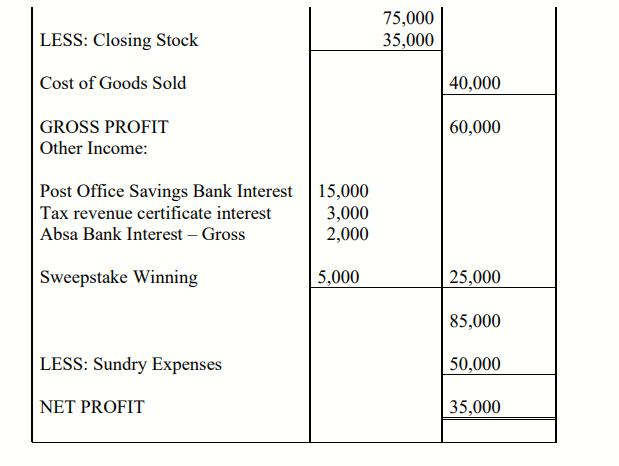

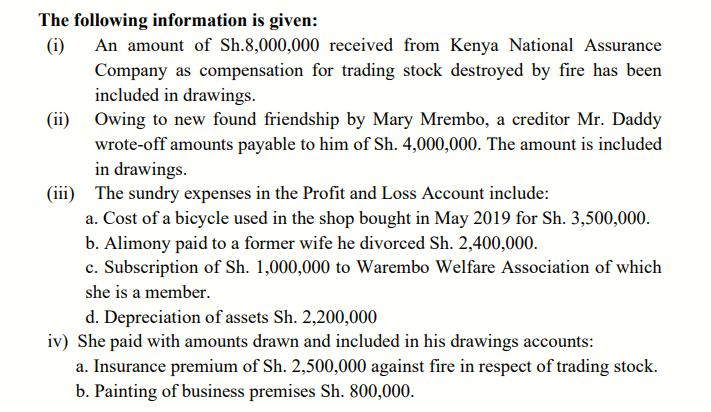

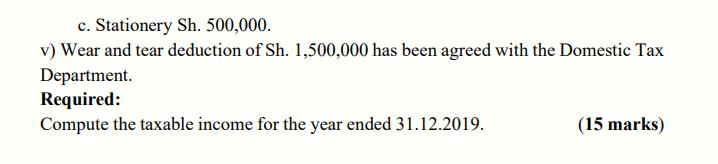

The profit and loss account of Mary Mrembo, a trader at Manyatta, Kisumu, show the following for the year ended 31.12.2019 Sales Opening Stock ADD: Purchases SH.'000' 25,000 50,000 SH.'000' 100,000 LESS: Closing Stock Cost of Goods Sold GROSS PROFIT Other Income: Post Office Savings Bank Interest Tax revenue certificate interest Absa Bank Interest - Gross Sweepstake Winning LESS: Sundry Expenses NET PROFIT 15,000 3,000 2,000 5,000 75,000 35,000 40,000 60,000 25,000 85,000 50,000 35,000 The following information is given: (i) An amount of Sh.8,000,000 received from Kenya National Assurance Company as compensation for trading stock destroyed by fire has been included in drawings. Owing to new found friendship by Mary Mrembo, a creditor Mr. Daddy wrote-off amounts payable to him of Sh. 4,000,000. The amount is included in drawings. (iii) The sundry expenses in the Profit and Loss Account include: (ii) a. Cost of a bicycle used in the shop bought in May 2019 for Sh. 3,500,000. b. Alimony paid to a former wife he divorced Sh. 2,400,000. c. Subscription of Sh. 1,000,000 to Warembo Welfare Association of which she is a member. d. Depreciation of assets Sh. 2,200,000 iv) She paid with amounts drawn and included in his drawings accounts: a. Insurance premium of Sh. 2,500,000 against fire in respect of trading stock. b. Painting of business premises Sh. 800,000. c. Stationery Sh. 500,000. v) Wear and tear deduction of Sh. 1,500,000 has been agreed with the Domestic Tax Department. Required: Compute the taxable income for the year ended 31.12.2019. (15 marks)

Step by Step Solution

★★★★★

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started