Answered step by step

Verified Expert Solution

Question

1 Approved Answer

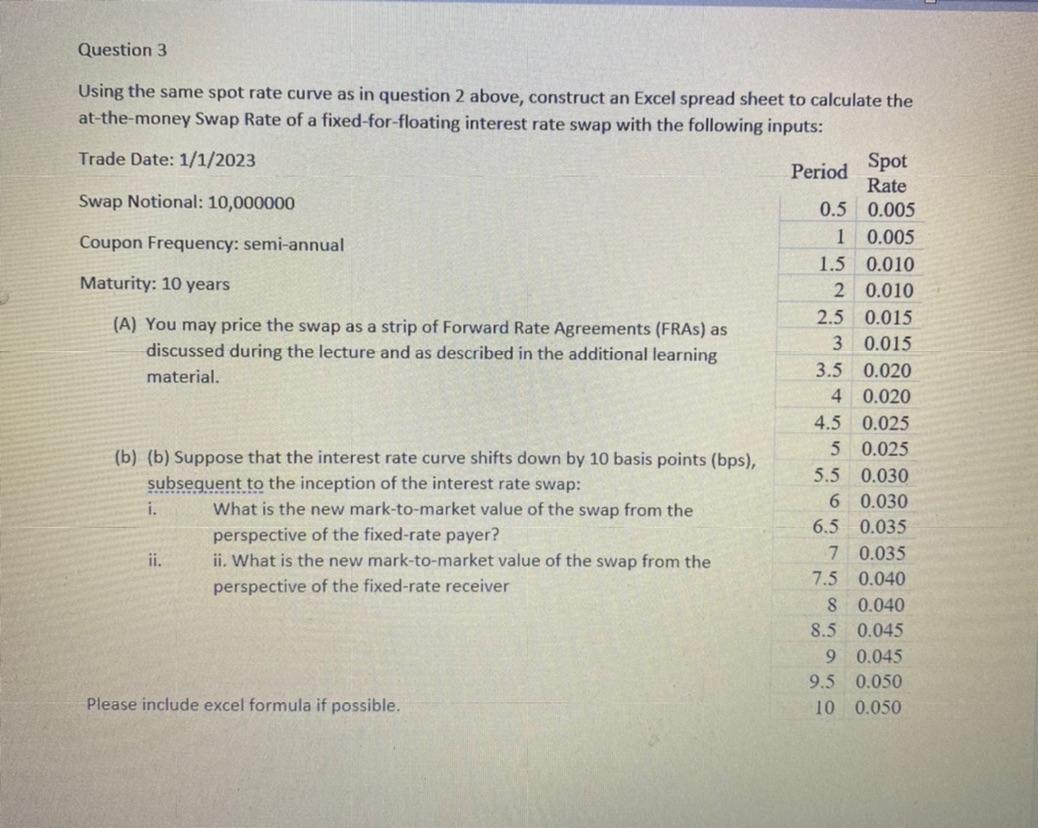

Question 3 Using the same spot rate curve as in question 2 above, construct an Excel spread sheet to calculate the at-the-money Swap Rate

Question 3 Using the same spot rate curve as in question 2 above, construct an Excel spread sheet to calculate the at-the-money Swap Rate of a fixed-for-floating interest rate swap with the following inputs: Trade Date: 1/1/2023 Swap Notional: 10,000000 Period Spot Rate 0.5 0.005 Coupon Frequency: semi-annual Maturity: 10 years 1 0.005 1.5 0.010 2 0.010 2.5 0.015 (A) You may price the swap as a strip of Forward Rate Agreements (FRAs) as discussed during the lecture and as described in the additional learning material. 3 0.015 3.5 0.020 4 0.020 4.5 0.025 5 0.025 (b) (b) Suppose that the interest rate curve shifts down by 10 basis points (bps), subsequent to the inception of the interest rate swap: 5.5 0.030 6 0.030 i. What is the new mark-to-market value of the swap from the perspective of the fixed-rate payer? 6.5 0.035 ii. 7 0.035 ii. What is the new mark-to-market value of the swap from the perspective of the fixed-rate receiver 7.5 0.040 8 0.040 8.5 0.045 Please include excel formula if possible. 9 0.045 9.5 0.050 10 0.050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Certainly Below is the stepbystep solution for calculating the swap rate and determining the marktomarket value of the swap Ill present the relevant i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started