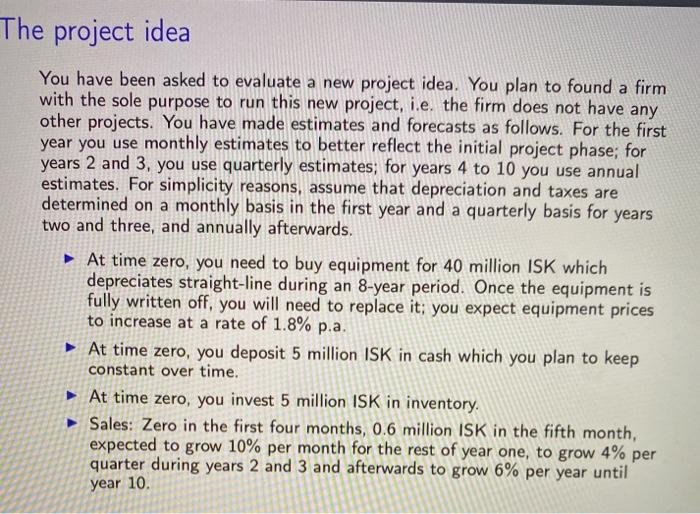

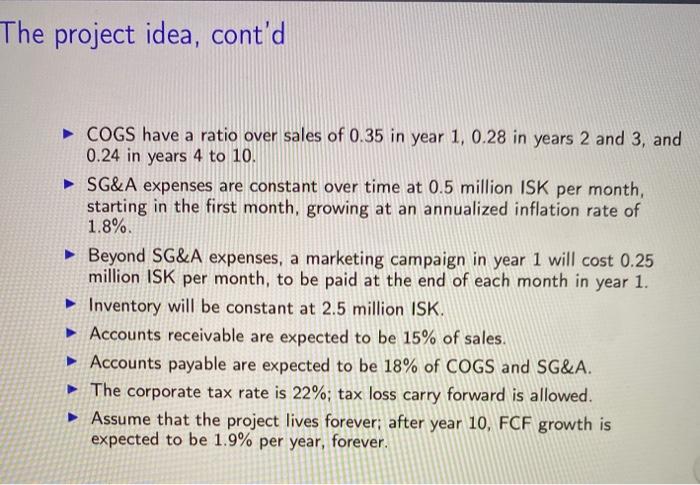

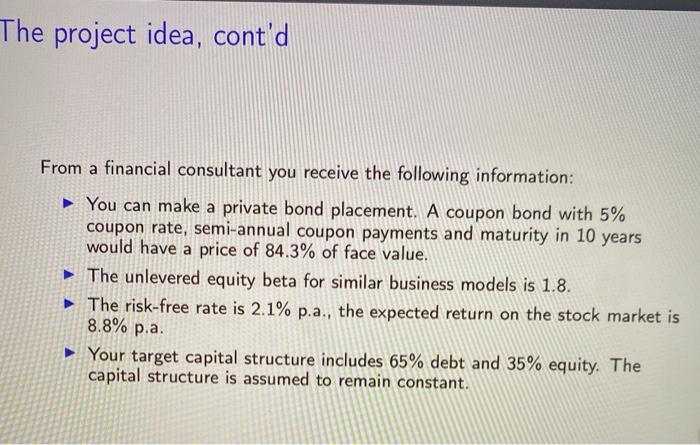

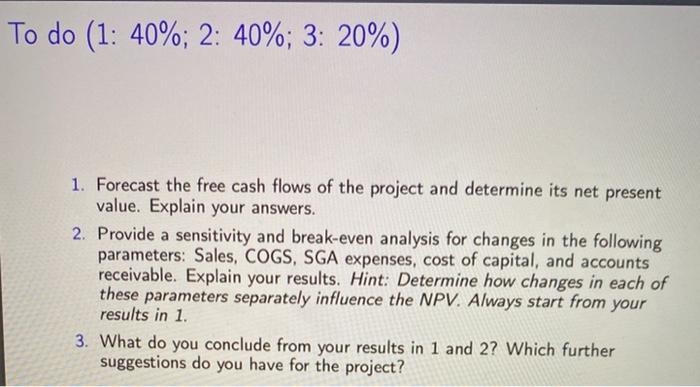

The project idea You have been asked to evaluate a new project idea. You plan to found a firm with the sole purpose to run this new project, i.e. the firm does not have any other projects. You have made estimates and forecasts as follows. For the first year you use monthly estimates to better reflect the initial project phase; for years 2 and 3, you use quarterly estimates; for years 4 to 10 you use annual estimates. For simplicity reasons, assume that depreciation and taxes are determined on a monthly basis in the first year and a quarterly basis for years two and three, and annually afterwards. At time zero, you need to buy equipment for 40 million ISK which depreciates straight-line during an 8-year period. Once the equipment is fully written off, you will need to replace it; you expect equipment prices to increase at a rate of 1.8% p.a. At time zero, you deposit 5 million ISK in cash which you plan to keep constant over time. At time zero, you invest 5 million ISK in inventory. Sales: Zero in the first four months, 0.6 million ISK in the fifth month, expected to grow 10% per month for the rest of year one, to grow 4% per quarter during years 2 and 3 and afterwards to grow 6% per year until year 10. The project idea, cont'd COGS have a ratio over sales of 0.35 in year 1, 0.28 in years 2 and 3, and 0.24 in years 4 to 10. SG&A expenses are constant over time at 0.5 million ISK per month, starting in the first month, growing at an annualized inflation rate of 1.8%. Beyond SG&A expenses, a marketing campaign in year 1 will cost 0.25 million ISK per month, to be paid at the end of each month in year 1. Inventory will be constant at 2.5 million ISK. Accounts receivable are expected to be 15% of sales Accounts payable are expected to be 18% of COGS and SG&A. The corporate tax rate is 22%; tax loss carry forward is allowed. Assume that the project lives forever, after year 10, FCF growth is expected to be 1.9% per year, forever. The project idea, cont'd From a financial consultant you receive the following information: You can make a private bond placement. A coupon bond with 5% coupon rate, semi-annual coupon payments and maturity in 10 years would have a price of 84.3% of face value. The unlevered equity beta for similar business models is 1.8. The risk-free rate is 2.1% p.a., the expected return on the stock market is 8.8% p.a. Your target capital structure includes 65% debt and 35% equity. The capital structure is assumed to remain constant. To do (1: 40%; 2: 40%; 3: 20%) 1. Forecast the free cash flows of the project and determine its net present value. Explain your answers. 2. Provide a sensitivity and break-even analysis for changes in the following parameters: Sales, COGS, SGA expenses, cost of capital, and accounts receivable. Explain your results. Hint: Determine how changes in each of these parameters separately influence the NPV. Always start from your results in 1. 