Question: the question I wanted answer is one and two under overall response to the russells View Buddies Window Help 19 Personal Finance Case (1) E

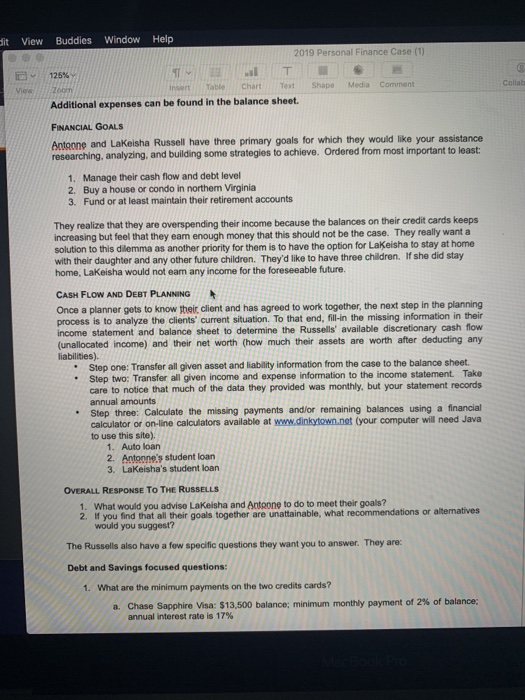

View Buddies Window Help 19 Personal Finance Case (1) E 125%- Table Chart Text Shape Media Comment Insert Your team focuses on providing clients with comprehensive financial planning and as a fiduciary Antonne and LaKeisha Russell were referred to your firm by a current client who praised your ability to consider all available information and provide farmilies with many options so that they may best meet their goals In your first meeting with the Russells you leamed the facts below and completed parts of the attached balance sheet and budget, and income statement. Use all the information provided to assist the Russell family in reaching their financial goals and improving their financial well-being. PERSONAL INFORMATION Antoone and Lakeisha met when they were both students at Clark Atlanta University. As freshmen, they lived down the hall from one another but met at the local skating rink at the end of their first year They married several years after graduation as they wanted to wait until they had enough money for a wedding. Now ages 32 and 31, respectively, they live in Manassas Park, Virginia and have a 3-year-old daughter named Chloe. Following graduation from Clark Altlanta University, the Russells moved to the Washington, D.c area where Antonne worked for BB&T as a teller and Lakeisha began taking licensing exams to teach elementary school. After working for three years as a teller, Antonne decided he wanted to go back to school to get his MBA. He was driven to go back to school, so he could increase his future salary While Antoone obtained his MBA at The University of Georgia, LaKeisha found a job teaching fourth- grade in Athens. Antoone did not work during school, so they did their best to live solely on her income. However, their expenses were too high at times and they accumulated some credit card debt. Upon graduation three and a half years ago. Antoone took a job in Alexandria, Virginia, as a branch manager for Big National Bank. LaKeisha found a job as a second-grade teacher in Alexandria but would like to stay home with their daughter. It's important to them that LaKeisha have the option of being a stay-at-home mom if they're able to afford to live from Antoone's salary. Originally, they were thinking that she would work until the birth of their second child; however, Chloe has a lot of food allergies and other childhood-related illnesses that have taken a lot of time to resolve or control. As a result, Lakeisha is feeling more pressure and desire to be a stay-at-home parent to care for Chloe. They'd like to buy a house or condo, so they have a home they can call their own in or near Alexandria but recognize housing costs in northern Virginia are quite expensive. Given their student loans, credit card and auto debt, and need to save for a down payment, theyve postponed buying a property. For now, they're renting an apartment for $1.550 per month. However, they are also coming to realize that commuting almost one hour each way to work is also expensive in that they are paying for child care an extra 10 hours a week - which adds nearly $2,500 a year. Additionally, since they can't commute together due to the differences in working hours they are driving nearly 1,000 miles a week combined that dramatically increases their transportation costs Antone makes $100,000 annually and has been told he can expect his salary to grow by 3% each year. He's contributing $1,000 per month to his pre-tax 401(k) as he's trying to reduce their taxes. Big National Bank matches dollar for dollar up to the first 6% ($500 per month). He also saves the maximum amount to his Roth IRA as he's heard he could one day make too much money to contribute. dit View Buddies Window Help 2019 Personal Finance Case ( ir 125%- ViewZoom Insert Table Chart Text Shape Media Comment Collaborate Antone makes $100,000 annually and has been told he can expect his salary to grow by 3% each year. He's contributing $1,000 per month to his pre-tax 401(k) as he's trying to reduce their taxes. Big National Bank matches dollar for dollar up to the first 6% ($500 per month). He also saves the maximum amount to his Roth IRA as he's heard he could one day make too much money to contribute. 1 Case study provided by the faculty of the Virginia Tech Financial Planning Program: Professor Derek Klock. Dr. Ruth Lytton and Christine Daosico, CFP LaKeisha is making $40,000 and saves $750 per month to her VRS Retirement Plan. In addition to continuing to save for retirement they are still saving $300 for the down payment on their new home. As they have tried to be prodigious savers they allot themselves only $8 per day for "lunch money This sometimes goes to lunch out for Agtonne, but more frequenty goes to Starbucks for coffee, the occasional "happy hour with co-workers, or just a quick bite for Lakeisha on the nights Antoone works late. ECONOMIC ASSUMPTIONS Al The economy has been steadily recovering ever so slowly since the financial crisis in 2008. While the economy is back to "fur employment with an unemployment rate of about 4%, studies continue to show that wages for most Americans are just barely keeping pace with the inflation rate that has averaged less than 2% since the crisis. RETIREMENT INVESTMENTS Goteone would like to retire at