Question

The Project Information: The equipment will cost $680, is expected to have a working life of 4 years, and will be depreciated on a straight-line

The Project Information:

The equipment will cost $680, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero. The equipment is expected to have a salvage value of $180 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $870 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 3% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $260 per year. Maintenance costs will amount to $140 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $190. The networking capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company but recently is not being used. If the project does not proceed, this building could be rented out for $190 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $200. The company has sufficient capital to undertake all positive-NVP projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year 0 would need to be recovered within 3 years for the project to be acceptable under this method.

Calculate:

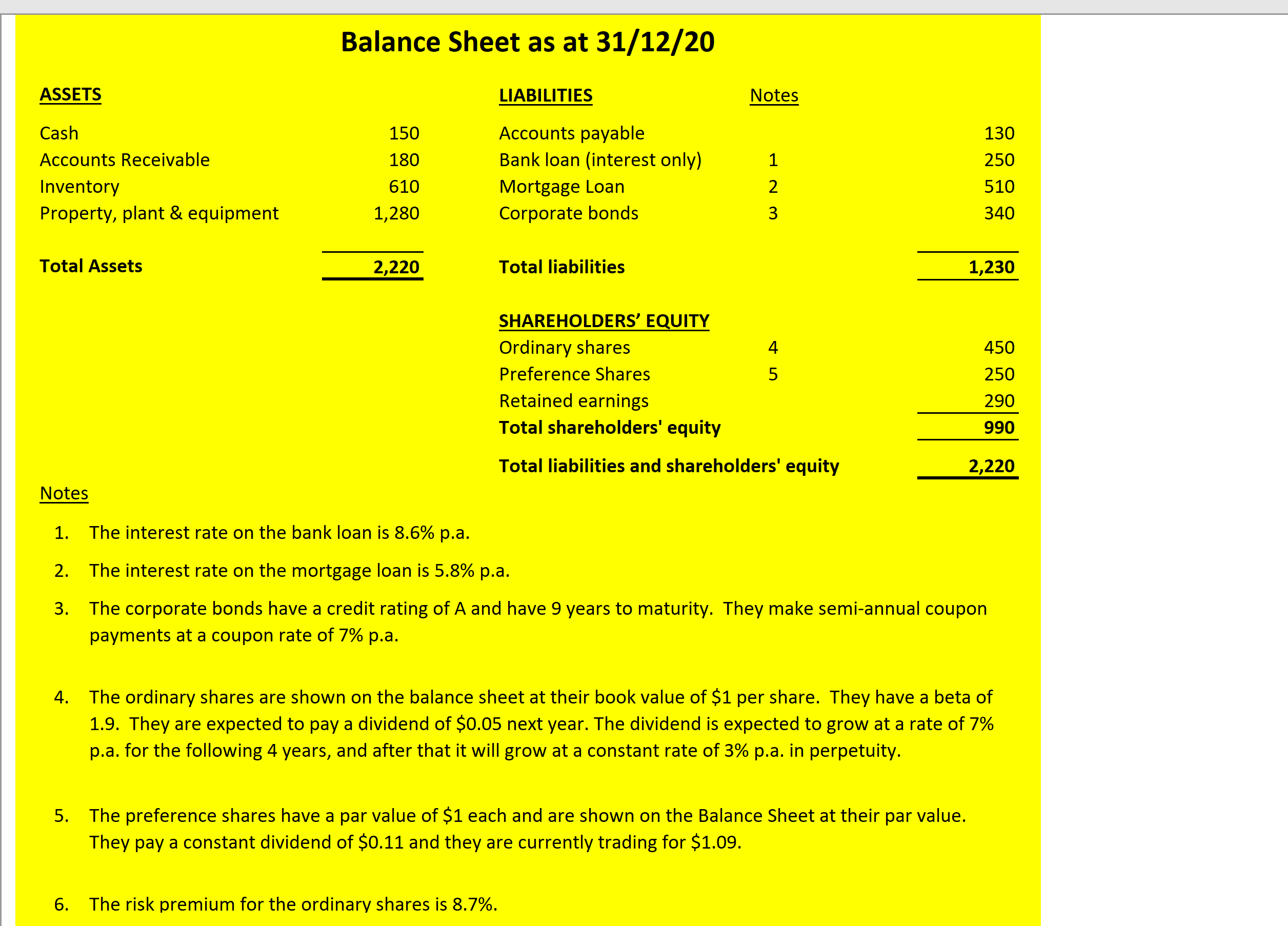

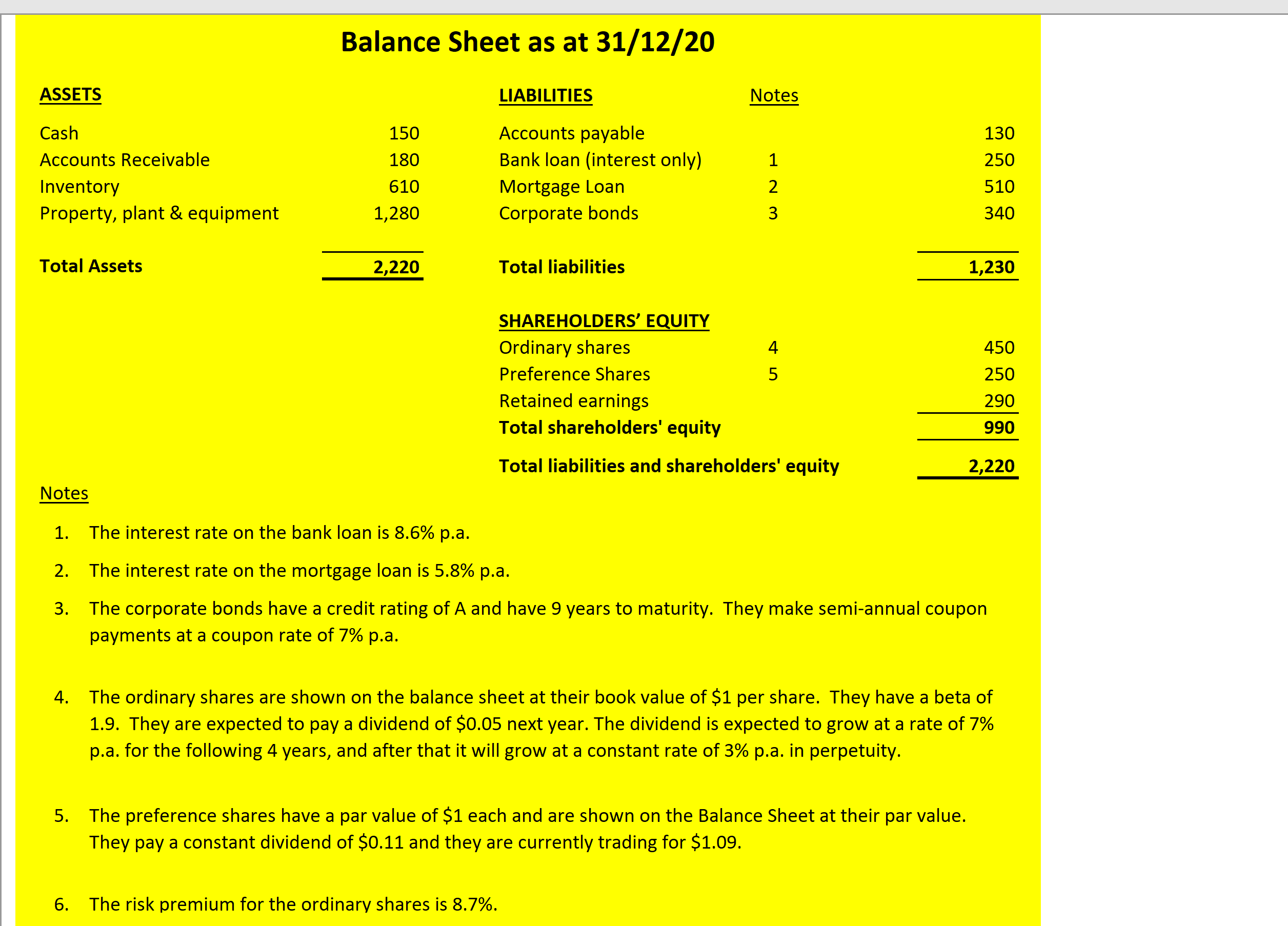

a.Bank Loan (interest only): Before-tax cost of bank loan?

Market value of bank loan (value and weight)? (whole number)

b. Before-tax cost of mortgage loan?

