Question

The question is: A. In worksheet Ex 1of the Excel file provided, model a two-asset portfolio and examine the risk and return characteristic of a

The question is:

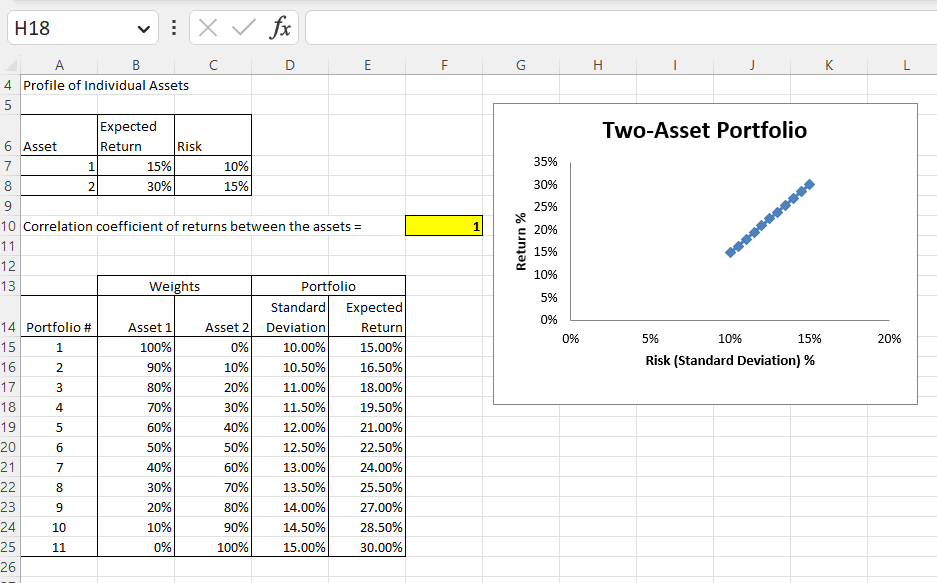

A. In worksheet Ex 1of the Excel file provided, model a two-asset portfolio and examine the risk and return characteristic of a two-asset portfolio - using the data provided. In this worksheet paste three graphs:

a. When correlation coefficient of returns between the assets is -1.0;

b. When the correlation is 0.5; and

c. when the correlation is1.0.