age 60 whereas LaKeisha could see herself rejoining the work force as a teacher (assuming she can raise their children without working) after their daughter and any future kids are more independent, such as late middle school or in high school. Antoone's family health history isn 't great and many of the men in his family suffer from heart disease. Retiring at age 60 is important to him as he wants time to mark a few items off his bucket list. He'd like to go to Italy with LaKeisha, write a memoir, and volunteer teaching kids how to play hockey Former Regional Bank Pre-tax Traditional" 401(k): $9,692 :o Rgional Roth 4010k) $25,248 $11,863 $26,133 Roth IRA Big National Bank Pre-tax "Traditional" 401(k LaKeisha's Investments: Traditional IRA: 403(b) VRS Vested Balance Pre-tax Retirement: VRS Unvested Balance Pre-tax Retirement $23,086 $13,658 $2,551 $2,987 FINANCIAL/VESTABLE ASSETS (ALL ACCOUNTS ARE OWNED JOINTLY) View Buddies Window Help 12536 View Zoom Shape Media c Colaborat FINANCIAL/INVESTABLE ASSETS (ALL ACCOUNTS ARE OWNED JOINTLY $7,534 $1,000 $35,267 Checking account: Savings account: Brokerage account: The brokerage account is 50% large-cap growth stocks and 50% money market. The taxable distributions in the brokerage account have been small enough to be considered irrelevant for planning purposes USE/PERSONAL AsSETS 2013 Subaru Outback 2.5i Premium: $18,000 $6,000 2009 Hyundai Santa Fe Limited AWD LaKeisha drives the Subaru as they bought this when she was pregnant with Chloe and Antoone wanted her to have a very safe and dependable car LIABILITIES 2013 Subaru (Joint): 2 Case study provided by the faculty of the Virginia Tech Financial Planning Program: Professor Derek Kock Dr. Ruth Lytton and Christine Dariso, CFP o The monthly payment is $550.01 and they know they have exactly 24 payments remaining, but could not find the loan balance. The Russell's financed the Outback for six years at 4.9%. $13,500 balance (17% APR). They try to pay at least $300 per month $9,000 balance (15% APR). They try to pay at least $250 per month. : Visa (Joint) o Mastercard (Joint) o STUDENT LOANS Antanne worked very hard and did not have any student loan debt from his undergraduate degree but he did take out two unsubsidized Stafford loans to help pay for his MBA. Upon graduation he consolidated his two loans into one $20,000 Direct Loan with the U.S. Department of Education. He chose the standard repayment plan and has an interest rate of 6.2%. He has made 42 payments. Lakeisha had debt from undergraduate school which she consolidated into one $36,000 loan when Antone started graduate school in August 2012, Her onginal loans had annual interest rates of 68% and 6.0% so her consolidation loan rate is 6.4%. She chose the extended repayment option and has made 66 payments so far LIFE INSURANCE .Antgone has a group term life insurance policy through work that will pay 2x his salary . it View Buddies Window Help 2019 Personal Finance Case () Collab Insert Table Chart Text Shape Media Comment Additional expenses can be found in the balance sheet FINANCIAL GOALS Antgone and LaKeisha Russell have three primary goals for which they would like your assistance researching, analyzing, and building some strategies to achieve. Ordered from most important to least Manage their cash flow and debt level 1. 2. Buy a house or condo in northem Virginia Fund or at least maintain their retirement accounts 3. They realize that they are overspending their income because the balances on their credit cards keeps increasing but feel that they eam enough money that this should not be the case. They really want a solution to this dilemma as another priority for them is to have the option for LaKeisha to stay at home with their daughter and any other future children. They'd like to have three children. If she did stay home, LaKeisha would not earn any income for the foreseeable future. CASH FLOW AND DEBT PLANNING Once a planner gets to know jheir client and has agreed to work together, the next step in the planning process is to analyze the clients' current situation. To that end, fillin the missing information in their income statement and balance sheet to determine the Russells' available discretionary cash flow (unallocated income) and their net worth (how much their assets are worth after deducting any liabilities) Step one: Transfer all given asset and liability information from the case to the balance sheet. Step two: Transfer all given income and expense information to the income statement Take care to notice that much of the data they provided was monthly, but your statement records annual amounts . Step three: Calculate the missing payments andlor remaining balances using a financial calculator or on-line calculators available at www.dinkytown.net (your computer will need Java to use this site) 1. Auto loan 2. Antoone's student loan 3. LaKeisha's student loan OVERALL RESPONSE TO THE RUSSELLS 1. What would you advise LaKeisha and Antoone to do to meet their goals? 2. If you find that all their goals together are unattainable, what recommendations or altermatives would you suggest? The Russells also have a few specific questions they want you to answer. They are: Debt and Savings focused questions: 1. What are the minimum payments on the two credits cards? Chase Sapphire Visa:S13 500 balance minimum monthly payment of 2% of balance: annual interest rate is 17% a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts