Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The purchase of new injection molding equipment (MACRS-GDS 3 year property) costs $125,000 and has a planned salvage value of $13,000 after a useful

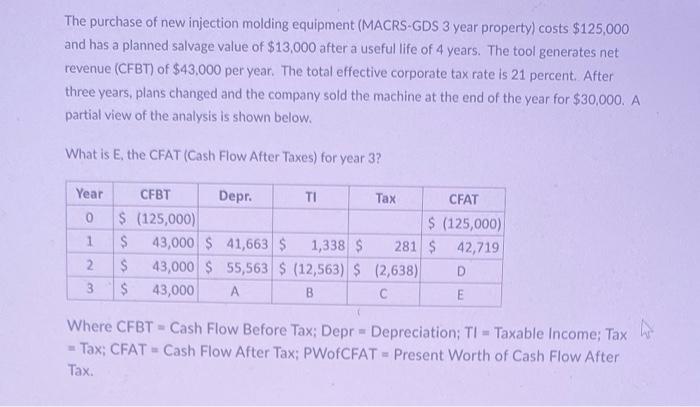

The purchase of new injection molding equipment (MACRS-GDS 3 year property) costs $125,000 and has a planned salvage value of $13,000 after a useful life of 4 years. The tool generates net revenue (CFBT) of $43,000 per year. The total effective corporate tax rate is 21 percent. After three years, plans changed and the company sold the machine at the end of the year for $30,000. A partial view of the analysis is shown below. What is E, the CFAT (Cash Flow After Taxes) for year 3? Year 0 1 2 3 CFBT $ (125,000) $ $ $ Depr. TI 43,000 $ 41,663 $ 1,338 $ 43,000 $ 55,563 $ (12,563) $ 43,000 A B ( Tax W CFAT $ (125,000) 281 $ 42,719 (2,638) C D E Where CFBT Cash Flow Before Tax; Depr Depreciation; TI = Taxable Income; Tax Tax; CFAT Cash Flow After Tax; PWofCFAT = Present Worth of Cash Flow After Tax.

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started