3. What do you conclude from your results in 1 and 2? Which further suggestions do you have for the project? The project idea You have been asked to evaluate a new project idea. You plan to found a firm with the sole purpose to run this new project, i.e. the firm does not have any other projects. You have made estimates and forecasts as follows. For the first year you use monthly estimates to better reflect the initial project phase; for years 2 and 3, you use quarterly estimates; for years 4 to 10 you use annual estimates. For simplicity reasons, assume that depreciation and taxes are determined on a monthly basis in the first year and a quarterly basis for years two and three, and annually afterwards. At time zero, you need to buy equipment for 40 million ISK which depreciates straight-line during an 8-year period. Once the equipment is fully written off, you will need to replace it; you expect equipment prices to increase at a rate of 1.8% p.a. At time zero, you deposit 5 million ISK in cash which you plan to keep constant over time. At time zero, you invest 5 million ISK in inventory. Sales: Zero in the first four months, 0.6 million ISK in the fifth month, expected to grow 10% per month for the rest of year one, to grow 4% per quarter during years 2 and 3 and afterwards to grow 6% per year until year 10. The project idea, cont'd COGS have a ratio over sales of 0.35 in year 1, 0.28 in years 2 and 3, and 0.24 in years 4 to 10. SG&A expenses are constant over time at 0.5 million ISK per month, starting in the first month, growing at an annualized inflation rate of 1.8%. Beyond SG&A expenses, a marketing campaign in year 1 will cost 0.25 million ISK per month, to be paid at the end of each month in year 1. Inventory will be constant at 2.5 million ISK. Accounts receivable are expected to be 15% of sales Accounts payable are expected to be 18% of COGS and SG&A. The corporate tax rate is 22%; tax loss carry forward is allowed. Assume that the project lives forever, after year 10, FCF growth is expected to be 1.9% per year, forever. The project idea, cont'd From a financial consultant you receive the following information: You can make a private bond placement. A coupon bond with 5% coupon rate, semi-annual coupon payments and maturity in 10 years would have a price of 84.3% of face value. The unlevered equity beta for similar business models is 1.8. The risk-free rate is 2.1% p.a., the expected return on the stock market is 8.8% p.a. Your target capital structure includes 65% debt and 35% equity. The capital structure is assumed to remain constant. To do (1: 40%; 2: 40%; 3: 20%) 1. Forecast the free cash flows of the project and determine its net present value. Explain your answers. 2. Provide a sensitivity and break-even analysis for changes in the following parameters: Sales, COGS, SGA expenses, cost of capital, and accounts receivable. Explain your results. Hint: Determine how changes in each of these parameters separately influence the NPV. Always start from your results in 1. 3. What do you conclude from your results in 1 and 2? Which further suggestions do you have for the project