Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Project Manager of a company has gathered the following information relating to setting up a new project for a proposed new product after

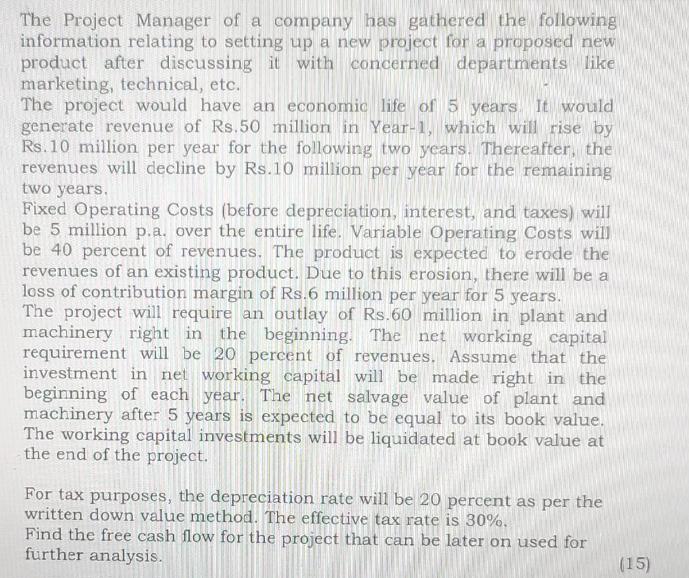

The Project Manager of a company has gathered the following information relating to setting up a new project for a proposed new product after discussing it with concerned departments like marketing, technical, etc. The project would have an economic life of 5 years. It would generate revenue of Rs.50 million in Year-1, which will rise by Rs.10 million per year for the following two years. Thereafter, the revenues will decline by Rs.10 million per year for the remaining two years. Fixed Operating Costs (before depreciation, interest, and taxes) will be 5 million p.a. over the entire life. Variable Operating Costs will be 40 percent of revenues. The product is expected to erode the revenues of an existing product. Due to this erosion, there will be a loss of contribution margin of Rs.6 million per year for 5 years. The project will require an outlay of Rs.60 million in plant and machinery right in the beginning. The net working capital requirement will be 20 percent of revenues. Assume that the investment in net working capital will be made right in the beginning of each year. The net salvage value of plant and machinery after 5 years is expected to be equal to its book value. The working capital investments will be liquidated at book value at the end of the project. For tax purposes, the depreciation rate will be 20 percent as per the written down value method. The effective tax rate is 30%. Find the free cash flow for the project that can be later on used for further analysis. (15)

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Free Cash Flow FCF is a measure of a companys financial performance calculated as operating cash flow minus capital expenditures 15 To calculate the FCF for the proposed new product project we need to ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started