Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The question did not provide. This is the only information Answer the questions from the Information provided. (25 Marks) 2.1 Use the information provided below

The question did not provide. This is the only information

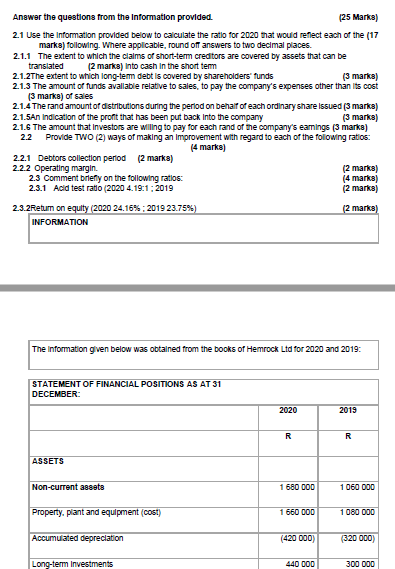

Answer the questions from the Information provided. (25 Marks) 2.1 Use the information provided below to calculate the ratio for 2020 that would reflect each of the (17 marks) following. Where applicable, round off answers to two decimal places. 2.1.1 The extent to which the claims of short-term creditors are covered by assets that can be translated [2 marks) into cash in the short term 2.1.2The extent to which long-term debt is covered by shareholders' funds (3 marks) 2.1.3 The amount of funds available relative to sales, to pay the company's expenses other than its cost (3 marka) of sales 2.1.4 The rand amount of distributions during the period on behalf of each ordinary share issued (3 marks) 2.1.5An Indication of the profit that has been put back into the company (3 marks) 2.1.6 The amount that investors are willing to pay for each rand of the company's earnings (3 marks) 2.2 Provide TWO (2) ways of making an Improvement with regard to each of the following ratios: (4 marks) 2.2.1 Debtors collection period (2 marks) 2.2.2 Operating margin (2 marks) 2.3 Comment briefly on the following ratlos: (4 marks) 2.3.1 Acid test ratio (2020 4.19:1:2019 (2 marks) 2.3.2 Return on equity (2020 24.16%2019 23.75%) (2 marks) INFORMATION The information given below was obtained from the books of Hemrock Ltd for 2020 and 2019: STATEMENT OF FINANCIAL POSITIONS AS AT 31 DECEMBER: 2020 2019 R R R ASSETS Non-current assets 1 680 000 1 060 000 Property, plant and equipment (cost) 1 660 000 1 080 000 Accumulated depreciation (420 000) (320 000) Long-term Investments 440 DOD 300 000 Answer the questions from the Information provided. (25 Marks) 2.1 Use the information provided below to calculate the ratio for 2020 that would reflect each of the (17 marks) following. Where applicable, round off answers to two decimal places. 2.1.1 The extent to which the claims of short-term creditors are covered by assets that can be translated [2 marks) into cash in the short term 2.1.2The extent to which long-term debt is covered by shareholders' funds (3 marks) 2.1.3 The amount of funds available relative to sales, to pay the company's expenses other than its cost (3 marka) of sales 2.1.4 The rand amount of distributions during the period on behalf of each ordinary share issued (3 marks) 2.1.5An Indication of the profit that has been put back into the company (3 marks) 2.1.6 The amount that investors are willing to pay for each rand of the company's earnings (3 marks) 2.2 Provide TWO (2) ways of making an Improvement with regard to each of the following ratios: (4 marks) 2.2.1 Debtors collection period (2 marks) 2.2.2 Operating margin (2 marks) 2.3 Comment briefly on the following ratlos: (4 marks) 2.3.1 Acid test ratio (2020 4.19:1:2019 (2 marks) 2.3.2 Return on equity (2020 24.16%2019 23.75%) (2 marks) INFORMATION The information given below was obtained from the books of Hemrock Ltd for 2020 and 2019: STATEMENT OF FINANCIAL POSITIONS AS AT 31 DECEMBER: 2020 2019 R R R ASSETS Non-current assets 1 680 000 1 060 000 Property, plant and equipment (cost) 1 660 000 1 080 000 Accumulated depreciation (420 000) (320 000) Long-term Investments 440 DOD 300 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started