Prepare a report about the company (Oman Flour Mills (OFM) to analyze the performance in the following area: 1. Liquidity 2. Solvency 3. Profitability 4.

Prepare a report about the company (Oman Flour Mills (OFM) to analyze the performance in the following area:

1. Liquidity

2. Solvency

3. Profitability

4. Activity/ Operational efficiency

The below website gives some data about the company

https://www.barrons.com/market-data/stocks/ofmi?countrycode=om

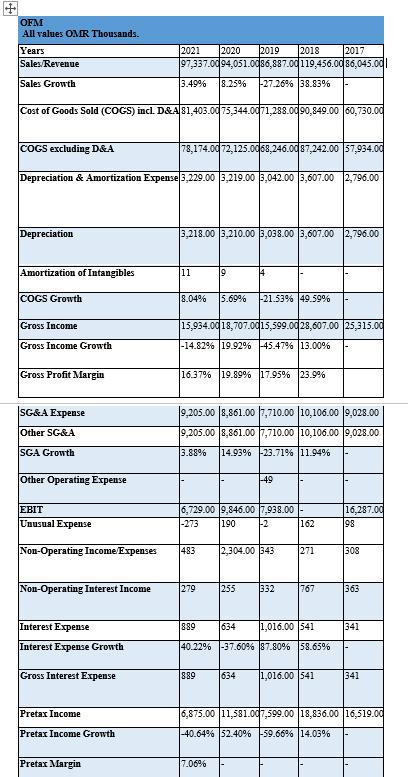

OFM All values OMR Thousands. Years Sales/Revenue Sales Growth COGS excluding D&A Cost of Goods Sold (COGS) incl. D&A 81,403.00 75,344.0071,288.0090,849.00 60,730.00 Depreciation Amortization of Intangibles Depreciation & Amortization Expense 3,229.00 3,219.00 3,042.00 3,607.00 2,796.00 COGS Growth Gross Income Gross Income Growth Gross Profit Margin SG&A Expense Other SG&A SGA Growth Other Operating Expense EBIT Unusual Expense Non-Operating Interest Income Interest Expense Interest Expense Growth 2021 2020 2019 97,337.0094,051.0086,887.00 3.49% 8.25% -27.26% 38.83% Gross Interest Expense Pretax Income Pretax Income Growth Pretax Margin 78,174.00 72,125.0068,246.00 87,242.00 57,934.00 3,218.00 3,210.00 3,038.00 3,607.00 2,796.00 11 Non-Operating Income Expenses 483 8.04% 5.69% -21.53% 49.59% 15,934.00 18,707.0015,599.00 28,607.00 25,315.00 -14.82% 19.92% -45.47 % 13.00 % 19 16.37 % 19.89% 17.95% 23.9% 9,205.00 8,861.00 7,710.00 10,106.00 9,028.00 9,205.00 8,861.00 7,710.00 10,106.00 9,028.00 3.88% 14.93% 23.71% 11.94% 279 6,729.00 9,846.00 7,938.00 -273 190 -2 889 2018 2017 119,456.00 86,045.00 14 889 7.06% 255 -49 2,304.00 343 634 162 271 1,016.00 541 40.22% -37.60% 87.80% 58.65% 332 767 634 1,016.00 541 16,287.00 98 308 363 341 341 6,875.00 11,581.007,599.00 18,836.00 16,519.00 -40.64% 52.40% -59.66 % 14.03%

Step by Step Solution

3.46 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

A report about the company Oman Flour Mills OFM to analyze the performance 1 Liquid ity The liquidit...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started