Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question asks to Reconstruct these amounts/statements under the assumption the functional currency is US Dollar. Wizard Inc. has a subsidiary in OZ where the

The question asks to "Reconstruct these amounts/statements under the assumption the functional currency is US Dollar."

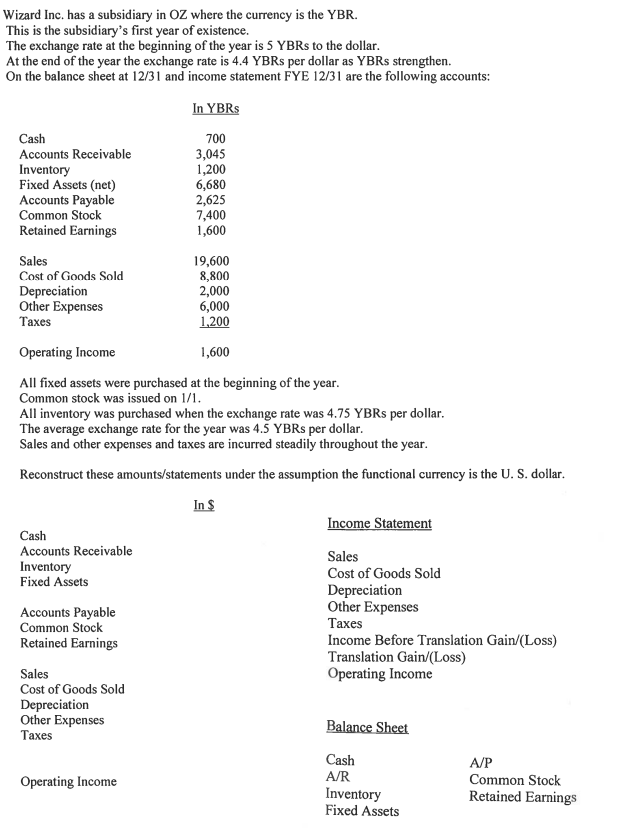

Wizard Inc. has a subsidiary in OZ where the currency is the YBR. This is the subsidiary's first year of existence. The exchange rate at the beginning of the year is 5YBRs to the dollar. At the end of the year the exchange rate is 4.4 YBRs per dollar as YBRs strengthen. On the balance sheet at 12/31 and income statement FYE 12/31 are the following accounts: All fixed assets were purchased at the beginning of the year. Common stock was issued on 1/1. All inventory was purchased when the exchange rate was 4.75 YBRs per dollar. The average exchange rate for the year was 4.5 YBRs per dollar. Sales and other expenses and taxes are incurred steadily throughout the year. Wizard Inc. has a subsidiary in OZ where the currency is the YBR. This is the subsidiary's first year of existence. The exchange rate at the beginning of the year is 5YBRs to the dollar. At the end of the year the exchange rate is 4.4 YBRs per dollar as YBRs strengthen. On the balance sheet at 12/31 and income statement FYE 12/31 are the following accounts: All fixed assets were purchased at the beginning of the year. Common stock was issued on 1/1. All inventory was purchased when the exchange rate was 4.75 YBRs per dollar. The average exchange rate for the year was 4.5 YBRs per dollar. Sales and other expenses and taxes are incurred steadily throughout the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started