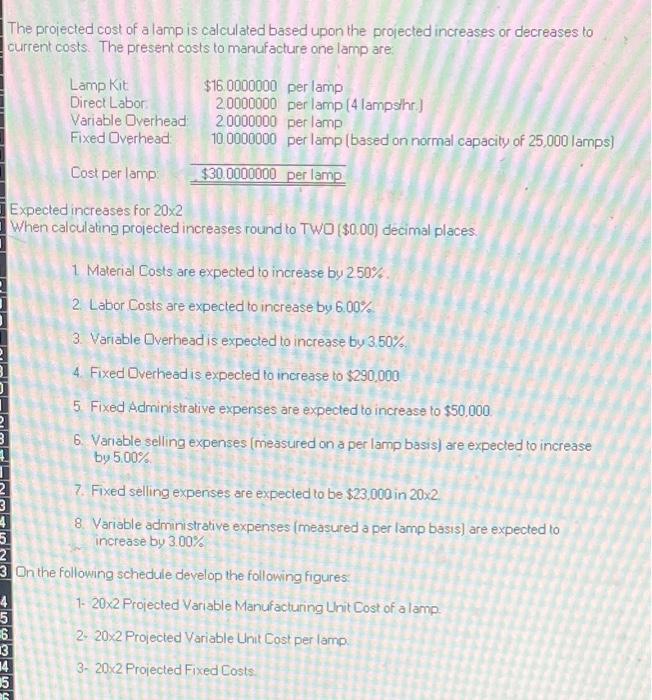

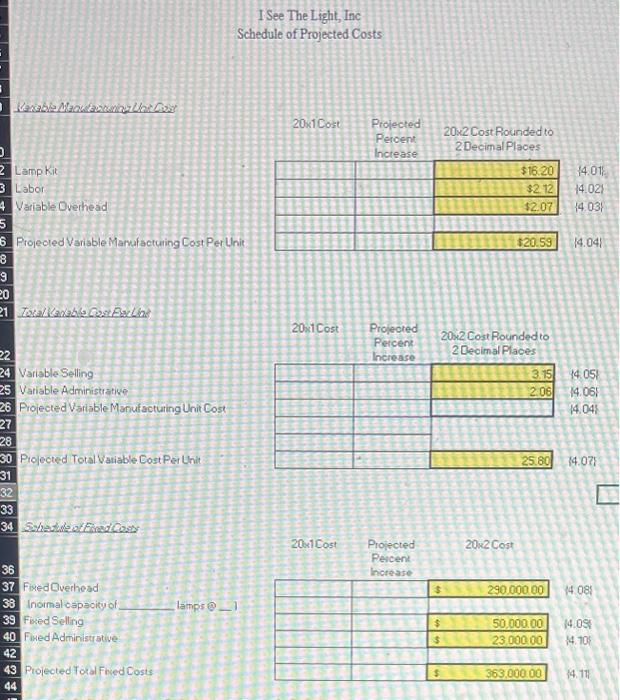

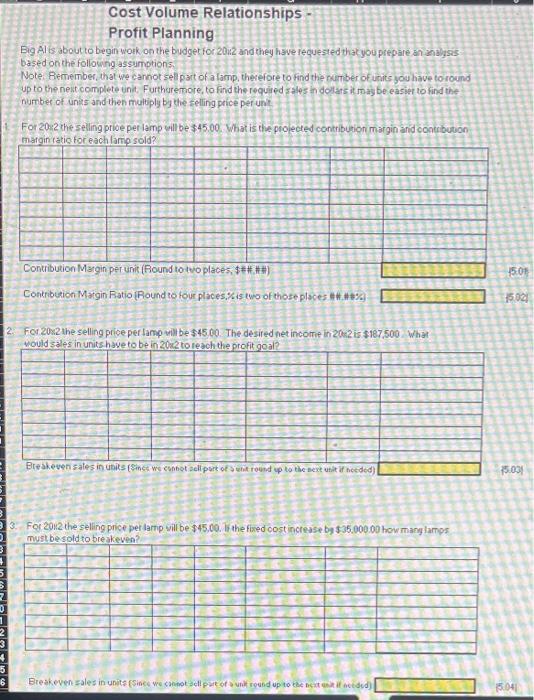

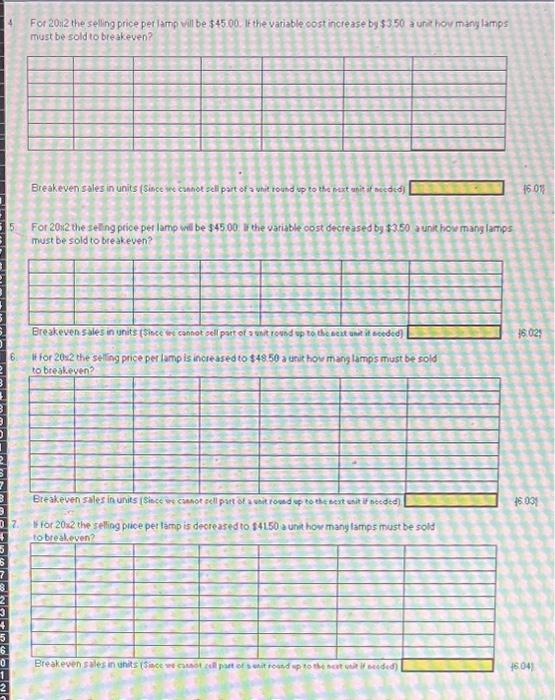

The prolected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating prolected increases round to Tw0 ($0.00) decimal places. 1 Material Costs are expected to increase by 250%. 2. Labor Costs are expected to increase by 6.00% 3. Variable Overhead is expected to increase by 3.50% 4. Fixed Overhead is expected to increase to $290,000 5. Fixed Administrative expenses are expected to increase to $50,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 5.00% 7. Fixed selling experises are expected to be $23,000 in 202. 8. Variable administrative expenses [measured a per lamp basis] are expected to increase by 3.00% On the following schedule develop the following figures: 1. 202 Projected Variable Manufacturing Unit Cost of a lamp. 2. 202 Projected Variable Unit Cost per lamp. 3. 202 Projected Fixed Costs Fined Admiristative: Projected Toral Fined Costs Big Al is about to begin work on the budget for 2 buz2 and they have lecuested thac you prepare an anblysis: based onthe followng as surnptions. Note. Remember, that we cannot se part of a larmp, thecefore to find the number of units you have to round up to the nest complete unit, Furtharemore, to fund the required sales in dollars it maty be: easier to find the number of unts and then multiply by the relling price per unt. For 20 : 2 the selling prioe per lamp yill be 345.00 . What is the prolected contribution margin and conerbutuon miagn tatin for panh lamn emid? Contribukion Margin Fiatio (Round to four places, is two of those places 4 in in % ) For. 202 the selling price per Jamp wilibe $45,60. The desired net incompe in 20 an is $187,500. What vould sales in units have to be in 20 to to reach the profit aoal? For 20 u the seling price per lamp vili be $45,60. Fi the fixed cost increase by $35.000.00 how many hamps mustbesold to breakeven? For 20n2 the selling price petiamp vill be $45.00. If the vatiable cost increase by $350 a une hov many lamps must be sold to bie akeven? For 20x2 the selling price per lamp wil be $4500 It the variable cost decreased by $3.50 a unit how mang lamps must be sold to breakeven? If for 20x2 the seling price per lamp is increased to $4850 a unit hov mang tamps must be sold to biteak.ous? E For 20 -22 the selling price per lamp is deoreased to 14150 a una how many Iamps must be sold tohrealeven? The prolected cost of a lamp is calculated based upon the projected increases or decreases to current costs. The present costs to manufacture one lamp are: Expected increases for 202 When calculating prolected increases round to Tw0 ($0.00) decimal places. 