Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The purpose of this exercise is to price a vanilla call option with Monte-Carlo simulation and compare the result with the closed-form formula. The

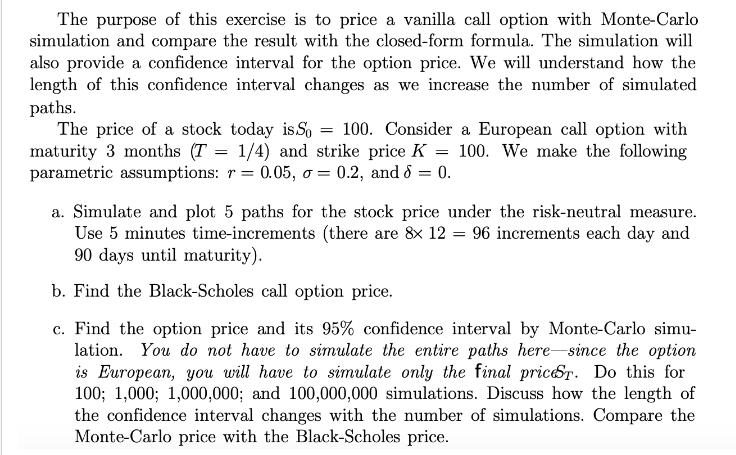

The purpose of this exercise is to price a vanilla call option with Monte-Carlo simulation and compare the result with the closed-form formula. The simulation will also provide a confidence interval for the option price. We will understand how the length of this confidence interval changes as we increase the number of simulated paths. = The price of a stock today is.So 100. Consider a European call option with maturity 3 months (T = 1/4) and strike price K = 100. We make the following parametric assumptions: r = 0.05, = 0.2, and 6 = 0. a. Simulate and plot 5 paths for the stock price under the risk-neutral measure. Use 5 minutes time-increments (there are 8x 12 = 96 increments each day and 90 days until maturity). b. Find the Black-Scholes call option price. c. Find the option price and its 95% confidence interval by Monte-Carlo simu- lation. You do not have to simulate the entire paths here since the option is European, you will have to simulate only the final priceSr. Do this for 100; 1,000; 1,000,000; and 100,000,000 simulations. Discuss how the length of the confidence interval changes with the number of simulations. Compare the Monte-Carlo price with the Black-Scholes price.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Pricing a Vanilla Call Option with Monte Carlo Simulation This scenario will guide you through pricing a European call option with Monte Carlo simulat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started