Answered step by step

Verified Expert Solution

Question

1 Approved Answer

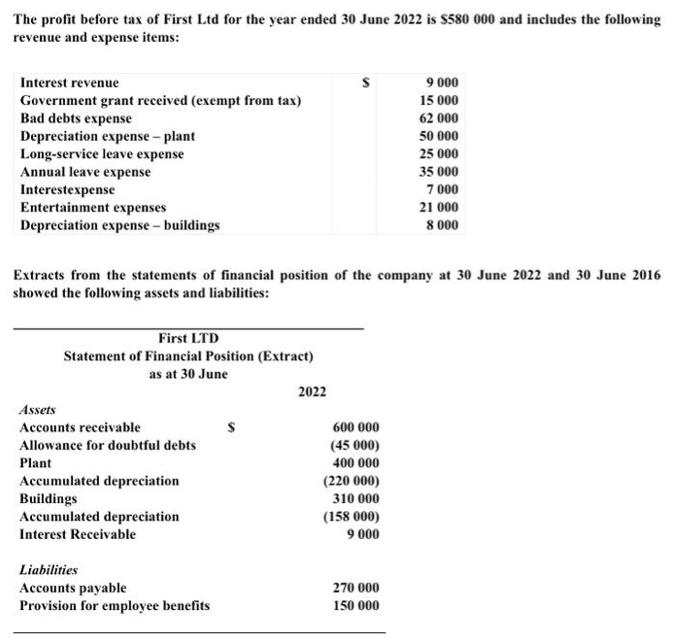

The profit before tax of First Ltd for the year ended 30 June 2022 is $580 000 and includes the following revenue and expense

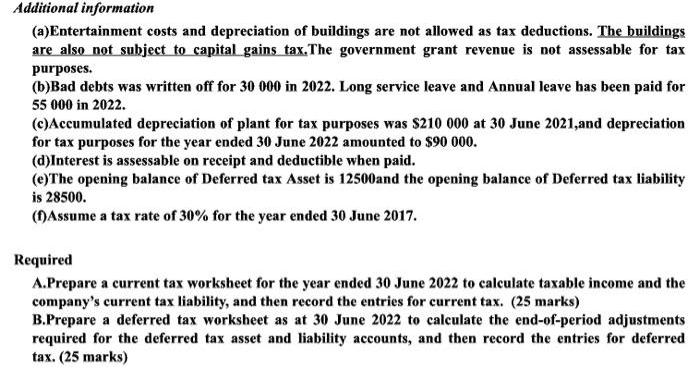

The profit before tax of First Ltd for the year ended 30 June 2022 is $580 000 and includes the following revenue and expense items: Interest revenue Government grant received (exempt from tax) Bad debts expense Depreciation expense - plant Long-service leave expense Annual leave expense Interestexpense Entertainment expenses Depreciation expense-buildings First LTD Statement of Financial Position (Extract) as at 30 June Extracts from the statements of financial position of the company at 30 June 2022 and 30 June 2016 showed the following assets and liabilities: Assets Accounts receivable Allowance for doubtful debts Plant Accumulated depreciation Buildings Accumulated depreciation Interest Receivable Liabilities Accounts payable Provision for employee benefits 2022 600 000 (45 000) 400 000 (220 000) 310 000 (158 000) 9 000 9 000 15 000 62 000 50 000 25 000 35 000 7 000 270 000 150 000 21 000 8 000 Additional information (a)Entertainment costs and depreciation of buildings are not allowed as tax deductions. The buildings are also not subject to capital gains tax.The government grant revenue is not assessable for tax purposes. (b)Bad debts was written off for 30 000 in 2022. Long service leave and Annual leave has been paid for 55 000 in 2022. (c)Accumulated depreciation of plant for tax purposes was $210 000 at 30 June 2021, and depreciation for tax purposes for the year ended 30 June 2022 amounted to $90 000. (d)Interest is assessable on receipt and deductible when paid. (e) The opening balance of Deferred tax Asset is 12500and the opening balance of Deferred tax liability is 28500. (f)Assume a tax rate of 30% for the year ended 30 June 2017. Required A.Prepare a current tax worksheet for the year ended 30 June 2022 to calculate taxable income and the company's current tax liability, and then record the entries for current tax. (25 marks) B.Prepare a deferred tax worksheet as at 30 June 2022 to calculate the end-of-period adjustments required for the deferred tax asset and liability accounts, and then record the entries for deferred tax. (25 marks)

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings A Current Tax Worksheet 1 Profit before tax 580000 2 Add back nonde...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started