1 Material Costs are expected to increase by 250%. 2. Labor Costs are expected to increase by 6.00% 3. Variable Overhead is expected to increase by 3.50% 4. Fixed Overhead is expected to increase to $290,000 5. Fixed Administrative expenses are expected to increase to $50,000. 6. Variable selling expenses (measured on a per lamp basis) are expected to increase by 5.00% 7. Fixed selling experises are expected to be $23,000 in 202. 8. Variable administrative expenses [measured a per lamp basis] are expected to increase by 3.00% On the following schedule develop the following figures: 1. 202 Projected Variable Manufacturing Unit Cost of a lamp. 2. 202 Projected Variable Unit Cost per lamp. 3. 202 Projected Fixed Costs Fined Admiristative: Projected Toral Fined Costs Big Al is about to begin work on the budget for 2 buz2 and they have lecuested thac you prepare an anblysis: based onthe followng as surnptions. Note. Remember, that we cannot se part of a larmp, thecefore to find the number of units you have to round up to the nest complete unit, Furtharemore, to fund the required sales in dollars it maty be: easier to find the number of unts and then multiply by the relling price per unt. For 20 : 2 the selling prioe per lamp yill be 345.00 . What is the prolected contribution margin and conerbutuon miagn tatin for panh lamn emid? Contribukion Margin Fiatio (Round to four places, is two of those places 4 in in % ) For. 202 the selling price per Jamp wilibe $45,60. The desired net incompe in 20 an is $187,500. What vould sales in units have to be in 20 to to reach the profit aoal? For 20 u the seling price per lamp vili be $45,60. Fi the fixed cost increase by $35.000.00 how many hamps mustbesold to breakeven? For 20n2 the selling price petiamp vill be $45.00. If the vatiable cost increase by $350 a une hov many lamps must be sold to bie akeven? For 20x2 the selling price per lamp wil be $4500 It the variable cost decreased by $3.50 a unit how mang lamps must be sold to breakeven? If for 20x2 the seling price per lamp is increased to $4850 a unit hov mang tamps must be sold to biteak.ous? E For 20 -22 the selling price per lamp is deoreased to 14150 a una how many Iamps must be sold tohrealeven