Answered step by step

Verified Expert Solution

Question

1 Approved Answer

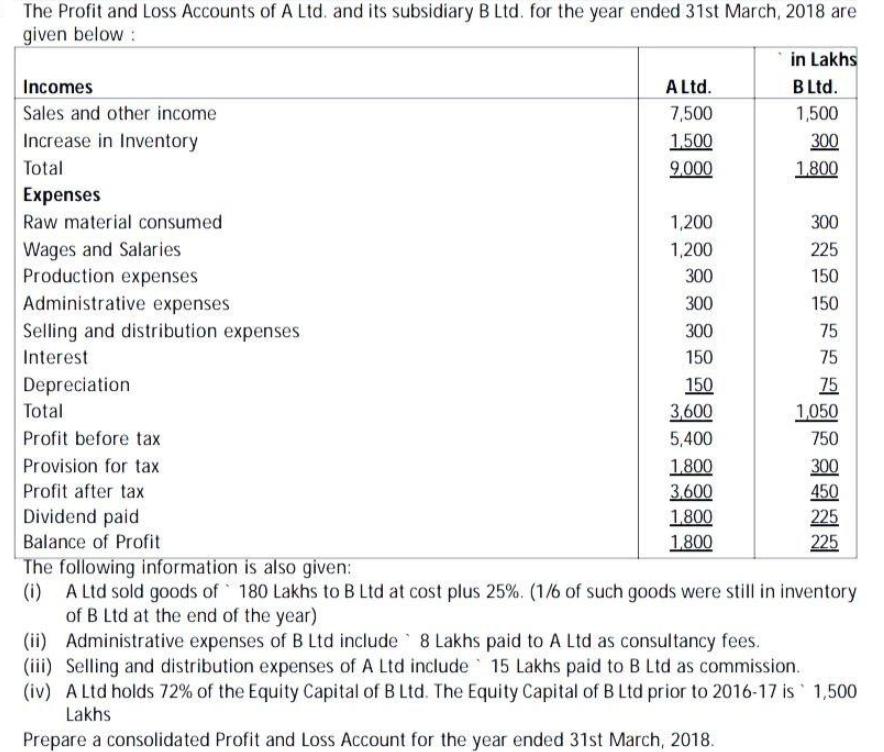

The Profit and Loss Accounts of A Ltd. and its subsidiary B Ltd. for the year ended 31st March, 2018 are given below: in

The Profit and Loss Accounts of A Ltd. and its subsidiary B Ltd. for the year ended 31st March, 2018 are given below: in Lakhs Incomes A Ltd. B Ltd. Sales and other income 7,500 1,500 Increase in Inventory 1.500 300 Total 9.000 1.800 Expenses Raw material consumed 1,200 300 Wages and Salaries Production expenses 1,200 225 300 150 Administrative expenses 300 150 Selling and distribution expenses 300 75 Interest 150 75 Depreciation 75 1,050 150 Total 3,600 Profit before tax 5,400 750 Provision for tax 300 1.800 3.600 Profit after tax 450 Dividend paid 1,800 1,800 225 225 Balance of Profit The following information is also given: (i) A Ltd sold goods of 180 Lakhs to B Ltd at cost plus 25%. (1/6 of such goods were still in inventory of B Ltd at the end of the year) (ii) Administrative expenses of B Ltd include 8 Lakhs paid to A Ltd as consultancy fees. (iii) Selling and distribution expenses of A Ltd include 15 Lakhs paid to B Ltd as commission. (iv) A Ltd holds 72% of the Equity Capital of B Ltd. The Equity Capital of B Ltd prior to 2016-17 is 1,500 Lakhs Prepare a consolidated Profit and Loss Account for the year ended 31st March, 2018.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Consolidated Profit Loss Account Particulars Amount Particulars Amount ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started