Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The profit-maximizing price for each group: P 1 = 142.50 P2 = 123.75 Then rounding to the nearest percent, you would offer a senior citizen

The profit-maximizing price for each group:

P 1 = 142.50

P2 = 123.75

Then rounding to the nearest percent, you would offer a “senior citizen discount” of? 11% or 15%?

QUESTION

What is the profit in this discrimination-free market? These are average daily demands, and assuming that you’re open 365 days a year

How much profit per year do you lose by not discriminating (compare your answer here with the Profit would you make if you price discriminated $3,668.75) ?

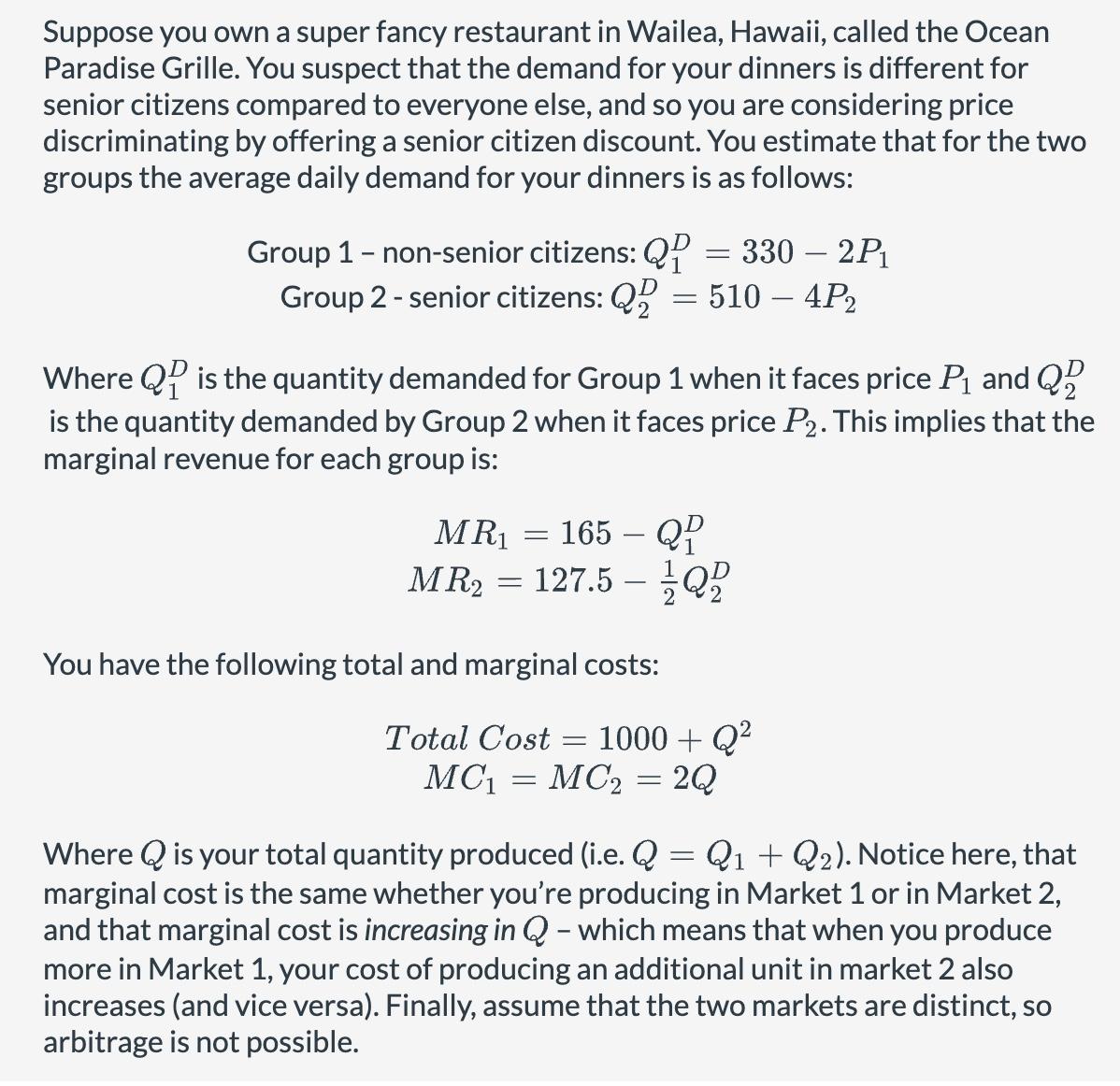

Suppose you own a super fancy restaurant in Wailea, Hawaii, called the Ocean Paradise Grille. You suspect that the demand for your dinners is different for senior citizens compared to everyone else, and so you are considering price discriminating by offering a senior citizen discount. You estimate that for the two groups the average daily demand for your dinners is as follows: Group 1 - non-senior citizens: Q = 330 2P1 Group 2 - senior citizens: Q = 510 - 4P2 Where Q is the quantity demanded for Group 1 when it faces price P and Q is the quantity demanded by Group 2 when it faces price P2. This implies that the marginal revenue for each group is: MR1 = 165 - Q MR2 = 127.5-Q You have the following total and marginal costs: Total Cost = 1000+ Q MC = MC2 = = 2Q = Q1 Where Q is your total quantity produced (i.e. Q Q2). Notice here, that marginal cost is the same whether you're producing in Market 1 or in Market 2, and that marginal cost is increasing in Q - which means that when you produce more in Market 1, your cost of producing an additional unit in market 2 also increases (and vice versa). Finally, assume that the two markets are distinct, so arbitrage is not possible.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started