Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The put-call parity states that the net cost of buying an asset on a particular date in the future is equal when using forward contracts

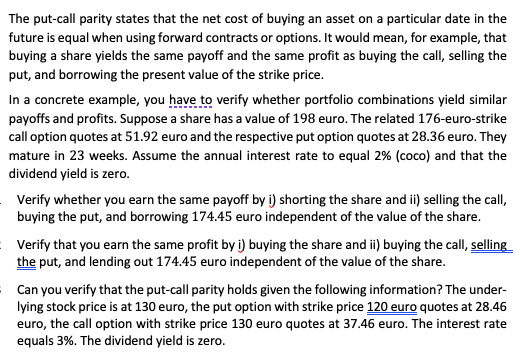

The put-call parity states that the net cost of buying an asset on a particular date in the future is equal when using forward contracts or options. It would mean, for example, that buying a share yields the same payoff and the same profit as buying the call, selling the put, and borrowing the present value of the strike price. In a concrete example, you have to verify whether portfolio combinations yield similar payoffs and profits. Suppose a share has a value of 198 euro. The related 176 -euro-strike call option quotes at 51.92 euro and the respective put option quotes at 28.36 euro. They mature in 23 weeks. Assume the annual interest rate to equal 2%(coco) and that the dividend yield is zero. Verify whether you earn the same payoff by i) shorting the share and ii) selling the call, buying the put, and borrowing 174.45 euro independent of the value of the share. Verify that you earn the same profit by i) buying the share and ii) buying the call, selling the put, and lending out 174.45 euro independent of the value of the share. Can you verify that the put-call parity holds given the following information? The underlying stock price is at 130 euro, the put option with strike price 120 euro quotes at 28.46 euro, the call option with strike price 130 euro quotes at 37.46 euro. The interest rate equals 3%. The dividend yield is zero. The put-call parity states that the net cost of buying an asset on a particular date in the future is equal when using forward contracts or options. It would mean, for example, that buying a share yields the same payoff and the same profit as buying the call, selling the put, and borrowing the present value of the strike price. In a concrete example, you have to verify whether portfolio combinations yield similar payoffs and profits. Suppose a share has a value of 198 euro. The related 176 -euro-strike call option quotes at 51.92 euro and the respective put option quotes at 28.36 euro. They mature in 23 weeks. Assume the annual interest rate to equal 2%(coco) and that the dividend yield is zero. Verify whether you earn the same payoff by i) shorting the share and ii) selling the call, buying the put, and borrowing 174.45 euro independent of the value of the share. Verify that you earn the same profit by i) buying the share and ii) buying the call, selling the put, and lending out 174.45 euro independent of the value of the share. Can you verify that the put-call parity holds given the following information? The underlying stock price is at 130 euro, the put option with strike price 120 euro quotes at 28.46 euro, the call option with strike price 130 euro quotes at 37.46 euro. The interest rate equals 3%. The dividend yield is zero

The put-call parity states that the net cost of buying an asset on a particular date in the future is equal when using forward contracts or options. It would mean, for example, that buying a share yields the same payoff and the same profit as buying the call, selling the put, and borrowing the present value of the strike price. In a concrete example, you have to verify whether portfolio combinations yield similar payoffs and profits. Suppose a share has a value of 198 euro. The related 176 -euro-strike call option quotes at 51.92 euro and the respective put option quotes at 28.36 euro. They mature in 23 weeks. Assume the annual interest rate to equal 2%(coco) and that the dividend yield is zero. Verify whether you earn the same payoff by i) shorting the share and ii) selling the call, buying the put, and borrowing 174.45 euro independent of the value of the share. Verify that you earn the same profit by i) buying the share and ii) buying the call, selling the put, and lending out 174.45 euro independent of the value of the share. Can you verify that the put-call parity holds given the following information? The underlying stock price is at 130 euro, the put option with strike price 120 euro quotes at 28.46 euro, the call option with strike price 130 euro quotes at 37.46 euro. The interest rate equals 3%. The dividend yield is zero. The put-call parity states that the net cost of buying an asset on a particular date in the future is equal when using forward contracts or options. It would mean, for example, that buying a share yields the same payoff and the same profit as buying the call, selling the put, and borrowing the present value of the strike price. In a concrete example, you have to verify whether portfolio combinations yield similar payoffs and profits. Suppose a share has a value of 198 euro. The related 176 -euro-strike call option quotes at 51.92 euro and the respective put option quotes at 28.36 euro. They mature in 23 weeks. Assume the annual interest rate to equal 2%(coco) and that the dividend yield is zero. Verify whether you earn the same payoff by i) shorting the share and ii) selling the call, buying the put, and borrowing 174.45 euro independent of the value of the share. Verify that you earn the same profit by i) buying the share and ii) buying the call, selling the put, and lending out 174.45 euro independent of the value of the share. Can you verify that the put-call parity holds given the following information? The underlying stock price is at 130 euro, the put option with strike price 120 euro quotes at 28.46 euro, the call option with strike price 130 euro quotes at 37.46 euro. The interest rate equals 3%. The dividend yield is zero Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started