Market value of mortgage loan? (value and weight)? (whole number)

c. Corporate Bonds

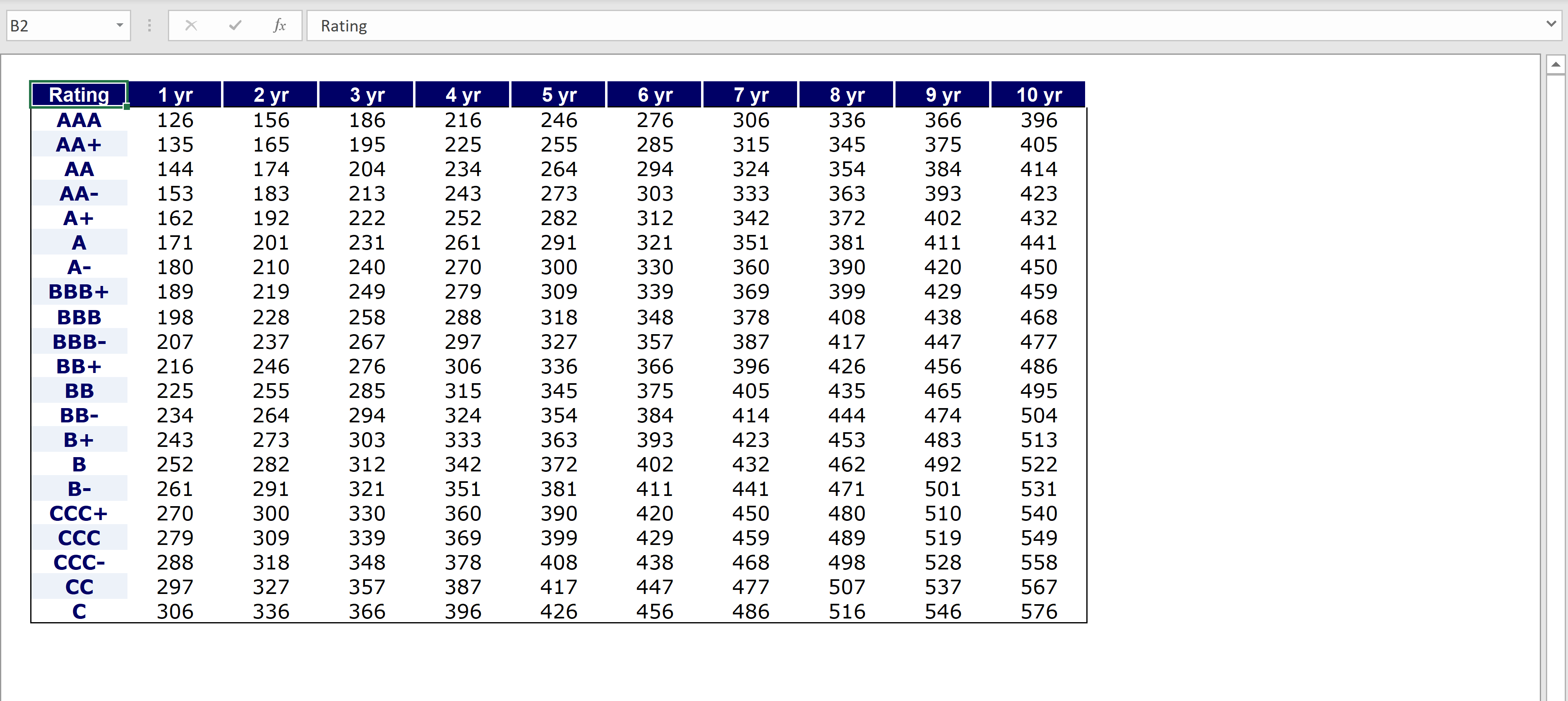

Credit Spread basis points?

Credit spread as a percentage (2 decimal places)

Risk-free rate to be used to calculate cost of corporate bonds? (3 decimal places)

Before-tax cost of corporate bonds

Face value of all bonds?

Coupon rate?

Number of years to maturity?

Total number of coupon payments remaining?

Total value of all coupon payments paid per year?

Value of each individual coupon payment?

Semi-annual yield (3 decimal places)?

Value of corporate bonds? (value and weight?)

d. Ordinary Shares:

Risk-free rate to be used to calculate cost of ordinary shares (3 decimal places)?

Beta?

Risk premium?

Cost of ordinary shares?

Dividend 1,2,3,4,5,6 years from now?

Price of ordinary shares?

Total market value of ordinary shares? (value and weight)?

e. Preference Shares

Preference dividend per share?

Preference share price?

Cost of preference shares?

Number of preference shares?

Total market value of preference shares?

f. Tax rate?

Weighted Cost of the Bank Loan (i.e. cost x weight)?

Weighted cost of the mortgage loan?

weighted cost of the corporate bonds?

weighted cost of the ordinary shares?

weighted cost of the preference shares?

Weighted Average Cost of Capital?

The data below are Credit Spread and Balance Sheet of the Company. The Melbourne's tax rate for the company is 30%, 10-year risk-free rate is 1.740% and 9-year risk-free rate is 1.630%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started