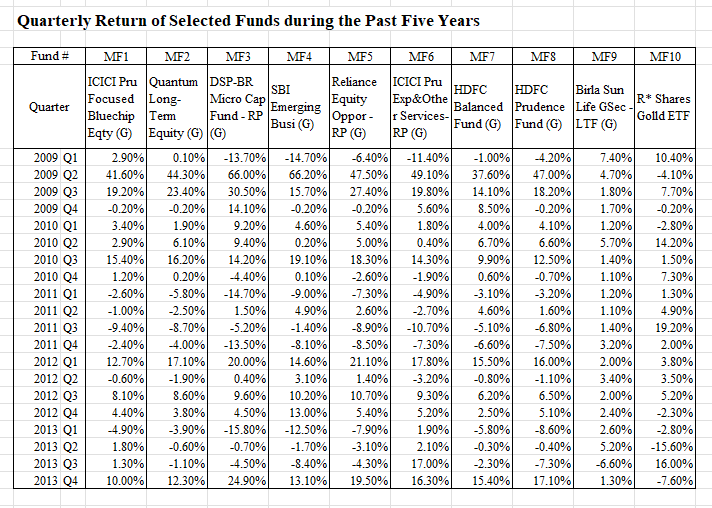

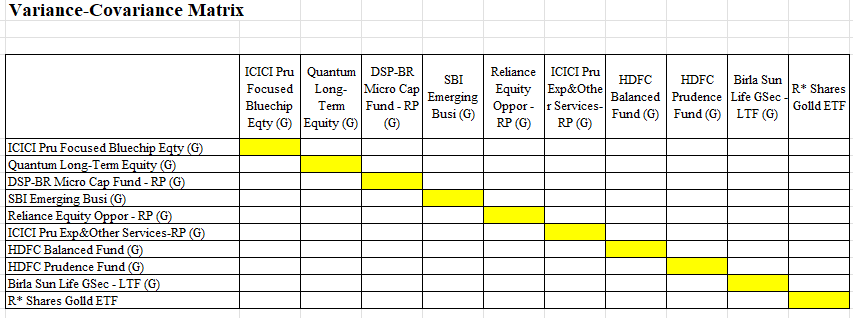

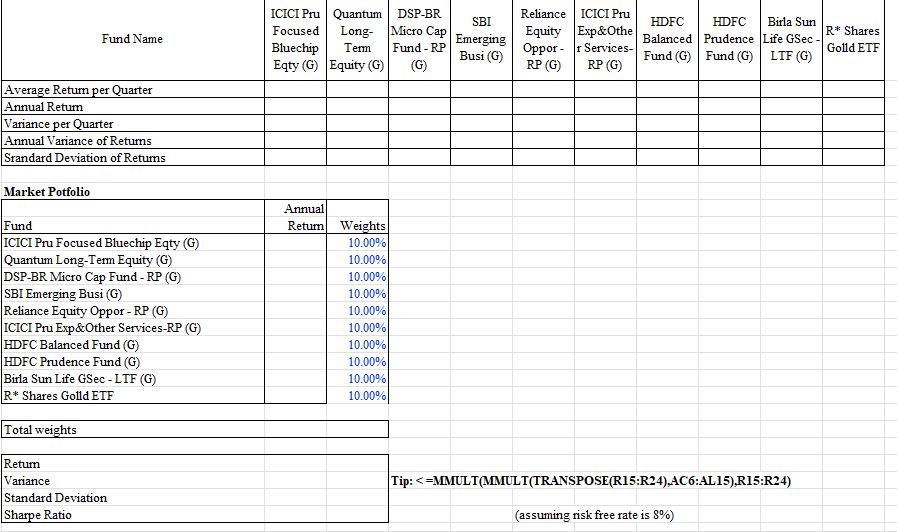

B. On worksheet Ex 2 construct an efficient multi asset portfolio of risky assets using the selected mutual funds in Exhibit 1 p.6 of the case.

C. Analyse the effect of adding a risk-free asset to a portfolio containing risky assets. Assume the risk-free rate is 8%.

D. Recommend an optimal portfolio that provides the highest return for the specified risk level with the constraint that:

i. The sum of the portfolio weights should equal 100%.

ii. The weight of any risky asset in the portfolio should not exceed 30% to ensure that the portfolio is diversified.

iii. No short selling or borrowing.

iv. Use the function of sample variance to calculate the variances of the fund returns. Do NOT use population variance.

Additional information pertaining to the question:

The below image pertains to part A of the question:

H18 A B 4 Profile of Individual Assets 5 WN 67 6 Asset 7 8 9 10 Correlation coefficient of returns between the assets = 11 12 13 14 Portfolio # 15 16 17 18 600 19 20 21 22 23 24 25 26 1 2 3 st 4 1 5 6 7 8 9 10 11 2 Expected Return 15% 30% Asset 1 100% 90% 80% 70% 60% X fx Weights 50% 40% Risk 30% 20% 10% 0% 10% 15% Asset 2 0% 10% 20% 30% 40% 50% 60% D 70% 80% 90% 100% Portfolio E Standard Expected Deviation Return 10.00% 15.00% 10.50% 16.50% 11.00% 18.00% 11.50% 19.50% 12.00% 21.00% 12.50% 22.50% 13.00% 24.00% 13.50% 25.50% 14.00% 27.00% 14.50% 28.50% 15.00% 30.00% F G Return% 35% 30% 25% 20% 15% 10% 5% 0% 0% H I J Two-Asset Portfolio 10% 5% 15% Risk (Standard Deviation) % K 20% L

Step by Step Solution

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

A Portfolio riskreturn for different correlations a Correlation 1 Generate variancecovariance matrix ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started